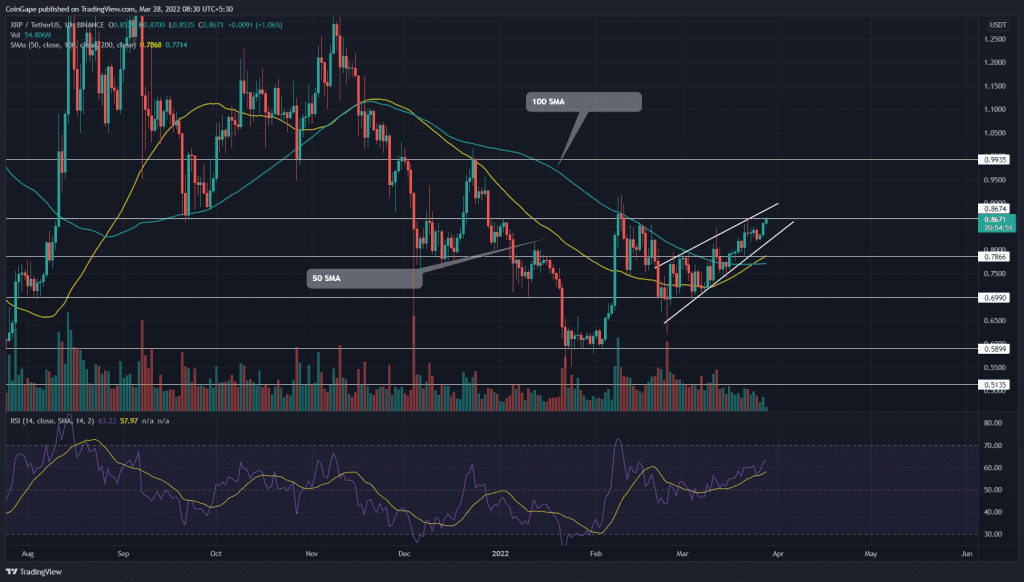

The slow and steady recovery in Ripple(XRP) price approaches the $0.8-$0.9 resistance zone. The lack of strong bullish momentum and decreasing volume activity may tease a bearish reversal, but, in that case, the support trendline breakdown stands as a key confirmation for short-sellers.

Key points:

- The XRP price action narrowing within the wedge pattern

- The daily-RSI slope rising with no signs of weakness

- The intraday trading volume in the XRP is $2.07 Billion, indicating a 57.6% loss.

Source-Tradingview

On March 7th, the XRP/USDT pair rebounded from the $0.7 local support. However, the new recovery sets a low pace as it is confined within a rising wedge pattern. The coin is currently trading at the $0.84 mark, indicating an 18.58% gain from the bottom support.

The price action is gradually narrowing inside the two converging trendlines, suggesting a breakout is on its way. In addition, a rising wedge pattern usually boosts intense selling pressure when the price breaches the support trendline.

Thus, if the XRP price gives a daily-candle closing below the dynamic support, the traders can expect a 16% fall to the $0.7 mark.

Best optionsEarnEarn 20% APRClaim5 BTC + 200 Free SpinsWalletCold Wallet

However, until the pattern is intact, the short-term trend remains bullish. A significant buying momentum and trading volume pump could pierce through $0.9 resistance, opening the path to $1.

Technical Indicator

The 50-and-100-day SMA has recently given a bullish crossover that could attract more buyers. Moreover, the 200-day SMA situated near the $0.9 mark strengthens the defense line for sellers.

The gradual rise of the daily-RSI slope shows that buyers are wresting control from sellers. The sustained bullish momentum would lead the RSI slope to the overbought region.

- Resistance level: $0.88-$0.90 and $1

- Support levels: $0.78 and $0.7