Lightning Labs’ Taro has caught the attention of many Bitcoin enthusiasts for the potential it has and what Lightning Labs are selling, stating Taro will help in Bitcoin-izing the dollar since Bitcoin will be used as liquidity on the network.

Now, although it sounds wonderful, the question is, can they actually pull it off? Moreover, if so, why hasn’t the lightning network ever been used for the same despite its proficiency in fast transactions.

Bitcoin on the Lightning Network

It is not a surprise that the king coin is the most traded non-stablecoin asset in the world. With volumes exceeding tens of billions of dollars every day, it is evident that the coin is favored by a lot of people for a lot of reasons.

In fact, just in the last 24 hours, over 344,888 BTC has been moved around, which amounts to $14.7 billion.

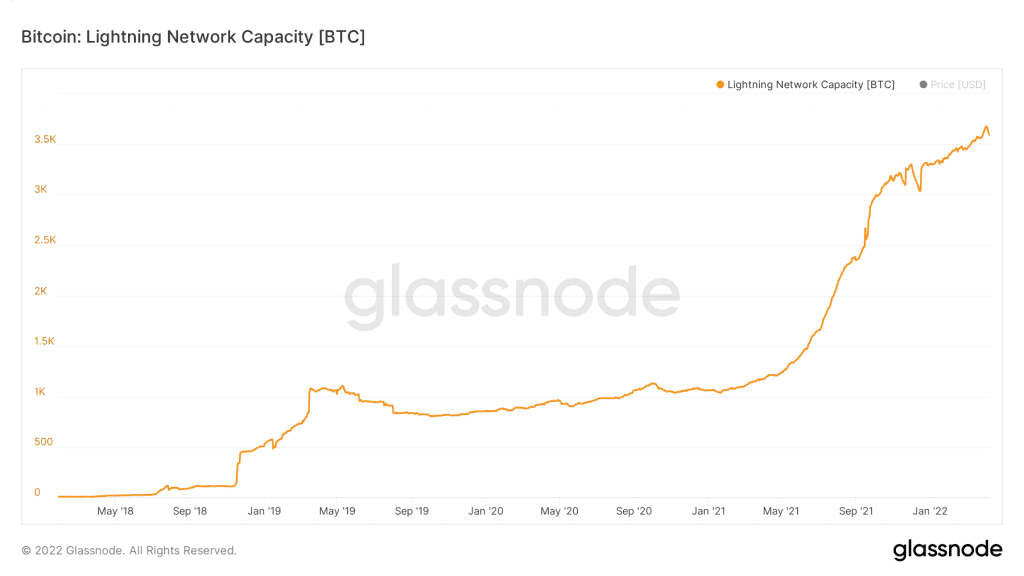

Now, on the other hand, the Lightning Network, which has been in use for more than four years now, to date, has only managed to lock about 3589.64 BTC on the network, which is no more than $152 million.

Total Bitcoin locked on the lightning network | Source: Glassnode – AMBCrypto

The total number of channels, unique and duplicate, comes up to about 83,160. These 83k+ channels altogether have to date, managed to lock in about 1.03% of Bitcoin’s daily volume.

Bitcoin lightning network channels | Source: Glassnode – AMBCrypto

Thus when the usage of the already existing Lightning Network is so meager, it is doubtful how much Taro could change things up.

Although Taro does bring a whole lot of other advantages to the Lightning Network, only after its launch and use can one tell if they will actually be worth it.

And usage will be affected by the market conditions going forward. Taro is still in development, but when it comes, the market could change by a mile for either good or bad since Bitcoin is kind of in-between right now.

As per the Fibonacci levels, Bitcoin is keeping above the 23.6% Fibonacci level ($41,175). In the past, this has been solid support for initiating rallies but also a tough-to-breach resistance.

Bitcoin price action | Source: TradingView – AMBCrypto

Given that Bitcoin is trading pretty close to it at $42,567, if the king coin falls through this in the next few days, it will be difficult to initiate recovery, and eventually, investors will quite down again as they did around January.