The beginning of June did bring a ray of hope with the cryptocurrency market recovering from the bloodshed of May. However, as we enter the third week of June, the scenario of the market doesn’t look at its best. Considering the performance of AAVE, the has come down by more than 13% in the last 24 hours. Furthermore, it may also seem like the token might have achieved its mascot’s vision of spooking the investors.

AAVE looks real scary…

As the dip hit the unsuspecting cryptocurrencies following weeks of consolidation, more than 90% of the market fell victim to price falls. However, it was just another day in the crypto space for some.

AAVE was among one of them as the DeFi asset fell by 21.28% in the last four days and continues to decline, trading at $83.

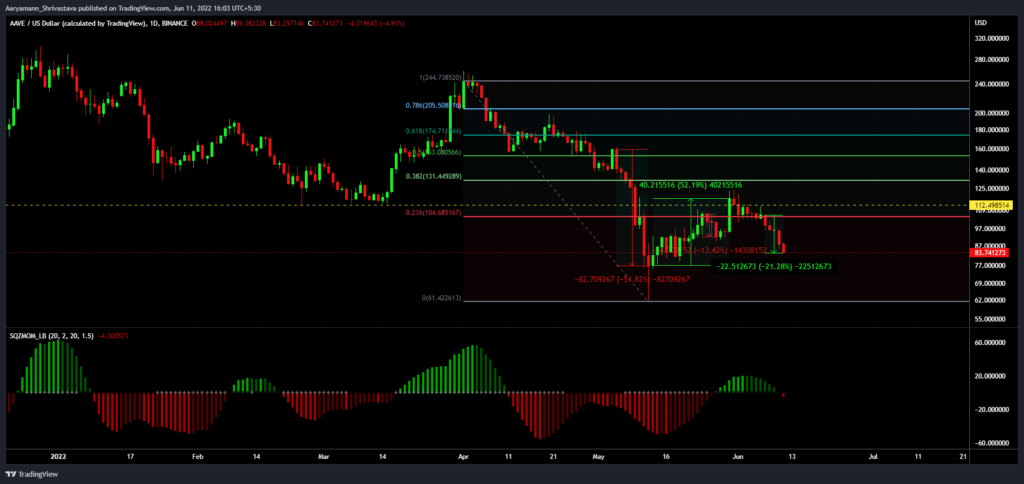

AAVE price action | Source: TradingView – AMBCrypto

Interestingly, AAVE holders were seemingly aware of a decline as they decided to book their profits the moment AAVE completed a 52% rally, selling $17 million worth of AAVE.

AAVE token selling | Source: Santiment – AMBCrypto

But these investors might witness another bout of a downtrend as the bearish pressure is going to increase.

The Squeeze Momentum Indicator flipped into the bearish mode today, with the active squeeze completing 17 days (ref. AAVE Price action image).

In the past, the squeeze release occurred within 14-20 days of an active squeeze, and if it happens in the next three days, AAVE will fall further.

Anticipating the same, investors have been disappearing on the network and have decided to quiet down until the bearishness passes. AAVE is sitting in their wallets without much movement resulting in low velocity.

AAVE is doing its most to ensure that the DeFi protocol is ahead of its competitors, and for the same reason, it deployed its V3 on the Ropsten Testnet post The Merge of 8 June.

However, since these tactics are failing to generate enough traction for the asset, investors don’t seem to care much for it. It is primarily because AAVE, as an investment vehicle, hasn’t generated many profits for its holders. January 2021 was the last time AAVE investors were in profit altogether.

Since then, profits began reducing, and as of press time, less than 13k investors are in profit. More than 84% of the addresses on the network are suffering losses making it further difficult for them to keep from selling in a bear market.

AAVE investors in loss | Source: Intotheblock – AMBCrypto

This is also why, on a broader scale, the DeFi token’s adoption has reduced significantly, and the network growth is struggling to mark an uptrend.

AAVE network growth | Source: Santiment – AMBCrypto