- A new trading strategy has emerged for BTC.

- An expert at Bespoke Investment Group pinpointed that ‘BTC buying at the open and selling at the stock market close’ has happened for the coin.

- The reason expected for this strategy might be linked with the busier news cycle in the after-hour market.

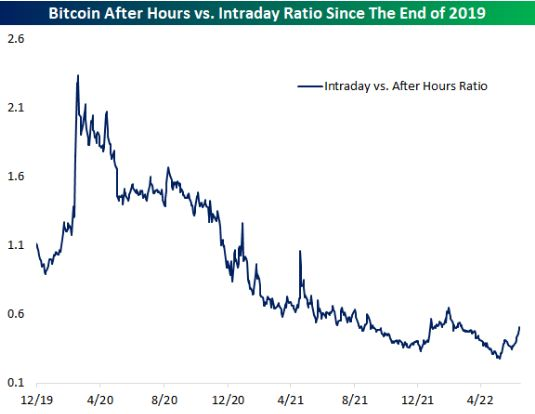

Bloomberg reported that the popular trading strategy that Bitcoin had been following is not available in the current chart pattern. In detail, analysts say that the strategy of ‘buying the coin at the close and selling at the open of the US stock market’ may not exist anymore.

Jake Gordon, a research analyst at Bespoke Investment Group, observed that contrary to the previous approach, people are currently buying BTC at the open and selling it at the close. This would mean that the time-tested strategy of the coin has come to an end.

Gordon specified that this new trading strategy began over the past month. He wrote: “The price action of Bitcoin and Ethereum have pivoted from intraday weakness earlier this year to intraday strength.” According to reports, people who buy the US stock market’s open and sell the close actually received higher profits.

However, the exact reason for this new trend has not yet been found, but Gordon believes that it might be related to the fact that the recent news flow is busier during the after-hours market.

Earlier, Bespoke found that BTC price hikes when the stock market closes during the weekends. With that said, from Monday to Friday, the coin trades flat before the stock market opens but drops as the trading begins.

Notably, BTC gained more profits during the pandemic, as traders bought and sold the coin outside regular trading hours. These traders took advantage of this strategy, making a prophecy that they would get more profits in this market trend.

At the moment, the price of BTC is $22,194.58, with a 3.44% hike in the past 24 hours. An 8.7% surge is also marked for the coin in the past week. Besides the new trading strategy, BTC shows an upward trend in the 1-hour trading chart since the day started.