Table of contents

Introduction

Yield farming is a way of generating interest and passive income on your crypto assets in the same way that you would collect interest money in your savings account. Yield farming, like depositing money in a bank, is “staking” your cryptocurrency for a specified time period in exchange for interest or other benefits, such as more crypto. The difference is that you can do this on crypto platforms, like Delta Exchange.

Yield farmers have earned returns in the form of annual percentage yields (APY) that can approach triple digits since the practice began in 2020. However, this potential profit comes with a significant level of danger, as the protocols and currencies acquired are prone to tremendous volatility and rug pulls, in which creators abandon a project and steal investors’ assets.

Why Yield Farming and how does it work?

Yield farming, also referred to as liquidity farming, allows investors to stake their coins by putting them into a lending protocol via a decentralized software, or dApp. Other investors can then borrow the coins through the dApp to use for speculation, hoping to profit from big swings in the coin’s market price that they foresee.

Yield farming is nothing more than an incentive system for early adopters. Users are rewarded for staking their coins in blockchain-based apps, which allows them to provide liquidity. When centralised crypto platforms take consumer deposits and lend them out to individuals seeking credit, this is known as staking. Creditors pay interest, depositors receive a portion of it, and the bank keeps the remainder.

Users are rewarded for staking their coins in blockchain-based apps, which allows them to provide liquidity. When centralised crypto platforms take consumer deposits and lend them out to individuals seeking credit, this is known as staking. Creditors pay interest, depositors receive a portion of it, and the bank keeps the remainder. Users that areyield farming, aka liquidity providers, lend their assets by adding them to a smart contract, which is effectively simply a piece of code running on a blockchain that functions as a liquidity pool.

Investors that use the yield-farming protocol to lock up their coins can earn interest and often more digital coins, which is the actual benefit of the arrangement. If the value of those additional coins rises, so do the investor’s profits.

Another reason to stake is to amass enough cryptocurrency to cause a hard fork, which involves a large infrastructure modification to the cryptocurrency’s design. Hard forks allow cryptocurrency holders to compel modifications that, in the opinion of the majority of holders, will improve the cryptocurrency in the future. In some ways, hard forking provides crypto investors with the same power that stockholders have with share voting. Cryptocurrency holders can utilize hard forks to push a cryptocurrency protocol in a specific direction, similar to how shareholders can vote on crucial items influencing the management or direction of the companies they invest in.

Is it profitable?

While yield farming is certainly risky, but also lucrative; otherwise. CoinMarketCap gives yield-farming rankings using the yearly and daily APY of major liquidity pools. It’s possible to locate pools with yearly APYs in the double digits, and even some with APYs in the thousands of percentage points.

However, many of these come with a substantial risk of temporary loss, making investors wonder if the possible payoff is worth the risk. The amount of crypto you can stake will also affect your overall profit. Yield farming involves thousands of dollars in capital and incredibly sophisticated tactics to be lucrative.

Here’s how you can get started with yield farming on the popular Delta Exchange:

Yield Farming strategies at Delta Exchange

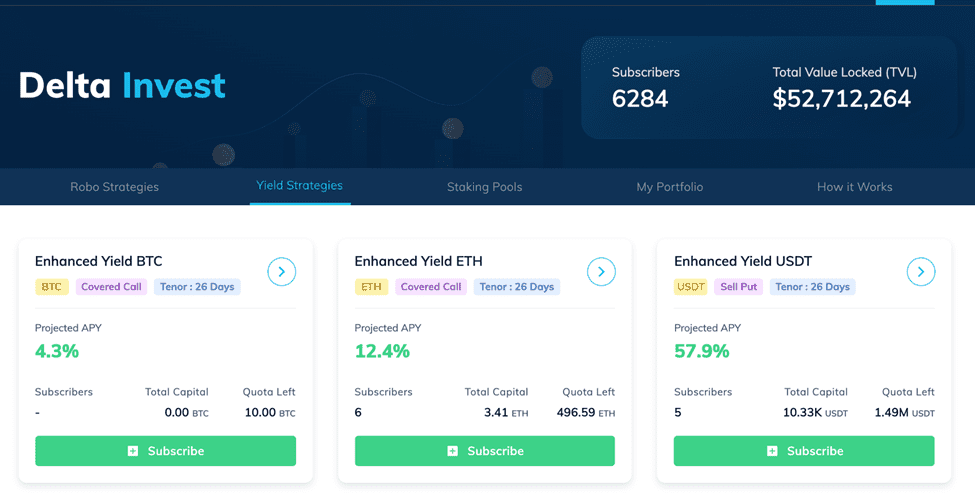

1. Enhanced Yield BTC

To boost the yield on your BTC holdings, theEnhanced Yield BTC technique entails selling BTC at a higher price on a predetermined date. It’s suitable for investors who believe Bitcoin’s gains will be restricted in the near future.

2. Enhanced Yield ETH

As the notional amount written is identical to the value of ETH, this approach earns yields by writing monthly call options with no liquidation risk.This method, however, may lose money if the price of ETH climbs drastically.

3. Enhanced Yield USDT

This strategy creates yields by creating monthly put options, with no risk of liquidation as the notional amount written is equal to the USDT value, just like the Enhanced Yield ETH strategy. This method, however, may lose money if the price of ETH falls dramatically. It currently has a projected APY of a whopping 58%!

Risks associated with Yield Farming

- Volatility – The extent to which the price of investment swings is known as volatility. A volatile investment is one that has a large price swing over a short period of time. While your tokens are locked up, their value may drop or rise.

- Fraud – Yield farmers may unknowingly invest their money in fraudulent enterprises or schemes in which they lose all of their money. According to CipherTrace, fraud and misappropriation account for the great majority of the $1.9 billion in crypto crimes expected in 2020.

- Issues with smart contracts – Yield farming smart contracts may contain faults or be vulnerable to hackers, putting your cryptocurrency at risk. We need better code-vetting and third-party audits to improve on these security flaws.

- Rug Pulls – Rug pulls are a form of exit scam in which a cryptocurrency developer collects funds from investors for a project and then abandons it without returning the funds. Rug pulls and other exit scams, which yield farmers are particularly vulnerable to, accounted for about 99% of big fraud during the second half of the year, according to the CipherTrace research.

- Impermanent Loss – While your crypto is staked, its value may rise or fall, resulting in unrealized gains or losses. When you withdraw your coins, these profits or losses become permanent, and you may be better off if you had kept your coins available to trade if the loss is greater than the interest you received.

The Final Takeaway

Staking, or locking up, your cryptocurrency in return for interest or more cryptocurrency is known as yield farming. Yield farming will become more common as cryptocurrency gets more popular. It’s a straightforward notion that has existed for as long as banks have, and it’s simply a digital version of lending with interest for profit to investors.

While yield farming has the potential to generate enormous returns, it is also quite dangerous. As proven by the many quick price changes seen in the crypto markets, a lot may happen while your cryptocurrency is locked up, but if you want to participate in safe and efficient Yield Trading strategies, Delta Exchange is where you need to go!

Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of CoinQuora. No information in this article should be interpreted as investment advice. CoinQuora encourages all users to do their own research before investing in cryptocurrencies.