Crypto Compare released their monthly report recently. The report focuses on development and adoption of various product types by analyzing AUMs, trading volume and price performance.

April was a difficult month for the crypto industry with the flagship tokens largely faltering. Data up to 27 April says that BTC fell by 16.3% and ETH dropped around 14.4%. With uncertainty surrounding the Fed and the ongoing Russia-Ukraine conflict, the digital assets market took the worst hit.

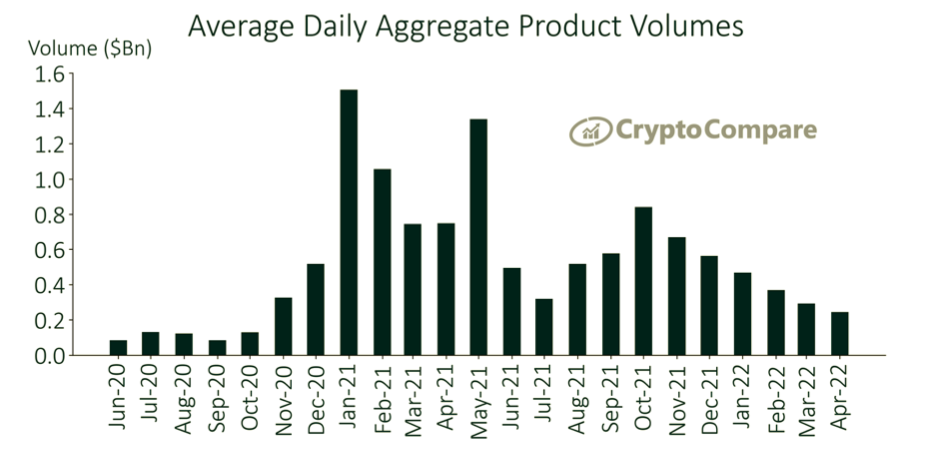

There was a further drop in trading volume, which has dropped for the sixth successive month. The average daily trading volumes fell by 16.3% $244 million this month. The report also says,

“In total, volumes have fallen 71.0% since October 2021 ($841 million) and 83.8% since the all-time high reached in January 2021 ($1.51 trillion).”

Grayscale’s Bitcoin trust product (GBTC) was able to maintain itself as the highest traded trust product this month. Despite a 17.3% drop, the average daily volume stood at $106 million followed Grayscale’s Ethereum trust with a $66.3 million daily average.

The ETC sector also suffered windfalls with drops across the major assets. Valour’s Bitcoin Product (BTCZERO) had the largest average daily volume at $4.24 million despite being down by 35.6%.

It is followed by XBT Tracker’s Ether Tracker One (BTC/SEK) at $4.23 million after a 35.7% drop. XBT Provider’s Ether Tracker Euro (ETH/EUR) trails them with $3.07 million after a 9.46% fall.

The April blips further continued in terms of crypto investment product outflows. April had the largest average outflows in 2022. The outflow trend for crypto investment products indicated a major negative sentiment in the market which is likely run into May.

The first week ended with the largest single-week outflow since mid-January at around $134 million. The average weekly outflows for April stood at $79.5 million and most of it came from Bitcoin products suggesting continued pessimism.