Is ADA looking like the next XRP? Rumors of regulatory concerns are flying around as eToro delists the token. Hoskinson argues back calling on the widespread misinformation, he is not worried about ADA’s future.

A recent announcement from eToro seemed to have put Cardano in hot waters. The cryptocurrency exchange said it would be limiting the tokens ADA and TRX for U.S. users.

The alleged reasons for the move were seemingly mysterious, as eToro said it was “due to business-related considerations in an evolving regulatory environment”, but Cardano’s founder Charles Hoskinson stated they have no regulatory concerns at the moment.

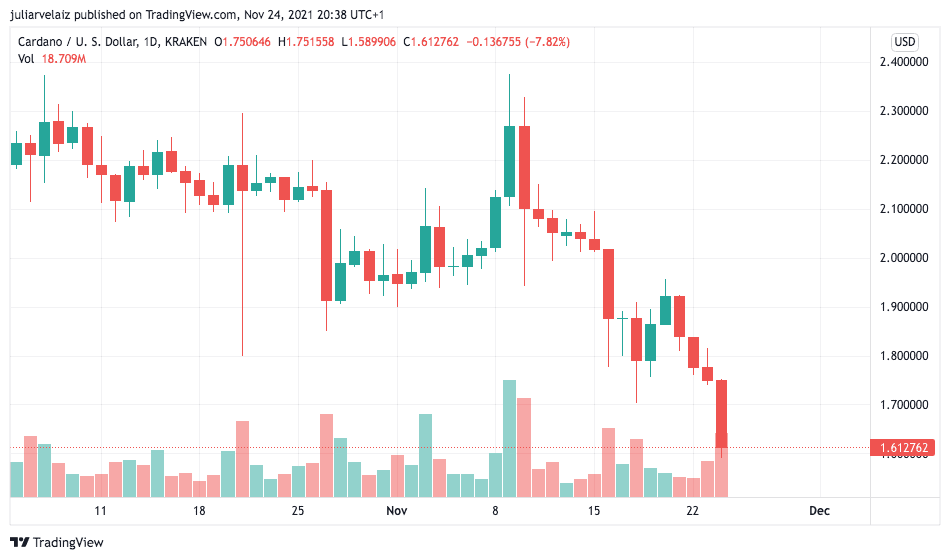

ADA’s price dropped more than 6% to $1.60 in a few hours after the announcement. This follows a few rough weeks for Cardano, although a good year overall skyrocketing around 900% with a market value of $54 billion, and surging to a $3.10 all-time high in September.

Cardano’s adamant supporters called on the FUD and misinformation around the event. The parallel announcement of Bitstamp, a larger crypto exchange, listing ADA paints a better landscape. It was described as an invalidation of eToro’s sudden action as Bitstamp’s offers bigger liquidity in comparison.

Related Reading | Insights From September’s 2021 Cardano Summit

XRP Working Its Way Up

eToro’s alleged concern for the “evolving regulatory environment” reminds the scenario around Ripple’s legal feud with the SEC. Last December, the SEC filed a lawsuit against the start-up that turned into a concern for a wider Crypto panorama.

After the SEC alleged the token XRP is an unregistered security offering, which would entail a violation of securities laws with a volume sales worth $1.38 billion, top crypto exchanges –Crypto.com, Coinbase, and OKCoin– delisted the token and its price tanked 31% subsequentially, losing 75% in value.

However, Ripple has fiercely fought back the allegations, claiming not only that it is wrong to call XRP a security, but also noting the SEC neglected to deliver a fair notice.

As they expanded globally and increased traction in Japan and the U.K.’s markets, XRP did not collide amidst its delisting, rather its price went up over five times since the lawsuit was filed due to positive expectations.

At the moment, the regulator’s hopes to stop XRP sales have ended in the opposite direction, roughly $60 billion worth of tokens in circulation, and XRP stands as the seventh-biggest digital currency in the world.

The scenario is not looking so bad for Cardano either. Hoskinson has already expressed on past occasion’s that the company’s project plays a long-term game and does not focus on momentary dips, as he firmly believes this would be “an utter lack of perspective” given that he feels “that there’s a strong possibility Cardano could be the backend of many nation-states,”

Now, Cardano’s founder has widely shared his opinion on Twitter about eToro’s decision, pointing at the consequences that the global crypto regulations’ current “systemic lack of clarity is having on the industry”:

If you’re a European entity with principal European customers, you usually limit your U.S. exposure because the cost of U.S. exposure is extremely high. If you’re an U.S. native company under U.S. regulation … it’s much easier to comply … The only way we’re gonna solve this as an industry is trough regulatory clarity.

Cardano Regulatory Status Clarified

Hoskinson calmly stated “There are no liquidity problems, you win some you lose some”, referring to Bitstamp’s inclusion of ADA, but also to the hard process ADA went through to get whitelisted in Japan, which had positive results in liquidity.

He claimed they would look into the reasons for eToro’s move since Cardano has “No regulatory event, no subpoena, nothing from any regulatory agency no threats of lawsuits,” also reminding that the last 6-months trend has been the remarkable increase in Cardano’s amount of liquidity, and “exchange after exchange” are listing ADA.

For Hoskinson, this event points at eToro’s derisking because of their own “regulatory tolerance” and “customer base”, rather than a direct problem coming from ADA.

As Bitstamp listing ADA is more of a win than eToro’s limitations are a loss, and Hoskinson sees a brighter panorama for crypto in the U.S. bills to come, the ADA FUD might turn into growth.

Related Reading | Cardano, Hydra & 2 millions Wallets Loaded With ADA