The biggest mystery for any investor is to know the best entry points in a current market cycle. For a Bitcoin maximalist, the $34,000 range was the most rewarding point of entry for opening long positions.

Notably, in the market-wide capitulation event on 24 February 2022, the weak hands gave in to FUD. Simultaneously, high net worth individuals resorted to accumulating.

At the time of writing, the king coin was resting well in its psychological level, up by about 8.75% over the last seven days. As the overall sentiment for BTC makes a bullish shift, the dominance of FOMO in the coming days can’t be ruled out. Well, only if the BTC crosses its one-month-long resistance at the $45,000 mark.

Now, the most pertinent question for a profit-seeking investor is- Should one enter the market at the current price level?

Interestingly, the derivative market and the on-chain metrics have the answer.

Derivatives got you

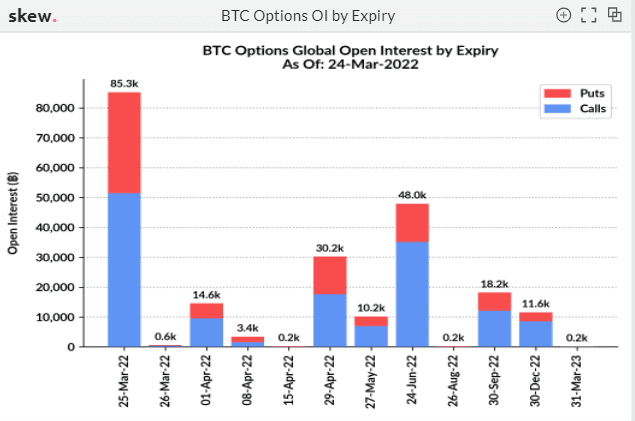

Curiously, over 85.3k BTC options open interest contracts are set to expire on 25 March 2022. Out of which a little over 50k contracts are calls options. This presents an interesting scenario. At the time of writing, BTC was changing hands at $44,115 with an increase of 2.60% over the last day.

In fact, out of the 17.9k option contracts at $40k strike price, 10k call option contracts – which shows a number of large option players are in losses. Now, investors excited about BTC reaching the $44,000 mark can take a little cautious approach.

Primarily because call option sellers at a $40,000 strike price wouldn’t easily want to book losses at this expiry. Interestingly, depending on this factor BTC’s price can go either north or might side with the bears. So basically, there is a possibility of a drop in Bitcoin prices until the expiry. However, in an extraordinary situation where BTC manages to stay above $40k, there’s a lot of upside that may come right after the expiry, but not before.

Also, from 26 February to 24 March 2022, the futures long liquidation dominance traded below 50%. This goes on to assert that the majority of people who were getting liquidated were on the short side. The shorts being squeezed is undoubtedly a part of the reason why BTC is going up the charts of late.

The current market level for BTC seems to be a decisive point for its future trajectory. For instance, looking at the MVRV ratio, it can be simply inferred that the unrealized profit and loss have been decreasing. Since January BTC’s MVRV ratio has stood below one.

Thus, indicating that the asset is undervalued. The likeability of it to cross the three-mark looks challenging in the near term.

Furthermore, since December 2021, NUPL has rested well below the 0.5 mark. Now, if there is an increase in the unrealized profit in blockchain, further price drops can’t be ruled out.

The reading of this metric invokes optimism with a pinch of anxiety. Risk-averse investors can plan to enter the market. However, it’s important to note that currently, NUPL stands in the undervalued zone.

Metrics have been putting forward the same prediction for Bitcoin. One where the king coin is undervalued. This connotes that unprecedented volatility can be expected in the near term.

Perhaps it’s the right time for people planning to allocate a percentage of their portfolio to BTC.