Of the 66.34 million Ethereum holders a lot of them have been inert for a while now. Consequently, despite the price rise, the volume has been at a low level. But the reasons and effects of this situation stretch beyond how it appears.

Ethereum calmed down…

Despite the broader market making a relatively quicker recovery, Ethereum’s performance has been lukewarm at best.

The altcoin king has been losing any gains coming its way, which has caused the altcoin’s rally to be significantly slower than other coins, including Bitcoin.

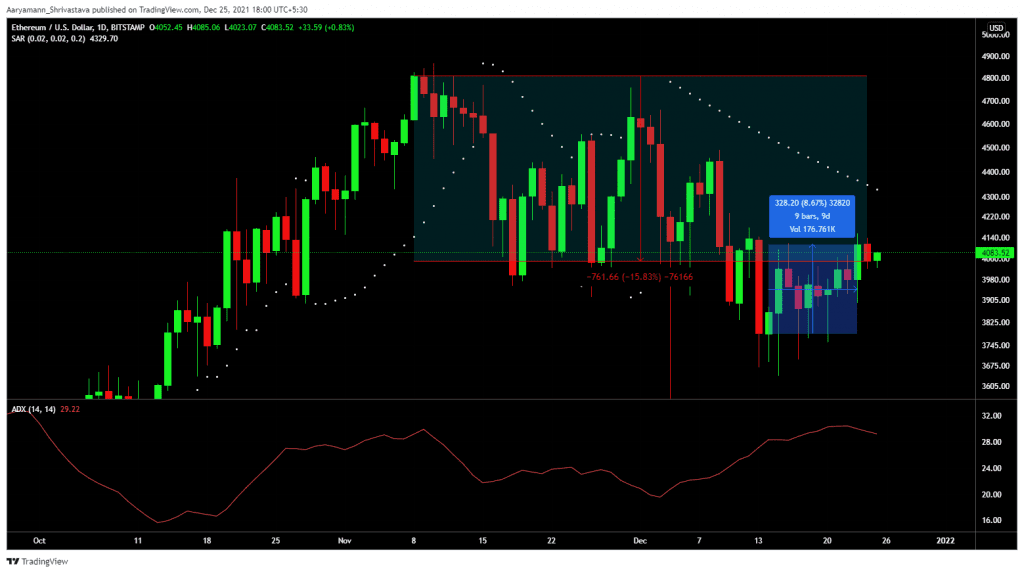

While the king coin has managed to rise by over 10.5% in six days, ETH is still at 8.67% even after nine days. This is because any price gains registered over the span of 2-3 days are negated within one day.

Ethereum price action | Source: TradingView – AMBCrypto

This fluctuation in price action is what is keeping investors from moving their assets around too much. Buying and selling are minimal for the same reason.

Consequently, the average transaction volume on a 7-day average has dropped to the lowest it has ever been in 22 months.

Ethereum volume | Source: Glassnode

This HODLing behavior is also verified by the fact that the rate at which Ethereum changes hands has also truncated to an 18-month low.

Ethereum velocity | Source: Santiment – AMBCrypto

In fact, the Ethereum whales who cumulatively hold over 21.3% of all supplies have been sitting silently for a while now. Their average volume has come down to $700 million from $1.2 billion.

But this hibernation from investors is actually protecting them from any severe losses. Price movement will eventually recover but exiting at the wrong moment would lead to the investors losing out on profits.

This is also why for the last seven months the network has only been realizing profits.

Ethereum profit/losses | Source: Santiment – AMBCrypto

Currently, 63.4 million addresses are either in/at the money (experiencing profits) and only 4.7 million investors are out of money (experiencing losses) including the 3.85 million investors who bought around the all-time high prices of $4811.

Ethereum investors in/out of money | Source: Intotheblock – AMBCrypto

Thus, as the sentiment of accumulation is once again rising, going forward new investors would only experience profits as the downtrend is beginning to lose strength.