Yearn.Finance (YFI) has created a short-term bullish pattern which suggests that an upcoming bounce is likely.

YFI has been falling since reaching an all-time high price of $95,000 on May 12. The increase was initially very swift, leading to a low of $23,589 11 days later. Measuring from the all-time high, this amounted to a decrease of 74%.

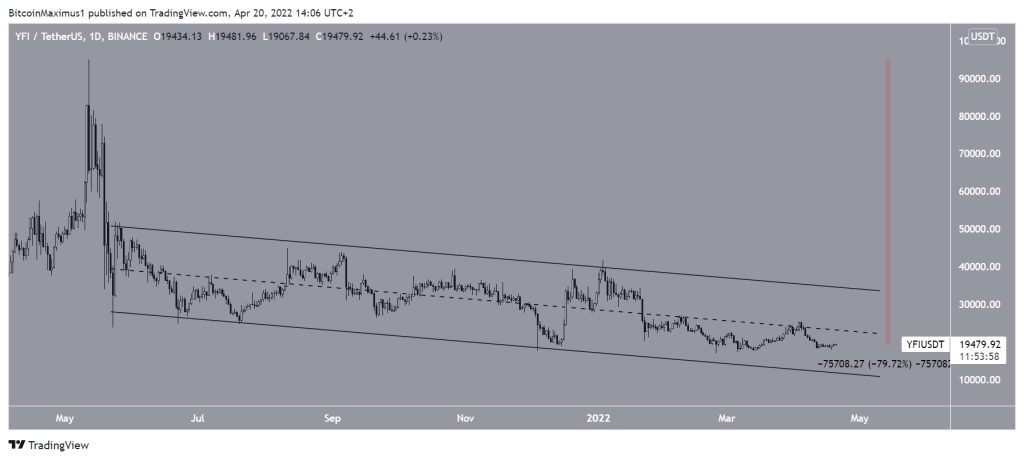

Since then, the price has been falling very gradually inside a descending parallel channel. Both the resistance and support lines of the channel have been validated numerous times.

Descending parallel channels are considered corrective patterns. Therefore, an eventual breakout from it would be likely. Despite this, YFI is currently trading in the lower portion of the channel and is 80% below its all-time high.

Short-term bounce

Market analyst @IncomeSharks tweeted a chart of YFI, stating that the price is likely to bounce despite lagging considerably relative to other cryptocurrencies.

The six-hour chart supports the possibility of a bounce. The first reason for the bounce is the bullish divergences that have developed in the RSI and MACD.

The second reason is the double bottom that has been created between April 11 and 18. The double bottom is considered a bullish pattern and often leads to bullish trend reversals. Its significance is increased because of the aforementioned bullish divergences.

If a bounce occurs, the closest resistance area would be at $20,900. This is the 0.382 Fib retracement resistance level and coincides with a horizontal area.

Future YFI movement

The weekly chart supports the possibility of a long-term upward movement. The main reason for this is the bullish divergence that has developed in the RSI. This supports the creation of the parallel channel, due to the latter being a corrective pattern.

So, if a breakout from the channel were to occur, the first important resistance would be at $47,700. This is the 0.382 Fib retracement resistance level.

However, it is possible that the price will re-test the $13,000 area once more before potentially breaking out.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.