Looking at AAVE, it may appear that the DeFi token is actually in a better position at the moment, given the 15% rally that occurred in the last 24 hours. However, the bigger picture is way less exciting.

AAVE whales HODL

Usually, when a token or an altcoin is heavily associated with whales, it is considered to be a risky investment owing to the fear of unprecedented dumplings.

However, certain tokens such as Polygon (MATIC), Chainlink (LINK), and in this case, AAVE as well have surprisingly stable whales. This is why these tokens have become one of the top cryptocurrencies in the world.

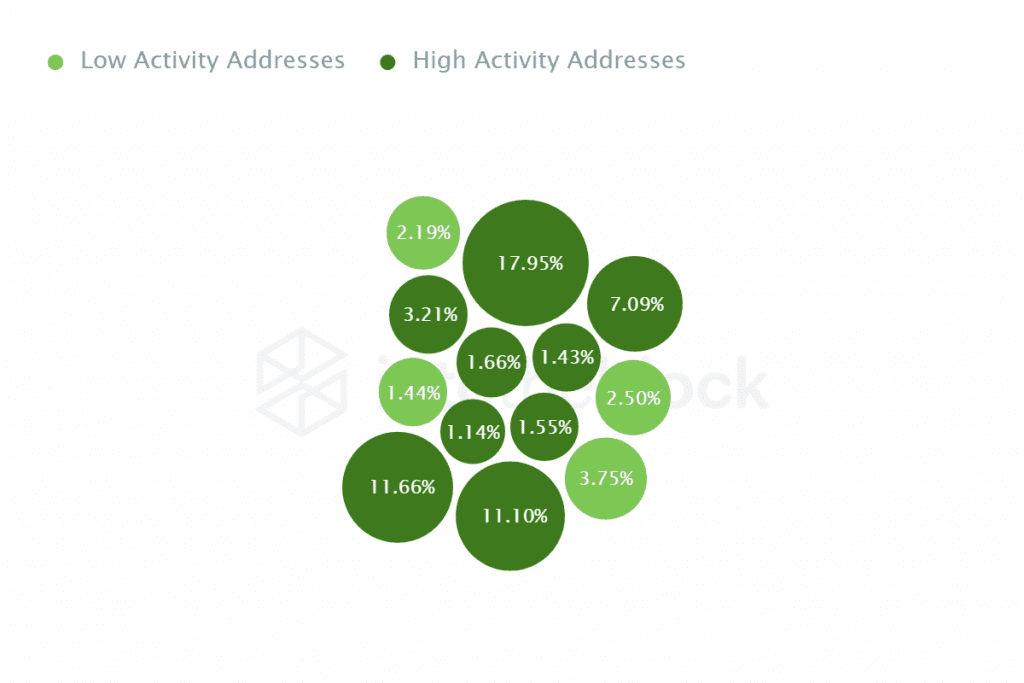

AAVE, in particular, has domination of 13 whales, which cumulatively account for 66% of the 16 million AAVE supply. Although they do have a majority of the supply in their hands, most of this supply has been untouched for a while now.

AAVE Whales dominate 66% supply | Source: Intotheblock – AMBCrypto

Addresses and balance divided based on their duration show us that AAVE began witnessing the emergence of HODLers (long-term holders) in October. These investors have been holding on to their AAVE for over a year. Furthermore, at the moment, these HODLers account for 32.78% (34.2k) of all addresses.

AAVE HODLers numbers are rising | Source: Intotheblock – AMBCrypto

These 34.2k addresses in all hold about 3.87 million AAVE, which has been sitting in these investors’ wallets for over a year now. But the question is can this persist?

HODL all the way

Apart from the 3.87 million AAVE held for 1+ years, another 10.94 million AAVE has been held for anywhere between a month to a year.

ITB data shows us that of the 103k total addresses holding AAVE, 82.8% of them are in loss right now. Although it may look like the current market conditions might be responsible for this, in reality, this has been a developing situation, not an overnight occurrence.

AAVE investors in loss | Source: Intotheblock – AMBCrypto

Beginning May 2021, the concentration of investors in profit started tumbling from 94% and hasn’t stopped yet.

This means that the AAVE holders who held the token for a month and more than a year, have witnessed AAVE’s peak at $629. However, they are currently witnessing the altcoin struggle to breach $140.

The only reason most of these HODLers are still HODLing is that the price fall still hasn’t invalidated all of 2021’s rise. AAVE is still 66.38% above January 2021 levels, and as long as it remains that way, these investors won’t plan to exit.

AAVE price action | Source: TradingView – AMBCrypto

It is interesting to note that a push from investors’ end might even help AAVE to recover provided the broader market cues turn bullish.