Litecoin [LTC] has been making improvements to its existing technology for quite some time now. In line with the same, the blockchain recently announced an MWEB feature that would allow users to make confidential transactions.

MWEB is now live on #Litecoin Street!

MWEB is an upgrade that gives users a new opt-in feature – confidential LTC transactions.

This also improves scalability as MWEB txs are stored in a separate extension block.https://t.co/QEdBTpfm4E pic.twitter.com/5GkpkLkOC4

— TxStreet (@txstreetCom) October 2, 2022

Can’t take privacy ‘Lite’ly

This latest update announced on the 3 October, stated that the new technology will help LTC users make discrete transactions and help Litecoin with its scalability.

Even though this development may help the altcoin’s growth in the long-term, Litecoin’s performance has been a disappointment since September.

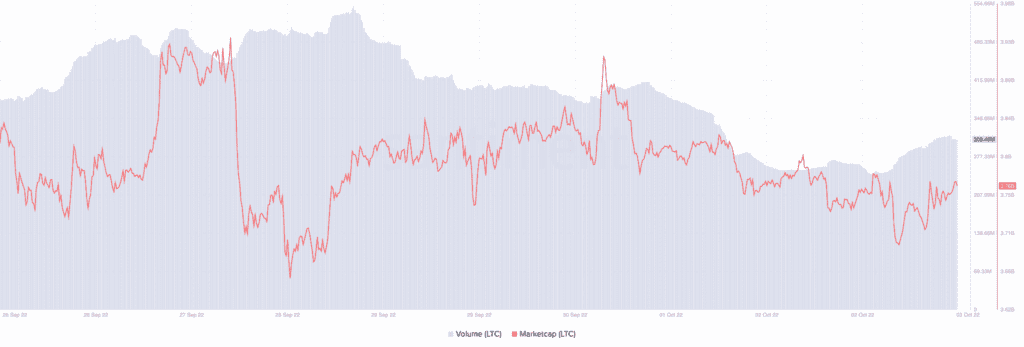

The alt’s volume has been on a decline since the past week. As can be seen from the image below, LTC’s volume stood at its peak at the beginning of the week, at 508 million. However, as of 3 October, this number stood at 308.45 million after a decline of about 40%.

Litecoin’s market cap didn’t put on a brave face either. At the time of writing, this number stood at 3.76 billion. Furthermore, its market cap dominance depreciated by 8.98% over the last 30 days.

Despite the grim picture painted by Litecoin, there was something to look forward to. The total number of addresses on the Litecoin network had been growing steadily over the past month.

Furthermore, according to the on-chain market intelligence platform Glassnode, the total number of addresses witnessed some growth. It surged from 152 million to 156 million in the span of 30 days, with four million new addresses joining the network.

However, the number of active addresses on the network didn’t witness similar growth. Over the past month, the number of active addresses decreased by 26%.

Litecoin’s transaction fees also witnessed significant volatility over the past month. This could have alienated potential investors from majorly relying on LTC.

What’s with the bearish outlook?

Overall, the outlook for LTC had been quite bearish upon considering multiple metrics. However, the price moved in a slightly positive direction as of 3 October. At press time, LTC exchanged hands at $54.80 and was up by 2.7% in the last 24 hours.

Despite some positive price movement, LTC’s general direction had been quite bearish. LTC’s price had gone down by 21% since 13 September.

The price inclined towards the lower band of the Bollinger Bands (BB) indicated that LTC was in an oversold position. Furthermore, the On-Balance-Volume (OBV) was also going on a downward trajectory.

However, the Chaikin Money Flow (CMF) was at 0.09 which implied that the money flow was still on the buyers’ side and it could be perceived as a slightly bullish indicator.

Although Litecoin’s future could be looking bearish in the short term, readers can look into other updates to understand what the long-term future could look like.