Bitcoin mining difficulty has been adjusting for a while now. With the hashrate falling as more miners go offline due to declining profitability, mining difficulty has been following pretty much the same trend. However, instead of falling the trend that was persistent through the last two months, the difficulty has been adjusting downward instead.

Mining Difficulty Declines

Instead of difficulty rising as expected, it is declining. After miners saw their cash flow fall over the last couple of months, they have been hard-fought to keep their activities going. The blocks per hour being produced had declined with it given the decreased hashrate.

Related Reading | Here Are Some Events That Point To More Decline In Crypto Prices

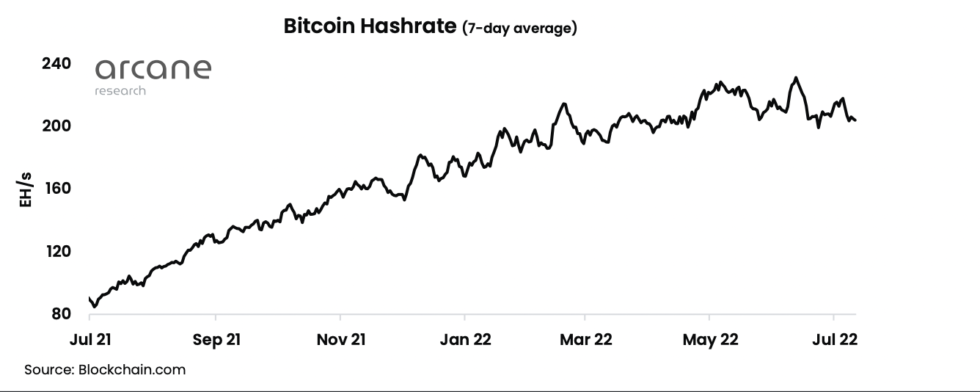

The bitcoin mining hashrate had actually touched a new all-time high back in June. But that would be short-lived given the decline in July. Presently, the block production per hour comes out to 5.70, down 7.71% from the previous week’s production rate of 6.18 blocks per hour. As a result, there has been another downward difficulty adjustment, marking two downward adjustments in a row. This comes after difficulty had family recovered to a normal level in the previous week.

An interesting thing that happened though was a one-of-a-kind event that was recorded in the mining space. On Saturday, there was a total of six blocks were discovered in 6-and-a-half minutes, something that is very unlikely. Nevertheless, the hashrate continues to decline.

Hashrate loses momentum | Source: Arcane Research

Bitcoin Miners Suffer Losses

The decline in bitcoin miner revenue has not been resolved in any way. Last week was no different from the weeks leading up to it as miner revenues had continued to plunge. This time around, revenues took a 1.34% nosedive, coming out to $18.39 million in revenue realized daily compared to the prior week’s number of $18.64 million.

Related Reading | Investor Sentiment Nosedives As Crypto Market Sheds $50 Billion

However, daily fees realized were up even though transaction volumes were down. Fees per day grew 44.37% in the 7-day period to come out at $404,688, compared to the prior week’s 280,310. This increase in daily fees saw the percentage of revenue made up by fees surge by 0.70%. Meaning that revenue from fees made up 2.20% of total revenue, one of the highest it has been.

BTC price trending below $20,000 | Source: BTCUSD on TradingView.com

The fees will turn out to be the only green in a sea of red on-chain metrics. Daily transaction volumes were down by 8.69% while the number of transactions being carried out per day dropped by 1.76%. Others include average transaction volume which recorded a 7.05% decline. Lastly, the average transactions per block dropped from 1,814 to 1,782 in a one-week period to come out to a 1.76% loss.

Featured image from How to Start an LLC, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…