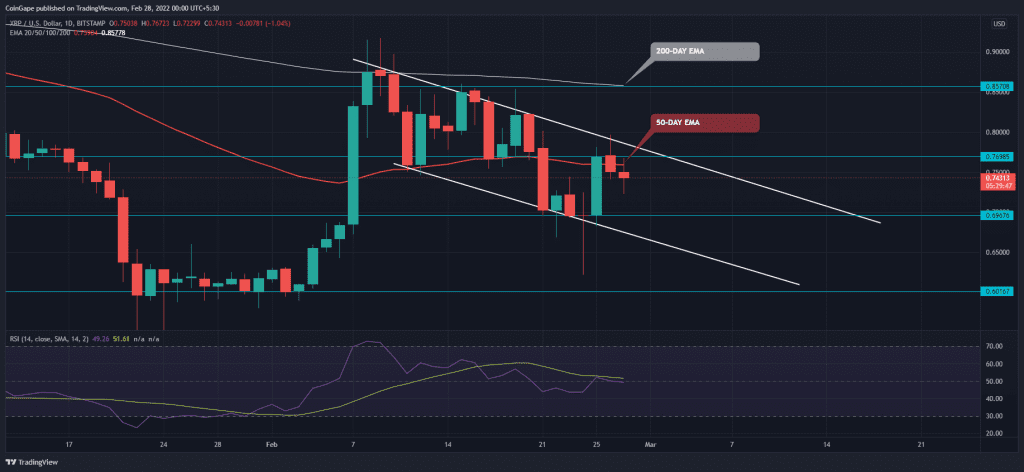

The XRP price recovery rally takes a short pause, resulting in the formation of a flag pattern. The retracement tumbled altcoin by 35%, reaching the February 24th low($30). The XRP price resonating in the falling channel is expected to recover once the buyers breach the overhead resistance.

Key technical points:

- The daily-RSI slope is poised to enter the negative territory.

- The 50-day EMA flipped to a potential resistance

- The intraday trading volume in the XRP is $3.12 Billion, indicating a 22.08% hike.

Source- XRP/USD chart by Tradingview

On February 8th, the Ripple (XRP) price turned down from the shared resistance of $0.87 and 200-day EMA. The retracement rally forming lower highs and lower lows show a flag pattern in the chart’s daily time frame.

The high price rejection on February 24th suggests another reversal from the descending trendline. This bullish continuation pattern could provide a long entry opportunity to traders once the price breaches the overhead trendline.

The XRP price chart displays a bearish alignment among the crucial EMAs(20, 50, 100, and 200). In the recent downfall, the buyers lost 20 and 50 EMA support, providing an extra edge to short-sellers.

The Relative Strength Index(49) slope would soon nosedive below the neutral zone, suggesting a switch to the bearish market sentiment.

XRP/USDT: 4-hour time frame chart

Source- Tradingview

The 4-hour XRP/USD chart shows a higher price rejection from the $0.76 resistance level and trendline confluence. Thus, if bears sustain the XRP price at the resistance trendline, the selling pressure would intensify and pull the price to the $0.60 mark upon the fallout of $0.69.

Alternatively, a bullish breakout and closing above the descending trendline could drive altcoin to the $0.895 mark.

- Resistance level: $0.85 and $1

- Support levels: $0.745 and $0.59