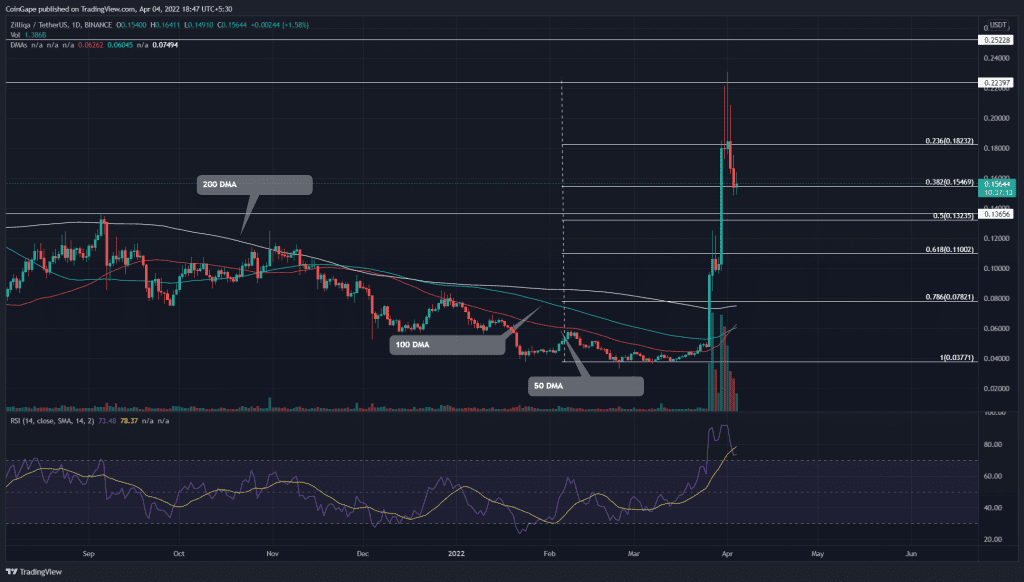

The ZIL price rally hit the $0.230 mark on April 1st, its highest in the past ten months. However, during mid-week, the several higher price rejection candles indicate the bullish momentum got exhausted from the sudden rally, which resulted in a 30% correction over the last three days. Continue reading to know the significant support levels that could renew the bull run.

Key points

- The daily-RSI slope turns down from the overbought zone

- The 50 and 100 DMA offers a bullish crossover

- The intraday trading volume in the Zilliqa coin is $2.2 Billion, indicating a 35% loss.

Source- Tradingview

The ZIL/USDT pair showed phenomenal growth during the late march, registering a $511 gain from the March 14th low to the April 1st high. The perpendicular rally reached a high of $0.23 on Saturday, but the aggressive sellers forced the ZIL price into forming a shooting star candle(High-wick candle).

A number of these higher price rejection candles indicate the failed attempts from buyers to sustain the above level, which eventually led to a minor correction. The retracement rally has devalued the ZIL price by 32%, dropping its 0.382 FIB level.

However, such corrections are needed to sustain a long uptrend.

Furthermore, the decreasing volume activity during the correction phase and a Doji candle at Fibonacci support(0.382) suggest a good rebound setup. Even so, if buyers failed to sustain above the $0.155 mark, the altcoin would dump another 14% to meet the 0.5 FIB level.

The ZIL price may consolidate for a few weeks; however, the coin sustaining above $0.365 is favorable to maintain a bullish sentiment.

Technical indicator

The Relative Strength Index(54) slopes tumbled lower after spending a week in the overbought region. However, the indicator value moving around 70% suggests an overall bullish sentiment.

The sudden upcurve in 20, 50, and 100 DMAs accentuates the aggressive buying from trades. Moreover, the 50 and 100 DMA triggers a positive crossover, encouraging the continuation of the bullish rally

- Resistance levels- $0.18, and $0.223

- Support levels are $0.153 and $0.136