The thrash of the bears has reached Chainlink as well and its myriad of DeFi protocol integrations have not been able to save it either. In the while, the market took to stop dipping, Chainlink already fell below its safe zone.

Chainlink revisits the past

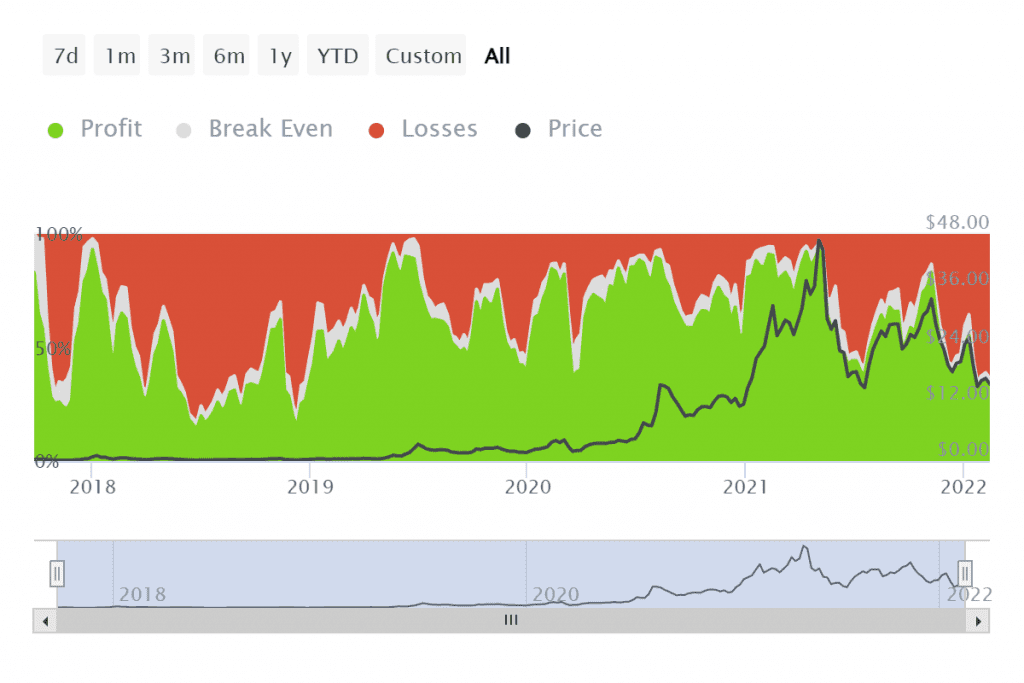

At the time of this report, 63.68% of Chainlink’s 628.62k addresses were witnessing losses. Now, this might not be as big a deal in general since the entire market is observing losses.

The consistent dips observed in the last two months certainly are to be blamed. But when it comes to Chainlink particularly it is significantly worse as this is the most Chainlink investors have suffered in over three years.

The last time such a huge portion of investors was in losses was back in December 2018 when the figure touched 80.7%.

Chainlink investors in losses | Source: Intotheblock – AMBCrypto

Thus, the dejection is clearly visible in investors’ behavior since network-wide their participation has come down.

Daily active users which at their peak were averaging around 15-16k, were still keeping above 3k until the end of December 2021. However, halfway through January, this average dropped to 2.7k and currently stands at 2.2k.

Chainlink active addresses | Source: Intotheblock – AMBCrypto

Consequently, the transactions on-chain also dropped by 65% in the span of five months.

Chainlink on-chain transactions | Source: Intotheblock – AMBCrypto

Although whales are known to be active players regardless of the prevalent market conditions, LINK whales too have slowed down at the moment. Conducting transactions worth less than $400 million for a month now, it becomes evident that LINK is playing by the bears rules right now.

Chances of escape?

Chainlink’s price action is slightly concerning since the downtrend wedge has been stuck in closing in soon. Despite a few attempts to breach the long-term resistance, LINK has failed to ride with the bulls.

Fortunately, the price still stands far above the lower trend line of $13.3. Thus, giving LINK some room to recover and attempt another breach. If the token manages to achieve a significant mark, the buying demand would eventually step in. It would also be a better time to opt for long trades.

Chainlink is still stuck in its downtrend wedge | Source: TradingView – AMBCrypto