At the moment the overall market is not in a good state and leading the charge is Bitcoin. Investors across all crypto assets are hoping for a recovery soon but for now they might have to resort to altering their expectations.

Bitcoin in bear market?

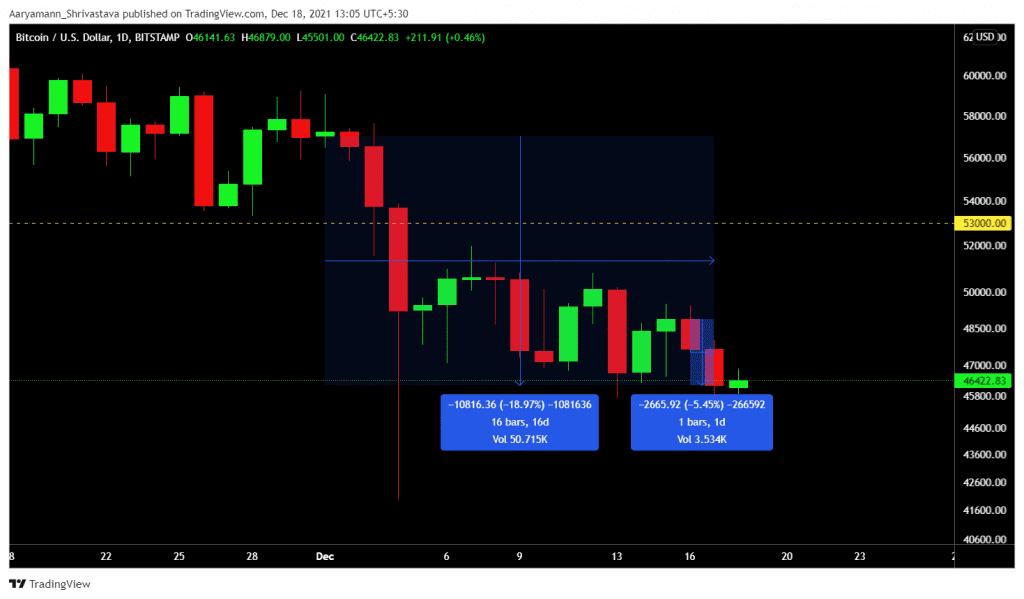

With the king coin dropping by another 5.45% yesterday – bringing the total declines of this month to 19% – the possibilities of a bear market cannot be ignored. And for that reason looking at the state of on-chain metrics, we can determine what stance to take going forward.

Bitcoin price action | Source: TradingView – AMBCrypto

The short-term holder SOPR on a 30 Day Moving Average for the last 5 months had been maintaining its position above the neutral line. Even throughout the September and November drawdown, the investors were still realizing profit in aggregate.

That changed this month when SOPR fell under 1 without a bounce indicating that the sentiment of profit has now changed to losses.

STH SOPR | Source: Blockware Intelligence

Similarly, the Profit/Loss ratio fell below 1 as well, which is a relatively rarer occurrence given the indicator mostly retested the neutral zone and never fell through it since the last year, except for the May crash.

STH Profit/Loss ratio | Source: Blockware Intelligence

However, it is not all negative since some metrics paint a slightly more bullish picture.

The supply shock ratio continues to see a bullish divergence which means that Bitcoin is continuing to move to entities with a history of less spending.

This also indicates that presently only the supply side is getting locked up while demand continues to rise.

Illiquid Supply Shock ratio | Source: Blockware Intelligence

So if this divergence plays out, we can see price action rising again. This would bring us back to the critical zone of $53k.

Reclaiming it would be a positive sign for Bitcoin as it also happens to be the level where not only the STH cost basis sits, but also where BTC’s $1 trillion market cap lies.

On-chain cost basis | Source: Blockware Intelligence

Thus should the cost basis revive, the market could turn bullish, if not then maintaining a cautious attitude would be wise.