Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

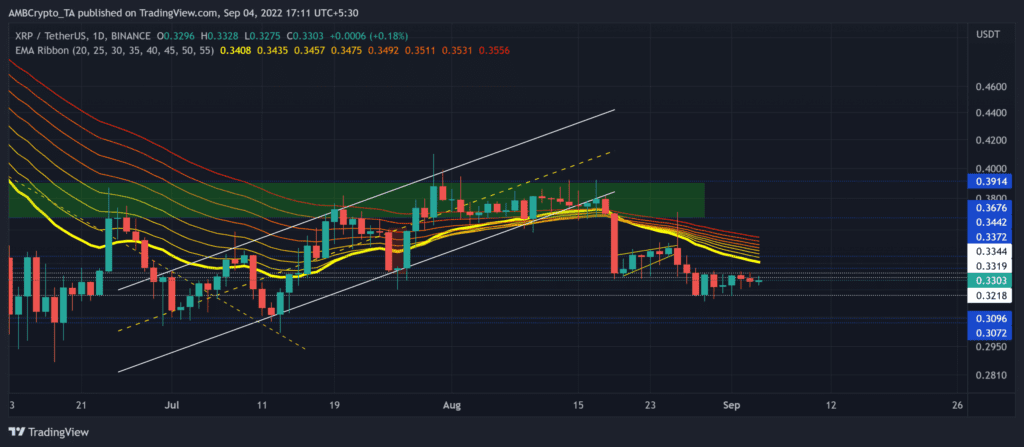

XRP’s latest breakdown highlighted near-term rebounding tendencies from the $0.32-support level. However, the drop below the EMA ribbons has expedited the long-term bearish edge on the daily chart.

The buyers are now trying to stop the bleeding of the recent bearish pennant breakdown. However, a reversal from the $0.3319-level would aid sellers in rekindling their power to initiate a sluggish phase. At press time, XRP was trading at $0.3303, down by over 11.2% in the past month.

XRP Daily Chart

After a nearly two-month up-channel oscillation, the sellers renewed their edge from the coin’s long-term supply zone in the $0.36-$0.39 range. This u-turn inflicted a reversal below its EMA ribbons. The bearish pennant breakdown snapped the $0.334 level and flipped it to immediate resistance from support.

Hereon, the bears might look to evoke a reversal from the $0.33-zone, especially with the rising gap between the south-looking EMA ribbons.

A potential reversal from the $0.33-support could position XRP to retest the $0.32-support. An eventual close below this support level would only aggravate the bearish pressure towards the $0.309-level in the coming sessions.

The buyers must find a way to test the 20 EMA to break the bearish press time shackles in the aforementioned price range.

Rationale

The Relative Strength Index (RSI) continued to sway below the equilibrium over the last few days. An eventual close above the 50-level could hint at easing selling pressure.

Also, the Accumulation/Distribution (A/D) trend marked higher troughs to depict a relatively mild bullish divergence with the price. A reversal from its immediate resistance level would reaffirm this divergence.

On the other hand, the DMI lines revealed a neutral-ish position. Even so, the ADX projected a substantially weak directional trend.

Conclusion

Given XRP’s bearish flip beneath the $0.33-level and the south-looking EMA ribbons, the sellers would look to maintain their edge in the coming sessions. The targets would remain the same as discussed.

Also, keeping an eye on Bitcoin’s movement and the broader sentiment would be important to determine the chances of bullish invalidation.