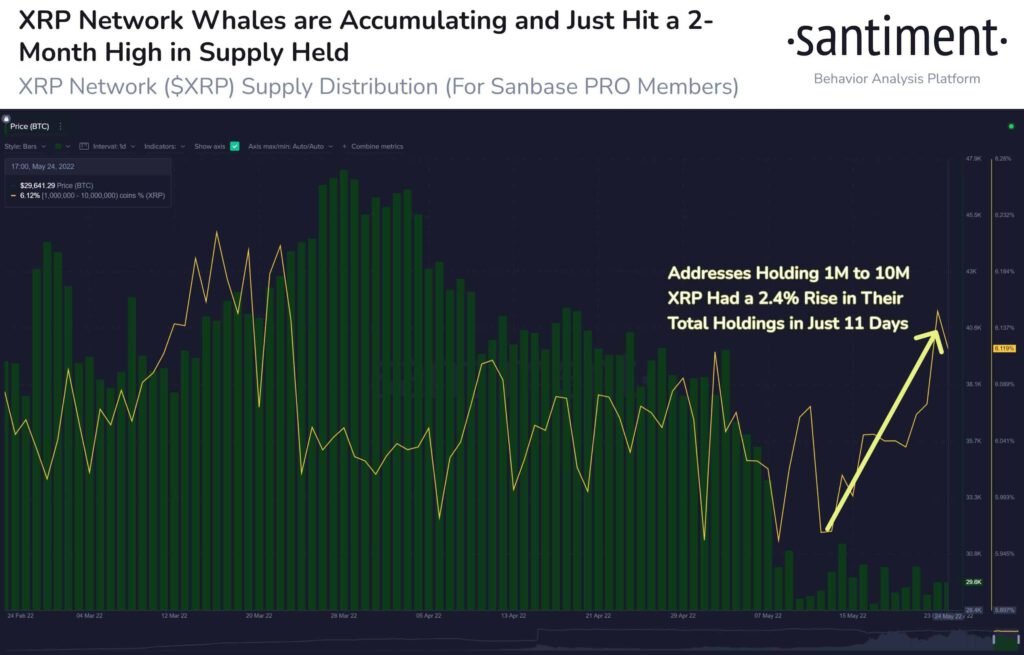

Amid the recent market downturn, Ripple whales have turned quite active in the market once again. As per on-chain data provider Santiment, Ripple whales holding between 1M-10M XRP have been on an accumulation spree. The data provider wrote:

“XRP Network whales holding between 1M and 10M $XRP have collectively been accumulating, and now hold their highest percentage of the asset’s supply in 2 months. This is the most active tier of non-exchange holders, and currently hold 6.12% of all $XRP”.

Ripple’s XRP cryptocurrency has indeed been part of the brutal market crash and has corrected more than 50% just over the last two months. As of press time, XRP is trading at $0.40 as the world’s sixth-largest cryptocurrency by market cap.

Ripple to Consider Public Listing

Ripple CEO Brad Garlinghouse has been currently attending the World Economic Forum in Davos, Switzerland. In his interview with CNBC, Garlinhgouse said that they will explore the possibility of an initial public offering (IPO) once they conclude their legal battle with the U.S. Securities and Exchange Commission (SEC).

The Ripple vs SEC battle has been ongoing for over 155 months now. The securities regulator has accused Ripple of selling its XRP tokens and unregistered securities. However, Ripple has been strongly defending its position of no wrongdoing in the courts. Many industry experts believe that the settlement shall happen in Ripple’s favor by this year. Speaking about their plans of public listing, ripple CEO Brad Garlinghouse said:

Trending Stories

“I think we want to get certainty and clarity in the United States with the U.S. SEC. You know, I’m hopeful that the SEC will not slow that process down any more than they already have. But you know, we certainly are at a point in scale, where that is a possibility. And we’ll look at that once we’re past this lawsuit with the SEC.”

advertisement

Despite the regulatory headwinds, Ripple continues to grow in the overseas market. For Q1 2022, the on-demand XRP liquidity for cross-border payments stood at $8 billion. This was 8 times more than the liquidity settlement for the same period last year.