Key Takeaways

- Avalanche Summit is a big event that helps projects from both inside and outside the Avalanche ecosystem connect with not only each other but also global audiences.

- AAA games are a great motivation for the development of Avalanche in the future.

- The Avalanche Terra collaboration and the collapse of LUNA/UST resulted in significant losses to Defi protocols.

- The stormy season of stablecoins and the stablecoin of the Avalanche ecosystem still stands.

- Subnets are being popularized and widely deployed.

- The collapse of 3AC led to significant impact on the Avalanche ecosystem, including projects that have not yet launched.

Introduction

During Q2, the Avalanche ecosystem clearly aimed to build infrastructure, which is essential for the long-term development of the project. We can see this through Avalanche hosted events that help connect projects in the ecosystem as well as programs to attract infrastructure construction projects on Avalanche. Avalabs also encourages incentives and support for other projects that want to build Subnets.

However, with long-term vision, the current legoes in this ecosystem do not have a breakthrough. TVL or price is gloomy, causing boredom for retail investors.

More details on what’s notable in the last quarter. Let’s dive into our article.

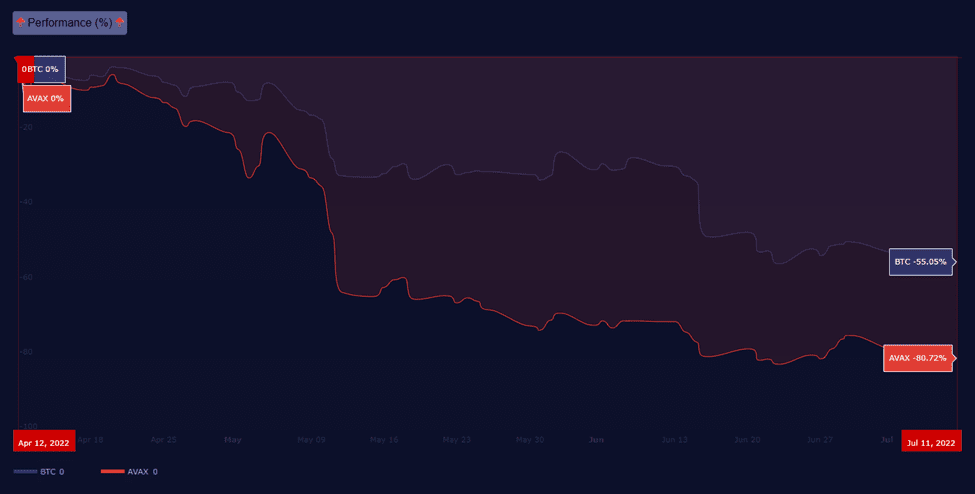

Market and Bitcoin correlation

Bitcoin Recap

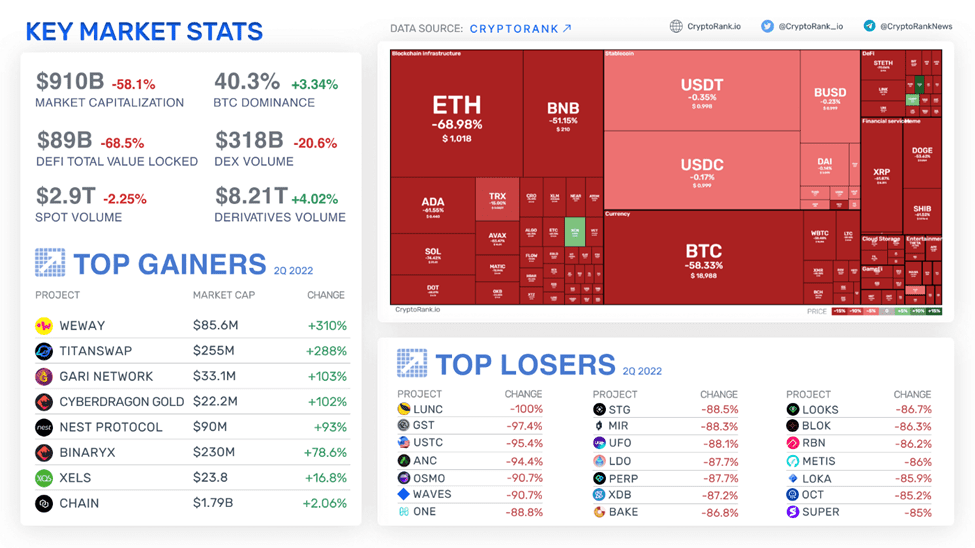

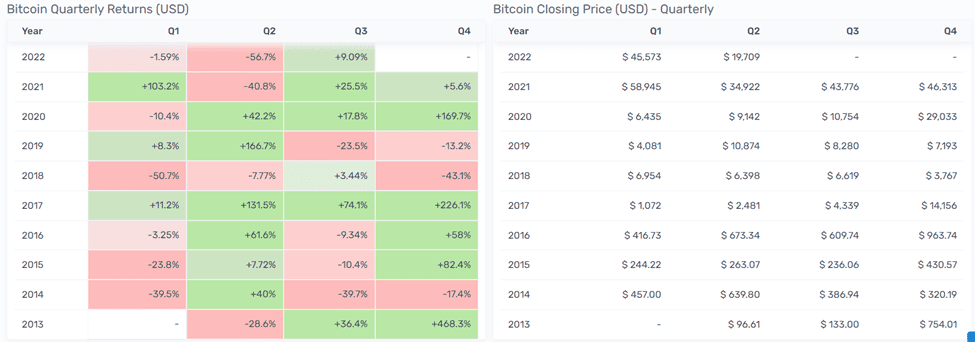

Bitcoin has a 59.6% drop (Binance) in Q2/2022

Bitcoin’s performance this quarter shows its worst drop in 10 years. Compared to the ATH peak at $69,000 on November 10, 2021, Bitcoin has lost almost 70% of its value. Moreover, the $17,600 dip has fallen more than the previous peak of $19,700, which is beyond the expectations of many large investment funds. Investors observed the domino effect from investment funds being called to liquidate makes the market worse.

With a decrease of 37.9%, July 2022 became the month with the strongest decline ever.

Support and Resistance

From Q2 up to now, Bitcoin’s $41,000 and $29,000 support levels have been repeatedly broken. Currently, Bitcoin is testing what is also considered the most important support level, trading history on the Spot market shows that Bitcoin is in a demand zone around $19,000 and a supply wall at $29,000 will play an important role in determining the Bitcoin trend in the near future.

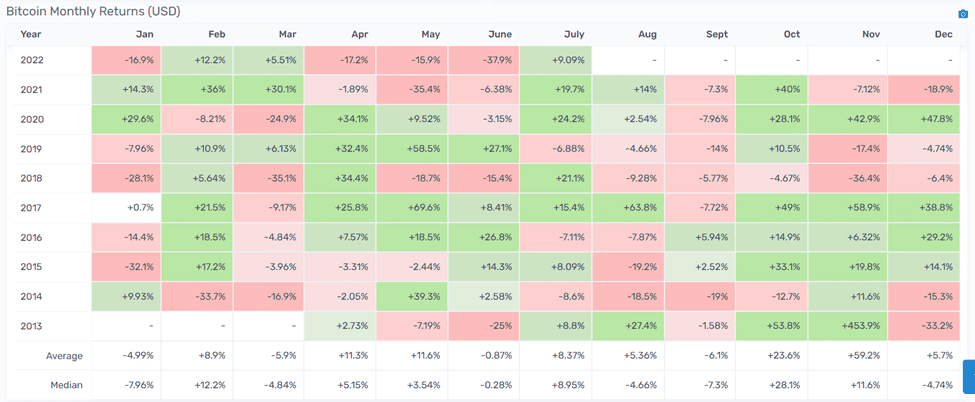

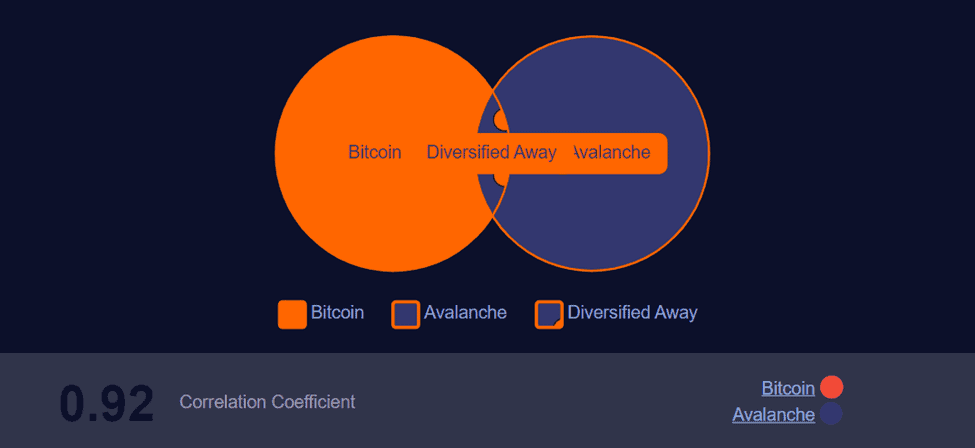

Diversification Opportunities For Bitcoin And Avalanch

The 3-month correlation between Bitcoin and Avalanche is 0.92. Overlapping area represents the amount of risk that can be diversified away by holding Bitcoin and Avalanche in the same portfolio, assuming nothing else is changed. The correlation between historical prices or returns on Avalanche and Bitcoin is a relative statistical measure of the degree to which these equity instruments tend to move together. Values of the correlation coefficient is 0,92 means almost no diversification.

Pair Correlation Between Bitcoin And Avalanche

Assuming the 90-day trading horizon Bitcoin is expected to generate 0.64 times more return on investment than Avalanche. However, Bitcoin is 1.55 times less risky than Avalanche.

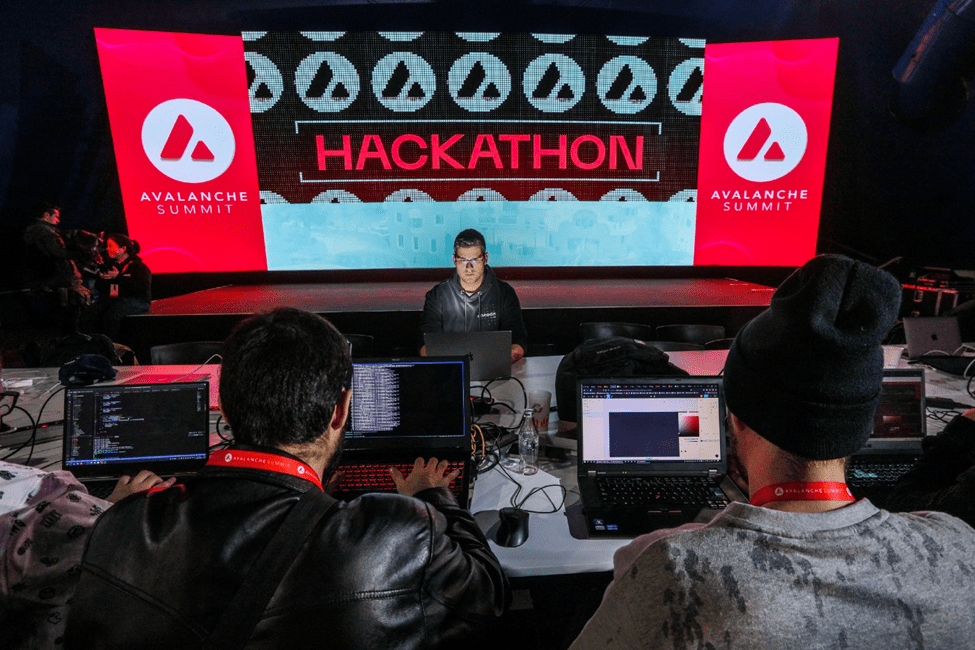

Avalanche Summit

Avalanche Summit is a conference for developers, researchers, and makers building on Avalanche at Barcelona, Spain from the 22 to 25 March 2022.

The Avalanche Summit hosted huge names in the crypto space inclusive of Ava Labs, Chainlink, VC firms and even the trade and investment Secretariat from the El Salvador government.

Important announcements

– The new ‘Core’ wallet

This new ‘Core’ wallet for the Avalanche blockchain is a multi-chain wallet with Ledger support. It works on mobile and as a browser extension.

– A Bitcoin bridge

The Avalanche Bridge will allow Bitcoin users to bridge to Avalanche. This will allow DeFi participation for BTC holders, in a secure and innovative way.

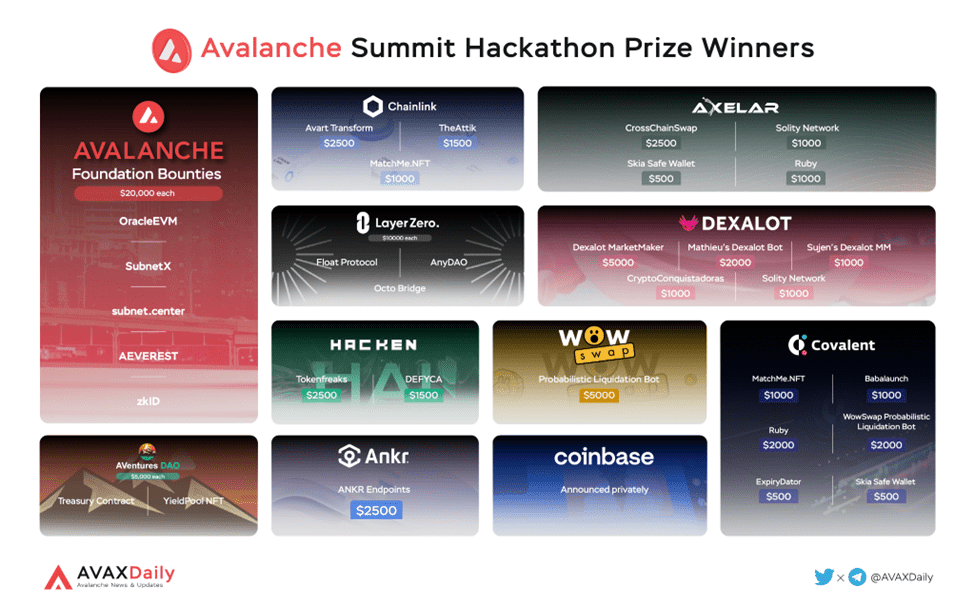

Avalanche Summit Hackathon

Hackathon took place over the weekend of Friday March 25 — Sunday March 27, 2022. Powered by Encode Club, the hackathon followed the highly successful Avalanche Summit DevCon.

– More than 250 hackers attended

– 56 projects submitted

– Around $200k of prizes were given out

The event was supported by awesome sponsors and mentors, without whose support the event would not have happened!

Motivation for the future development

DeFi infrastructure is evolving

(Reference: Chaindebrief’s Avalanche Summit recap)

The technology that drives DApps could also be one of the game changing trends in the DeFi space. Omer Demirel from MC ventures mentioned that AVAX’s subnets are of great importance, which will bring DeFi to have its own narrative and economy in attracting new users.

Bridges are essential to every ecosystem. Durgee claimed that the AVAX bridge to Ethereum is one of the best out there, and is “eloquently executed”.

However, the introduction of bridges to L1 or L2 will come with additional attack factors, just like what we saw with Wormhole. All that means is the need to have aggressive iterations on the development to fend off any of those attacks.

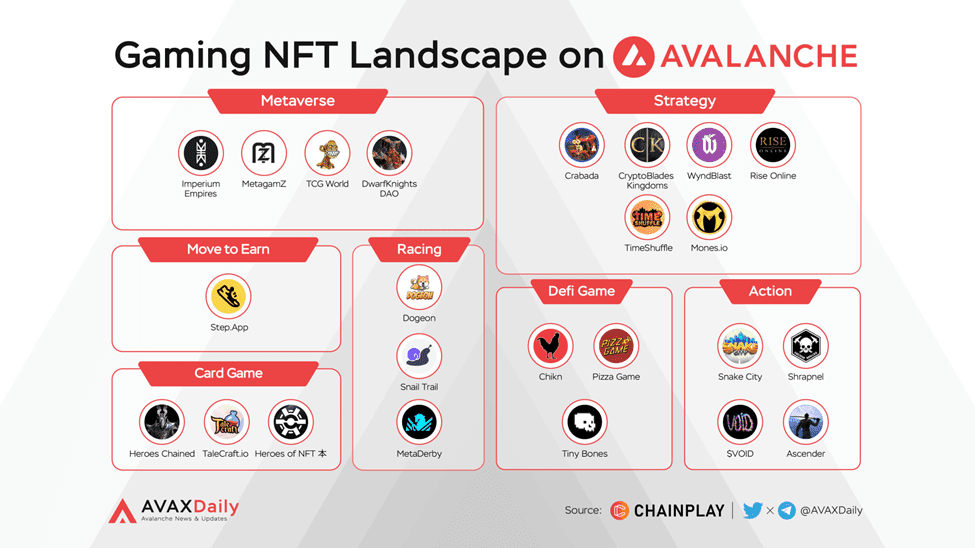

Triple A Games

Avalanche network, a high throughput smart blockchain platform, is currently receiving massive attention from game developers due to its speed, cost, and low environmental impact, thanks to the proof-of-stake consensus mechanism it has adopted to validate transactions and secure its network.

“AAA Games” is a classification used within the video gaming industry to signify high-budget, high-profile games that are typically produced and distributed by large, well-known publishers. Increasingly, AAA gaming properties are being incorporated into more mobile gaming platforms, most requiring powerful 3D graphics, high-performance compute, machine learning, and constant connectivity on mobile devices.

Notable AAA games will launch soon on Avalanche: Shrapnel, Ascenders, Imperium Empires.

Terra’s collapse sparked a crisis

Terra and Avalanche Collaboration

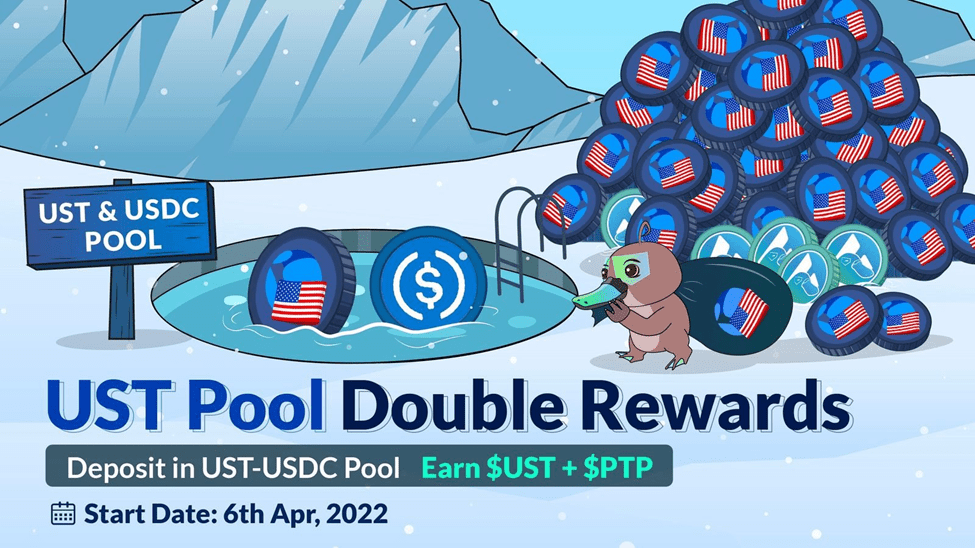

7 April 2022 Terra bought $200M in AVAX tokens to diversify their UST reserve and kickstart “blossoming collaboration” between Terra/Avalanche blockchains.

The Luna Foundation Group and Terraform Labs said they chose to purchase AVAX rather than other cryptocurrencies because of the rapid growth of the Avalanche blockchain and dedicated fanbase.

On May 7, the price of the then-$18-billion algorithmic stablecoin terraUSD (UST), which is supposed to maintain a $1 peg, started to wobble and fell to 35 cents on May 9. Its companion token, LUNA, which was meant to stabilize UST’s price, fell from $80 to a few cents by May 12.

Collapse’s effect on Avalanche

Realizing that Terra’s growth shouldn’t be ignored, Avalanche decided to partner up with them through a token swap.

Sirer – Avalabs founder pointed out that they swapped some $60 million worth of AVAX for LUNA and UST tokens in a bid to form a partnership with Terra. This would, however, turn out to be a losing bet.

The founder shared that all of their LUNA tokens essentially went to zero, but they were able to redeem a part of their UST for dollars. Despite all of the above, he also said that this didn’t cause any economic challenges for Avalanche because the sum was insignificant and that it can be “cleared in a day.”

The Collaboration also includes incentives and bonus rewards for UST stakers and UST pair Pools on Avalanche. Protocols that partner with Terra: Platypus Finance, Vector Finance, Echidna Finance, Pangolin.

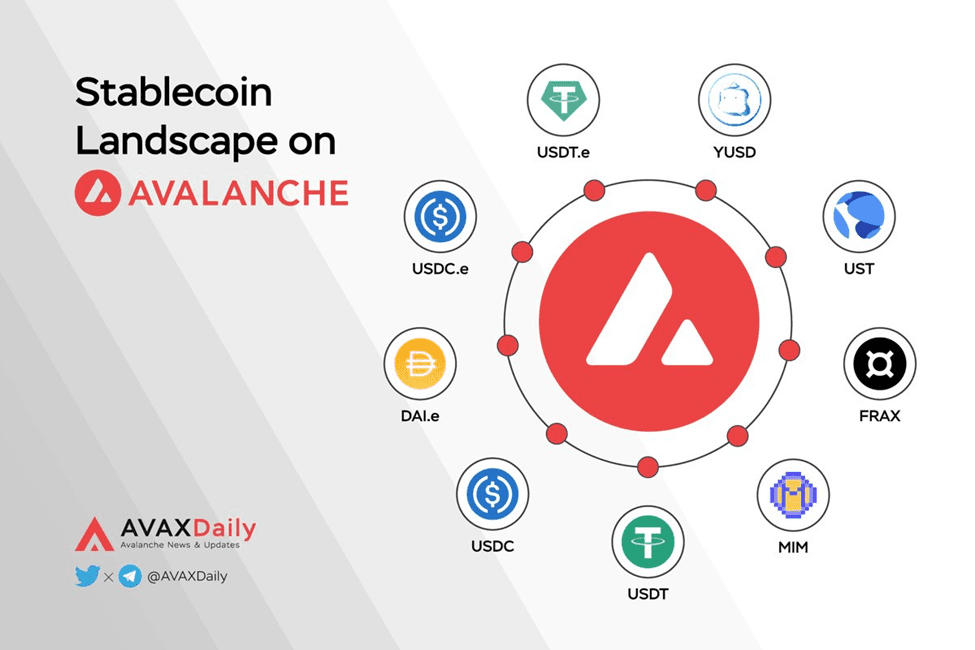

Avalanche’s Stablecoin in a storm of Stablecoins rumors

Tether (USDT), the world’s largest stablecoin, broke below its $1 peg

USDT temporarily dipped as low as 95 cents on May 12 after another type of stablecoin, terraUSD — or USDT — plummeted below 30 cents, which led to fears of a possible market contagion. USDT has seen its circulating supply plunge from a record $84.2 billion on May 11 to around $73.3 billion as of May 15, according to data from CoinGecko. About $1 billion was withdrawn late Friday evening.

However, for those who have been in the crypto market for a long time, this is not surprising. Every time the market fluctuates, there are concerns about this stablecoin. Even in its darkest days Tether has never once failed to honor a redemption request from any of its verified customers. Tether will continue to do so which has always been its practice.

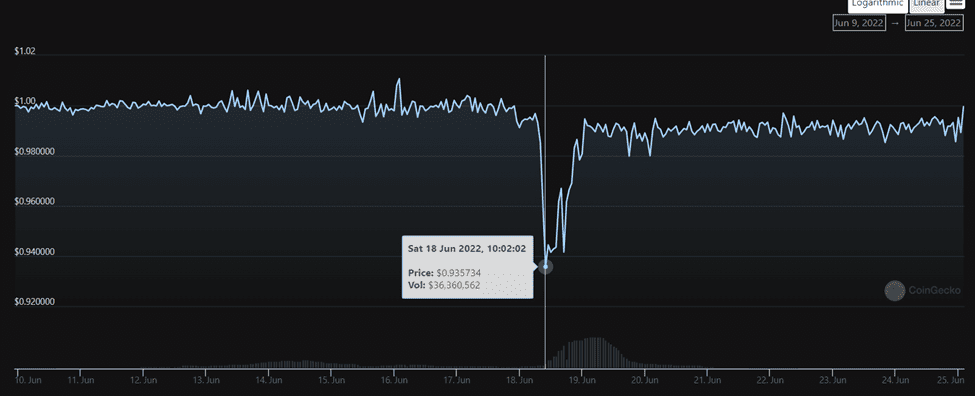

MIM become the latter domino to fall

Abracadabra’s US dollar-pegged stablecoin Magic Internet Money (MIM) was the latter victim of the panic. MIM started to de-peg on 17 June and dipped to $0.909 as of 18 June. The rumor proceeds from a Twitter thread from Autism Capital, they claimed that Abracadabra had $12 million of “bad debt” after the Terra crash. The inability to liquidate holdings during the crash was cited for the debt by officials. The thread later stated that “Abracadabra immediately took down their analytics dashboard so they could upgrade it.” Officials from Abracadabra confirmed that it was merely a “coincidence”.

After that, MIM quickly denied the rumors and confirmed that the protocols were still active and the platform had over $12 million worth of tokens. The MIM then quickly got the peg back.

Avalanche’s Native Stablecoin: YUSD

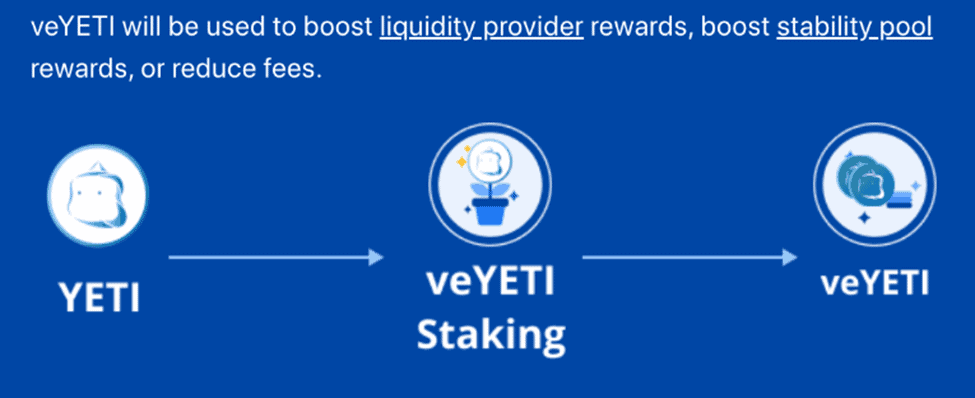

$YUSD is an over-collateralized native Avalanche stablecoin builded by Yeti Finance – backed by a diverse basket of yield-bearing collateral.

Yeti Finance is a cross-margin lending protocol on Avalanche that allows users to borrow up to 21x against their portfolio of LP tokens, staked assets such as sJOE and sAVAX, and yield-bearing stablecoins in a single debt position for 0% interest.

For every 1 YUSD minted, 1.1 USD worth of collateral is required. YUSD can be used to provide liquidity to stablecoin pools on Curve, then stake LP on Yeti to receive a reward of YETI tokens. In addition, you can also stake YUSD directly on the Stability Pool to receive YETI and a little reward when assets are liquidated.

Yeti also applies veTokenomics, you can stake YETI to receive veYETI, veYETI can then be used to increase liquidity providers and Stability Pool, reduce auto-compounding fees.

Thanks to the excellent mechanisms to ensure the stability of YUSD, the stablecoin has stood firm amidst the rumors.

New to YUSD? You can refer to the article about YUSD token breakdown or a video How to Earn on Yeti Finance

Subnets Status

The first to launch was DeFi Kingdoms: Crystalvale. DeFi Kingdoms is a play-to-earn MMORPG game that originally launched on the Harmony blockchain. As the game became popular, the team wanted more control over the underlying infrastructure and the ability to manage validation and transaction fees through their native token. DeFi Kingdoms attracted 200M+ TVL in the first month since launch.

Crabada, another play-to-earn game, launched its Swimmer Subnet, on May 9, 2022. Crabada is native to the Avalanche Ecosystem and had previously taken more and more of the C-Chain’s transaction capacity. By launching its own Subnet, Crabada reduces the cost of playing the game, utilizes a native token for transaction fees, and can modify the blockchain to better suit the game.

Based on data provided in Avascan. The current subnets on Avalanche:

Mainnet: DFK Chain, Swimmer Network, Wraptag

Testnet: Kairra Chain, Dexalot, Heroes of NFT, Castle Crush, DIGARD Chain, NMAC Chain

Three Arrows’ Margin Call and their investment in Avalanche

Three Arrows Capital is considered one of the largest investment funds in the crypto market, as well as the most influential investment fund in the Avalanche ecosystem. The firm lost roughly $200 million when Do Kwon’s algorithmic stablecoin UST destabilized and plunged in value in May. This debt led to the wrong decision to borrow capital to recover this loss, the subsequent decline in BTC and ETH prices led to a series of large investment funds being liquidated, including 3AC. .

In September 2021, Polychain Capital and Three Arrows Lead $230M Investment in Avalanche Ecosystem with participation from CMS Holdings and Dragonfly Capital, among others. Since then, 3AC has made large investments in projects on Avalanche.

Check out this article: Three Arrows Capital’s Investment on Avalanche

Network Activity

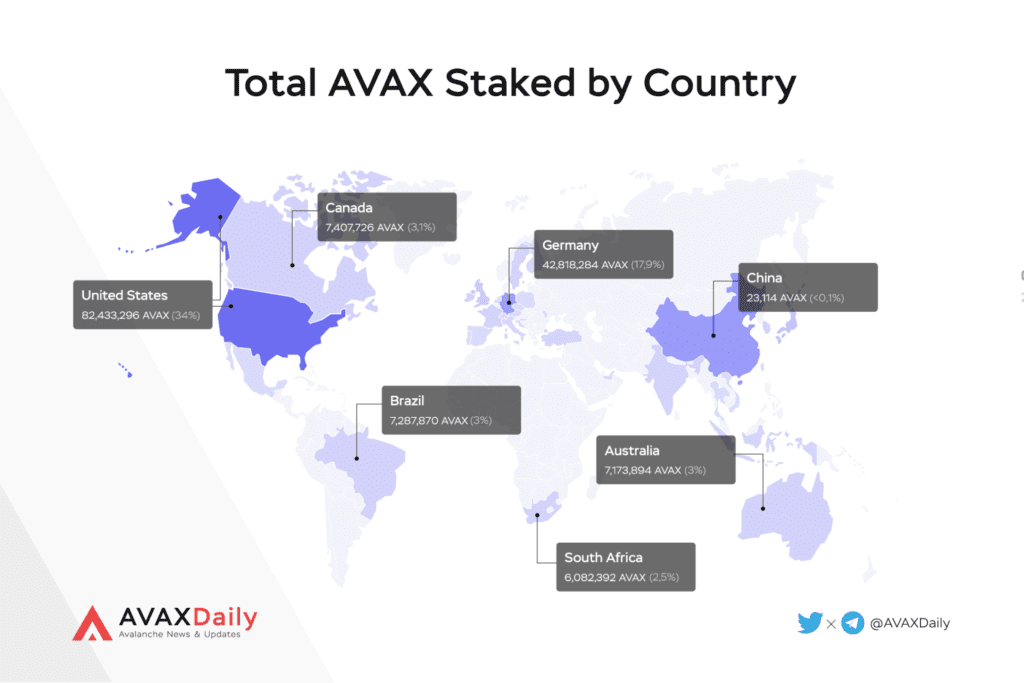

Validator/Delegator

According to data from stats.avax, the number of validators has continuously increased from the beginning of April until now, More notably, the number of Validators peaked at 1625 on April 21, 2022 and the number of Delegators reached ATH level 1 month later at 21882 delegators.

Of the total amount of AVAX staked on the blockchain, Validators account for 86.66% of AVAX, Deligators hold the remaining 13.34%.

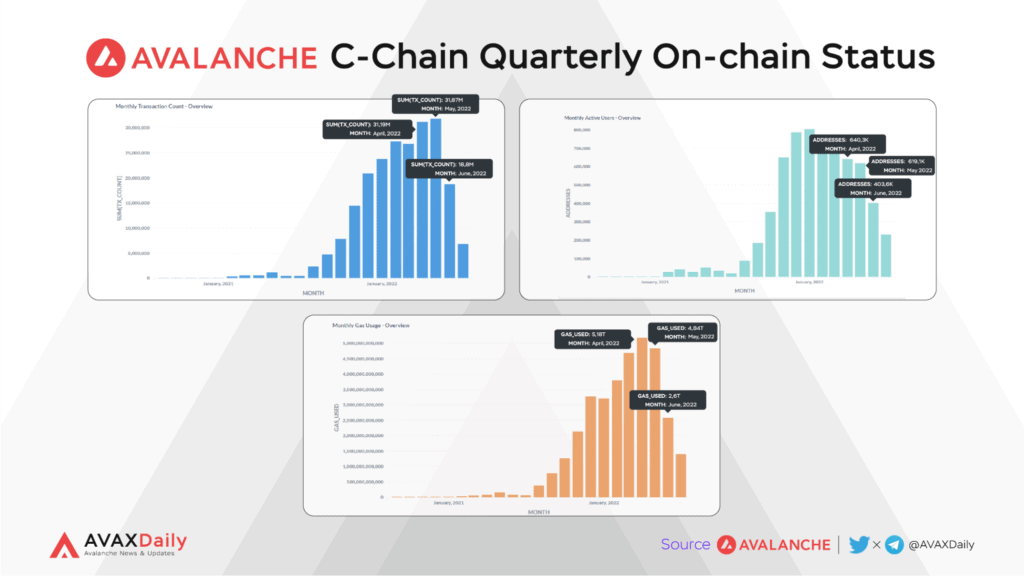

C-Chain Activities

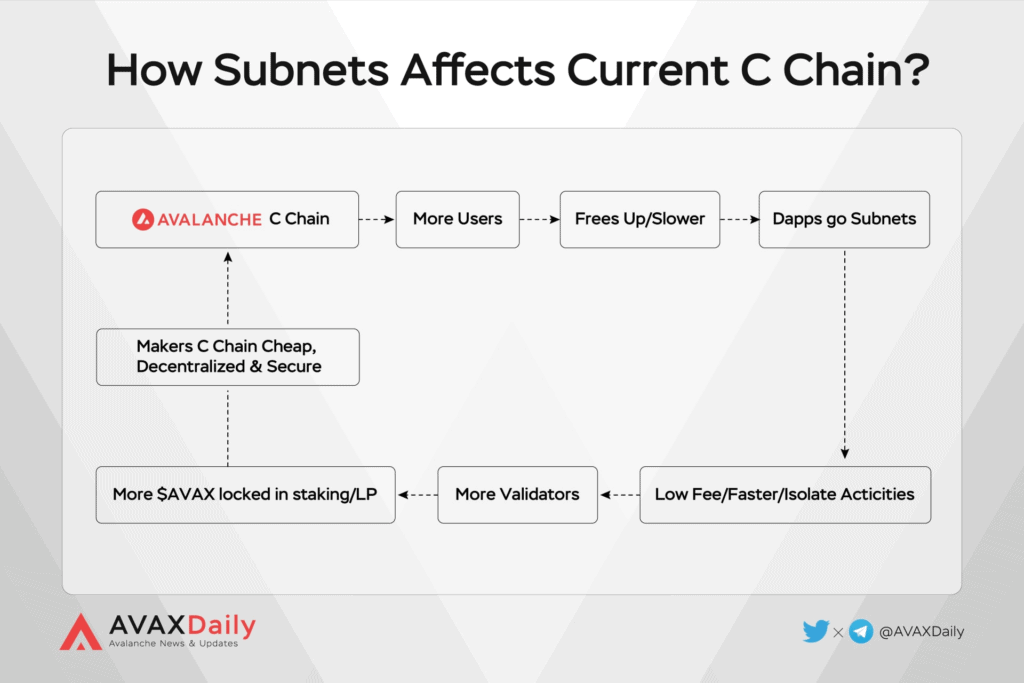

In May, the C-Chain Daily Transaction Count of the Avalanche ecosystem suddenly dropped sharply, along with a large decrease in the number of active users and gas used, which surprised those who did not understand the ecosystem well.

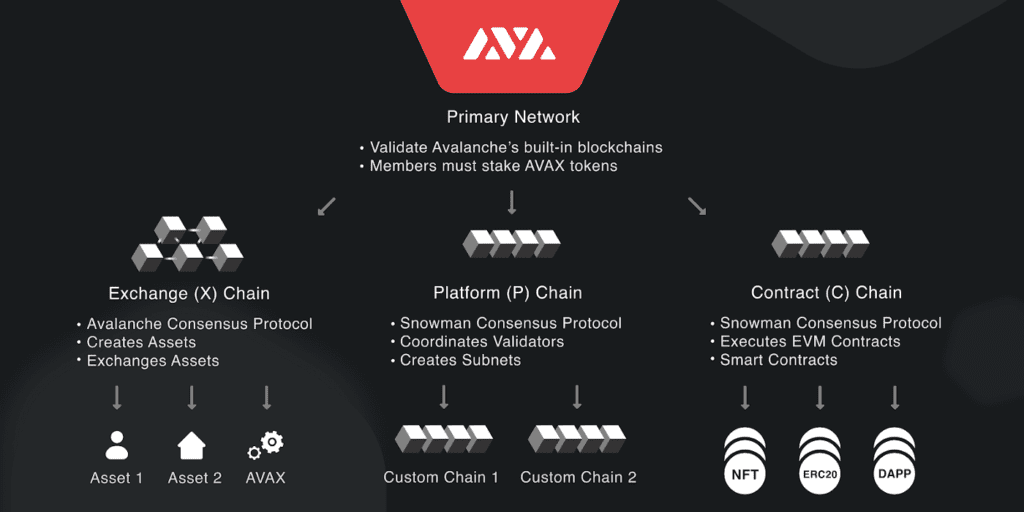

To explain this clearly, Avalanche’s ecosystem has 3 main chains X-chain, P-chain and C-chain. Users will mainly use C-Chain, however the parameters of the subnets will not be recorded on the C-Chain because the P-chain is where the protocols implement their Custom chain AKA Subnet.

We acknowledge that game Crabada is the protocol that accounts for a large number of total transactions on Avalanche as well as the number of users. May is also that this ecosystem migrates to its own Subnets, bringing with it all assets, users. Contrary to rumors, this is a good thing as Subnets reduce the volume load on C-Chain and increase the number of Validators, which will make C-Chain cheaper, faster, more secure, thereby attracting more users to Avalanche.

Ecosystem Breakdown

Highlighted Events

Luna Foundation buys 100m $AVAX to back its $UST stablecoin

Chainlink launches VRF and Keepers on Avalanche

Avalanche Bridge adds native support for $BTC

Shrapnel partners with gaming leader Razer

Top Fundraising

Shrapnel Completes $7M Token Sale

Timeshuffle raised $2.1M in Seed investment round

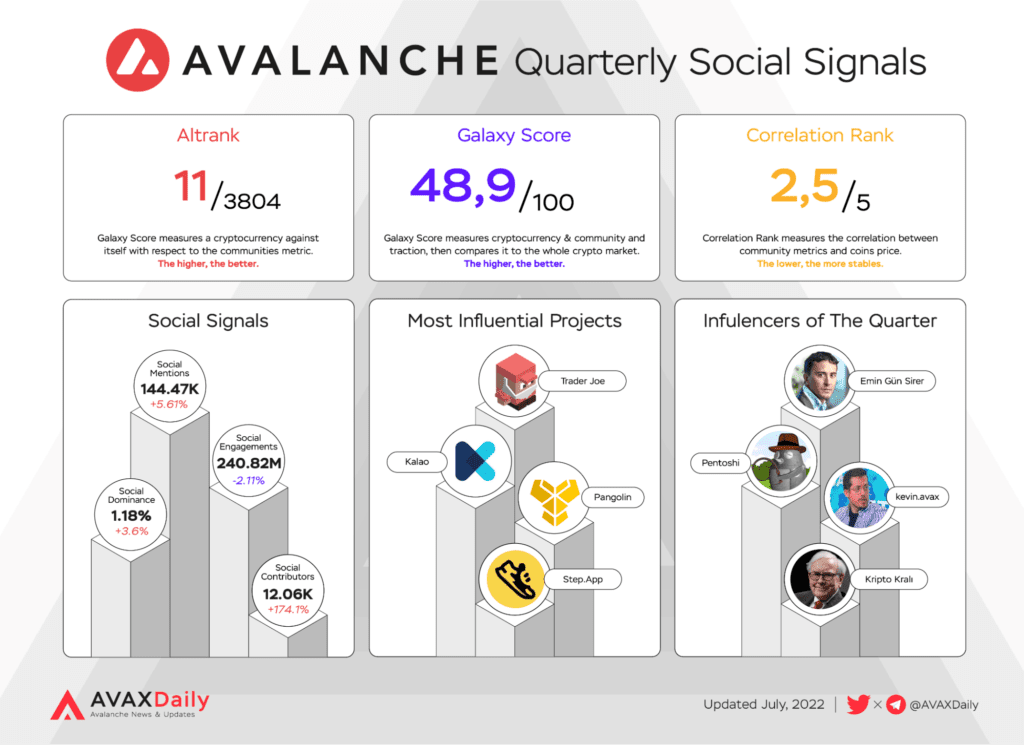

Social Signals

Highlighted Projects

Core Wallet: Core – an All-In-One Web3 Operating System for Avalanche

Platypus Finance: Project Deep Dive: @Platypusdefi

Yeti Finance: Economics in Yeti Finance

Step App: Project Deep Dive: @StepApp_

Comparison

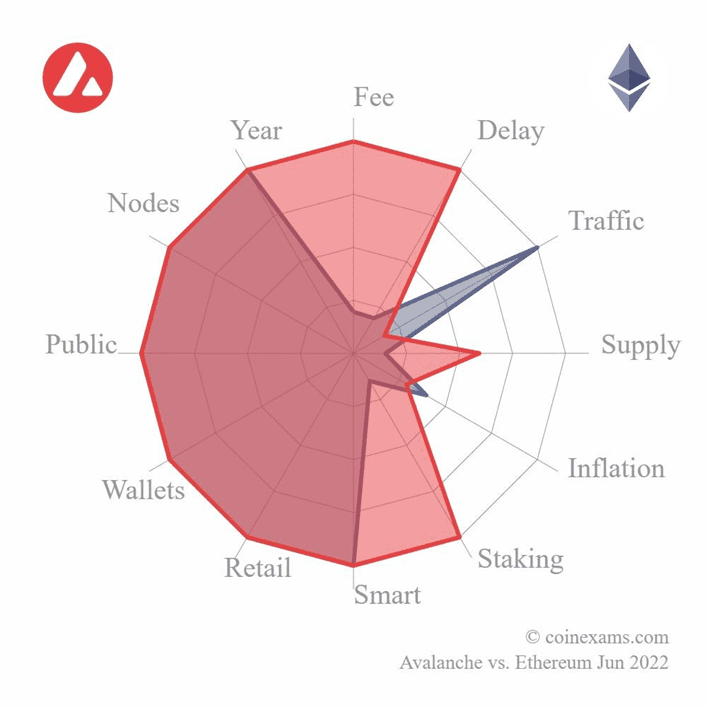

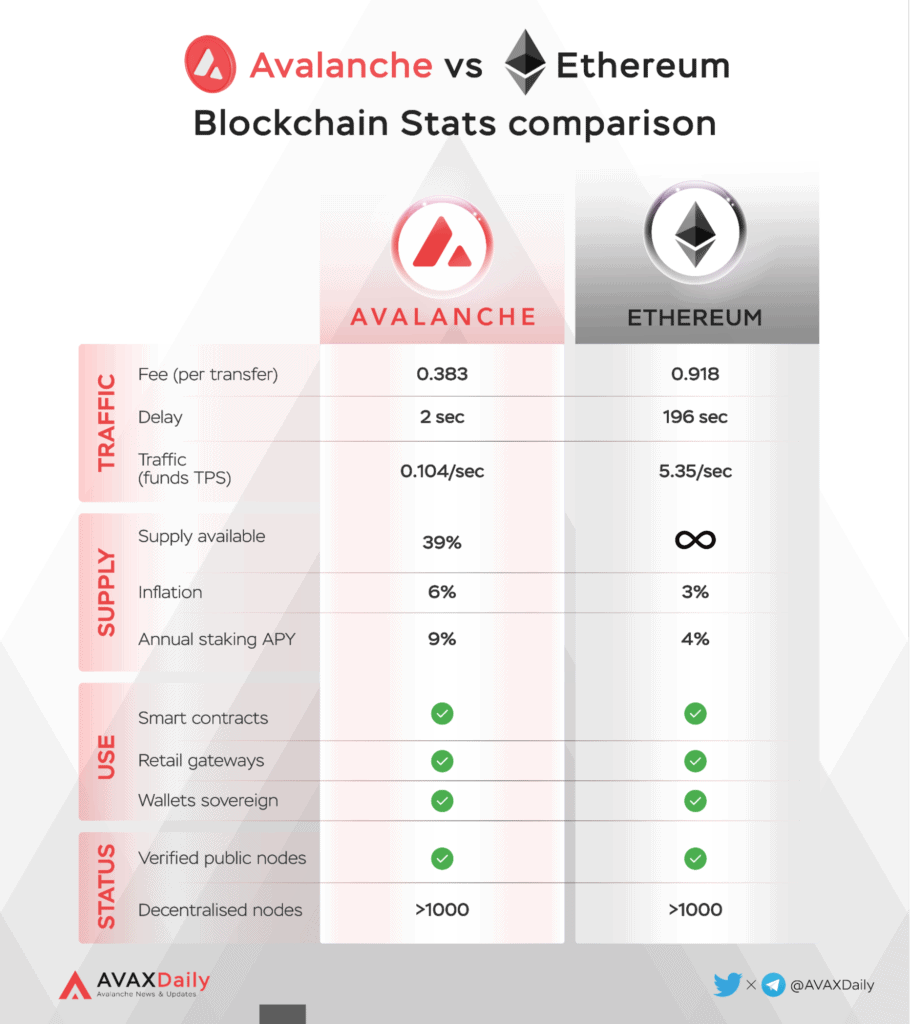

Avalanche vs Ethereum

(Reference: Coinexams)

Avalanche is generally better than Ethereum in terms of utility and would probably maintain its edge well into the future. Yet, AVAX is used relatively less in transactions, likely because Ethereum is relatively older.

Avalanche is usually 20 times cheaper to send compared to Ethereum. In addition, AVAX’s transactions are 100 times faster to confirm, i.e. reach acceptable certainty. Avalanche is four times less decentralized than Ethereum. This might indicate AVAX is less trustworthy compared to Ethereum, but does not necessarily mean Avalanche is less secure.

While Avalanche’s available supply percentage of AVAX coins is at 39.2%, Ethereum max supply is unknown/unlimited. As for inflation, Avalanche reaches an inflation rate that is two times higher compared to Ethereum. Where Ethereum does not offer staking, Avalanche’s staking offers returns of around 8.8% annually.

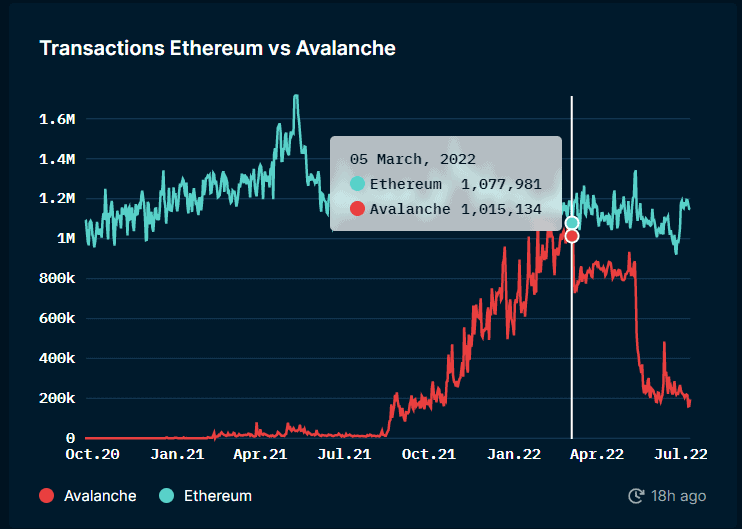

With the status of 1 Ethereum killer, Avalanche is showing its formidable ability against the opponent considered to be the Queen of the Crypto market. However, the large number of transactions while Avalanche’s infrastructure was not really good at that time led to consequences such as network congestion. But very soon everything was resolved when Crabada migrated over to the Subnets.

Avalanche’s Transactions volume at its peak on 5 March 2022 was about 1,015M transactions, which is close to Ethereum’s daily average of around 1.1M daily transactions.

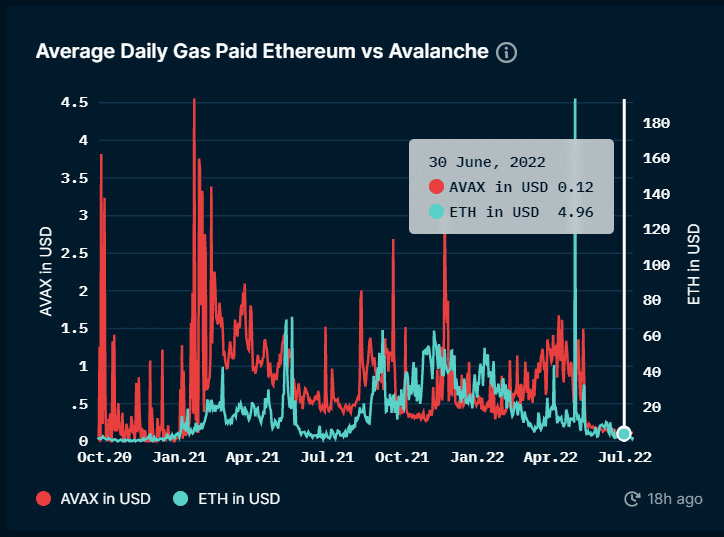

The sharp drop in transactions means that C-Chain will be extremely fast and cheap. Compared to before, the amount of Gas Fee is always higher than Ethereum, now the Gas Fee of C-Chain is only 1/30 of the total amount of Gas on Ethereum.

Projections

Defi

Defi is considered the most important factor linking the existence and development of all protocols in a cryptocurrency ecosystem. In recent years, the Alpha Defi project of Avalanche has not seen major improvements due to the fact that the cryptocurrency market is too FOMO and the token prices of these projects are pushed up quite high and then dropped, making retail investors depressed.

However, this is also a purge for the Defi market, it can be seen that projects on DEX, Stablecoins, CDP, infrastructures compared to the top tier protocols of ETH and BNB still have a lot of features to develop. More specifically, on Avalanche, Defi protocols can also create their own custom chains to create use cases for their tokens.

Gamefi/NFT

Compared to BNB and Solana, the gamefi/nft on Avalanche is currently lagging behind, but in terms of game richness, Avalanche is not inferior to any competitor. Moreover, with the characteristics of this ecosystem, it is fast, cheap, secure, especially the support of the Avalabs team that supports games to build their own Subnets (like Axie Infinity’s Ronin).

Booming next quarter, we’re looking forward to Move-to-earn Step App projects, AAA projects with top notch graphics. The problem of these projects will be the handling of inflation, the earning mechanism. As post-development projects, we believe they will do well in both play-to-earn and fun-to-play terms.

Conclusion

To sum up, the vision of the Avalanche development team towards long-term growth includes building the infrastructure to help protocols thrive on this ecosystem, and building good relationships with VCs, governments, other ecosystems, and organizing large events to attract the interest of users as well as developers.

So in the next quarter there may not be too many breakthroughs, because the financial market in general and the crypto market in particular are having a hard time in the face of war and inflation.

Disclaimer

The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the report’s content as such.

AvaxDaily does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligent research and consult your financial advisor before making any investment decisions.