Zilliqa price seems to be pulling a 180 after an impressive and exponential run-up over the past two weeks. This ascent seems to be getting undone by investors booking profits and due to the correlation with Bitcoin.

This retracement is currently testing a crucial support level, a breakdown of which, could trigger a massive crash.

Zilliqa price faces make or break moment

Zilliqa price rallied a whopping 503% as it skyrocketed from $0.038 to $0.230 from 15 March 15 to 1 April. The uptrend set up a swing high at $0.230 and has been crashing since then. So far, ZIL has dropped roughly 48% to where it is currently hovering – $0.123.

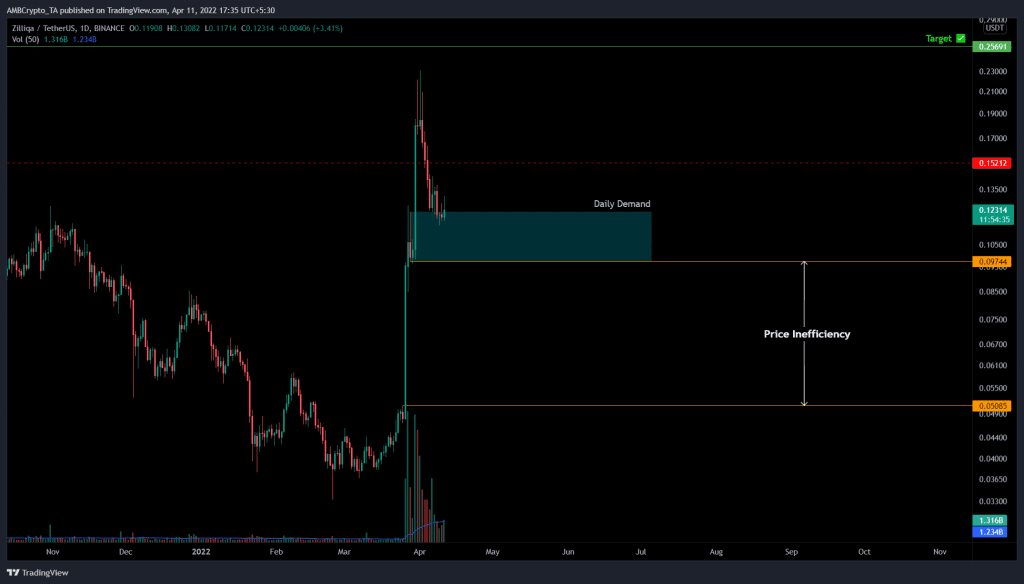

Fortunately for buyers, the $0.097 to $0.122 demand zone aka the support area will provide buying pressure. As seen in the chart, the retests of this barrier have resulted in an uptick. However, the selling pressure from BTC seems to be rippling out to Zilliqa price, causing it to crash as well.

If ZIL breaks below the $0.097 support level, it will invalidate the bullish thesis, triggering a crash to $0.051. The presence of a fair value gap (FVG) extending from $0.097 to $0.051, makes this downswing more compelling. An FVG is a price inefficiency caused due to rapid moves in either direction. Markets often reverse to mean, causing these gaps to be filled. Therefore, market participants need to stay prepared for a 50% crash to $0.051.

Supporting this downswing in the price for ZIL is the recent decline in on-chain volume from 17.6 billion to 10.42 billion over the past three days. This sudden collapse indicates that investors are booking profits and leaving the ecosystem, which coincides with the scenario detailed from a technical standpoint.

Hence, traders need to exercise caution, at least until Bitcoin price stabilizes and establishes a directional bias.

While the bearish outlook is dependent on the breakdown of the $0.122 to $0.097 demand zone, a bounce from the same area is likely to trigger an upswing. Moreover, a recovery for the big crypto could limit the downside regardless of the price inefficiency. Hence, a failure to move below the said barrier will allow buyers to recuperate and trigger another run-up to $0.151.