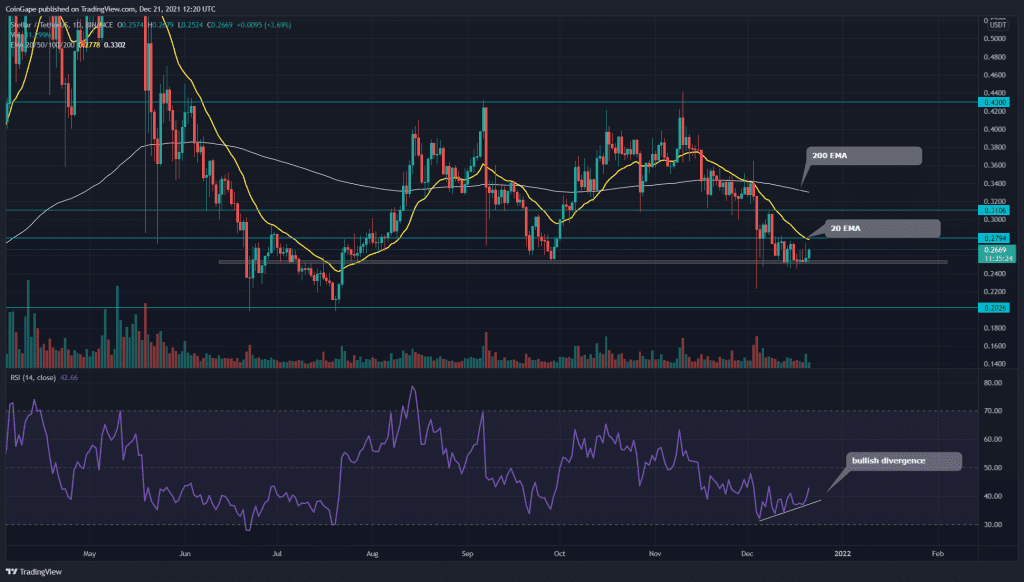

The XLM/USD technical chart projects an overall sideways trend. The current retracement phase has dropped the price to $0.25 support, which resonates in a tight range. Escaping this range should indicate the further movement in price.

XLM/USD Daily Time Frame Chart

Source- Tradingview

Past Performance or Trend

Since the bloodbath over the crypto market in May and June’21, the XLM coin has moved in a range-bound trend. Over the past five months, the price has been limited to the $0.45-$0.2 mark. Following the latest rejection from the $0.43 resistance, the price plummeted to the crucial support of $0.25, indicating a 43% loss.

XLM Price Consolidating In A Narrow Range

The XLM coin chart showed a steady downfall which brought the price back to $0.25 support. The XLM coin price has been resonating between the $0.28 and 0.25 mark for almost two weeks, creating a narrow range in its price. This consolidation could provide an excellent trading opportunity once the price breaches either of these levels.

On a contrary note, if the price manages to break out from the overhead resistance level, the market buyers will obtain their first hint for a possible bullish reversal.

At the time of writing this report, the XLM coin price is $0.265, with an intraday gain of 3.03%. The 24hr volume change is $625.3 million, indicating a 1.03% hike. As per the Coinmarketcap, the coins stand at 26th rank with their current market cap of $6.5 billion (0.27).

XLM/USD 4-hour Time Frame Chart

Source- Tradingview

Technical Indicators

- The daily Relative Strength Index(38) indicates a bearish sentiment for the coin. However, the RSI line projects bullish divergence in its chart, suggesting the rising strength of buyers.

- The XLM coin indicates a bearish alignment of the crucial EMAs(20, 50, 100, and 200). Additionally, this 20 EMA line offers strong resistance to the price.

- The Moving average convergence divergence shows both the MACD and signal are on the verge of crossing above the neutral zone(0.00). This crossover would provide extra confirmation for traders in a bullish breakout.