After the monumental ‘Uptober,’ the last two months haven’t been all that bullish for the larger market. Nonetheless, some assets like AVAX, LUNA and MATIC managed to carve their own trajectories reaching new ATHs even as the king coin consolidated. Cardano, however, once the third-ranked coin by market cap shed almost 50% price since its ATH on September 2.

After this bloodbath that ADA saw over the last month, the asset tested the long-term lower support of $1.22 on December 14. Nonetheless, with Cardano’s scaling solution Hydra closer to its release the market yet again turned its eyes towards the sixth-ranked altcoin in anticipation of a 150% price appreciation similar to the one seen in July-August.

So, could ADA repeat history?

ADA picked up from the lower $1.22 level noting 5.54% daily gains oscillating close to the $1.31 mark at press time. This came alongside the news of the development of Cardano’s layer-2 scaling solution Hydra. The Hydra team launched its second pre-release, end-to-end Cardano node integration, this week.

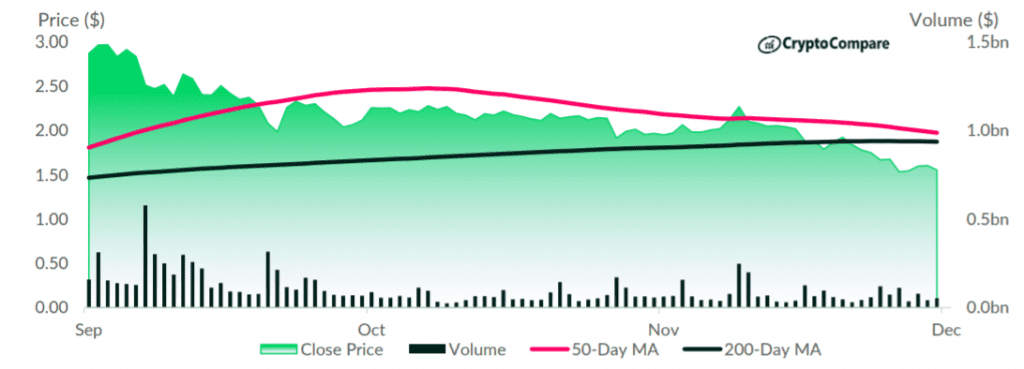

Data from Crypto Compare presented that Cardano’s price fell 20.5% in the month of November to $1.55, reaching a market capitalization of $51.8 billion at the end of the month. However, the total monthly volumes (ADA/USD) rose 7.80% to $2.28 billion, while volatility also rose significantly from 54.4% to 72.1%.

After recording three straight months of losses, on the 16th of November, ADA broke below its 200-day moving average, which has acted as a key resistance level over the last few months. It also remained below its 50-day moving average, which is typically a sign of overselling.

On the positive side, however, activity on the Cardano blockchain picked up considerably in November, with a 4x growth in daily active addresses to 216K. Monthly transactions also grew 75.8% to 4.62 million in November, a monthly all-time high for the coin, while the number of addresses grew at a large pace, with an average of 216K daily active addresses, four times larger than the previous month.

Reaching $3 anytime soon?

With ADA’s recovery from the $1.22 zone, its Relative Strength Index finally broke away from the triple bottom downtrend. The next major resistance for the coin was at the $1.37 mark which could further strengthen the recovery.

So, could ADA finally repeat the July-August rally?

The low $1.22 level was recently tested after July and a rebound from the same can pump the coin but retail euphoria which is key to the rally was still missing-in-action. Ownership stats show that the retail crowd formed the largest section of ADA owners. A retail backed rally could be key to ADA’s price pump in the short term.

Source: IntoTheBlock

That being said, while ADA’s 170% price appreciation in July-August was being expected by the market immediate recovery might not pan out the same way this time. ADA would first need to establish itself above the key SMAs to truly embark on a bullish journey.

If Cardano’s price could break resistance at $1.37 and retrace previous key levels it could reclaim the above $2 levels soon. A visit to the $3 level in the short term, however, is unlikely especially looking at the mellowed-down retail interest.