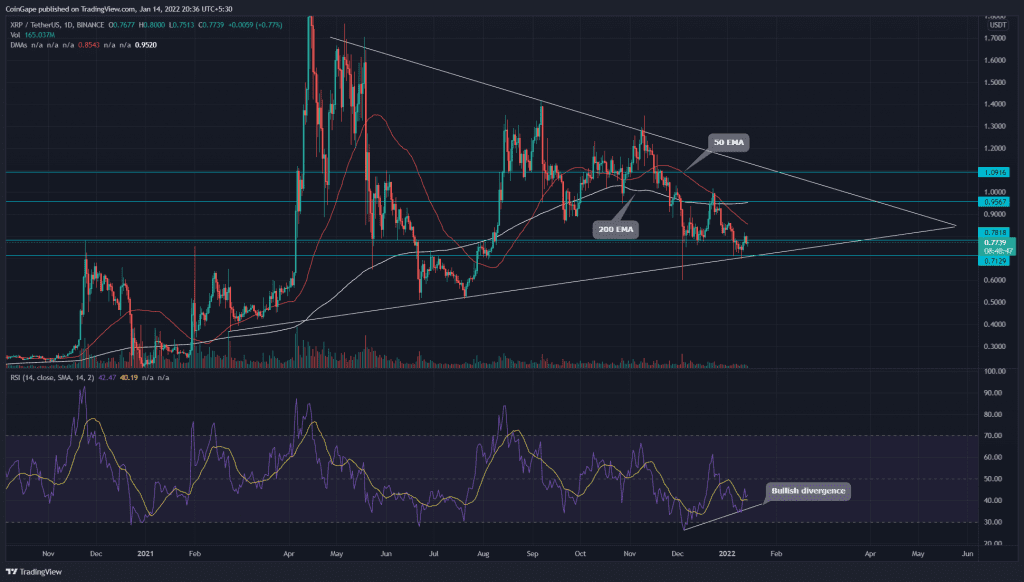

The overall trend for the XRP price is still sideways. The recent correction in price has plunged the coin to a crucial support level of $0.7. However, the technical chart shows the formation of a symmetrical triangle pattern, whose breakout could initiate a new trend in XRP price.

Key technical points:

- The RSI displays bullish divergence in the daily time frame chart

- The intraday trading volume in the XRP coin is $1.74 Billion, indicating a 3.69% hike.

Source- Tradingview

The last time we covered an article on XRP price analysis, the short-term downtrend plunged the price to the $0.7 support. The technical chart showed several lower price rejection candles, indicating the intense buying pressure.

Moreover, the XRP price is also at the support trendline of a symmetrical triangle pattern. Following this pattern, the price could bounce back from this support and rally towards the overhead resistance(approx. $1.1).

Moving in a sideways trend, the longer EMA lines 100 and 200 EMA have started to fatten. However, as for now, the price is trading below these EMAs, indicating a bearish trend.

The daily Relative Strength Index (43) is steadily approaching the neutral line. Moreover, the chart also shows bullish divergence, providing more confirmation for a bullish reversal.

XRP Price Could Retest The $0.7 Support

Source- Tradingview

On January 10th, the Ripple coin price bounced back from the $0.7 support with a morning star candle pattern. The price started to rally and breached the nearest resistance of $0.78. However, the price couldn’t sustain above this level and dropped below the breaking point.

If the price sustains below the $0.78 resistance, the coin might retest the bottom level for another support before it could initiate a proper rally.

The average directional movement index(20) slope moving lower displays the losing momentum in selling pressure. The traditional pivot level indicating the overhead resistance for XRP is $0.776, followed by 0.838. On the flip side, the support levels are $0.688 and $0.62.