hourly

1

The post Google Trends Data: ‘Dogecoin’ and ‘Ethereum Price‘ Amongst Top 10 Most Searched News appeared first on Coingape.

]]>As the crypto market began to pick up its bullish pace again, despite the most unexpected crash last weekend, it has become evident that virtual currencies are here to stay. However, surprisingly, in a recently published list by Google trends, it was determined that Ethereum and Dogecoin were more news worthy than the OG Bitcoin. According to Google Trends list of the most searched news across the world, ‘Dogecoin’ and ‘Ethereum Price’ secured its place amongst the top ten.

Last weekend, in the most unanticipated crypto market crash, the decentralized industry was hit with its highest liquidation recorded in past 15months, with more than $2.5 billion worth of leveraged positions getting liquidated in merely 24-hours. Furthermore, the market cap dropped by nearly 20% with the loss of over $500 billion. However, the crypto sphere is back on track after its flash sale. While eminent players like El Salvador, bought more of Bitcoin, Ethereum Price conveniently exceeded its $4k mark, while Bitcoin continues to struggle in breaking the $50k bracket.

Ethereum L2 Scaling Solutions

With Ethereum’s upcoming L2 scene heating up, the ultimate alt-coin is gaining more traction with each passing day. According to the Ethereum founder, Vitalik Buterin, the Layer 2 scaling solutions on the Ethereum network will revolutionise the crypto sphere by facilitating the safest and most sustainable way to scale Ethereum while preserving decentralization.

Earlier this October, Buterin spoke at the 2021 Shanghai International Blockchain Week, claiming that Ether’s L2 will resolve the issues of scalability. He noted that in lieu of the ongoing non-fungible tokens (NFTs) frenzy, together with the fierce growth of decentralized finance (Defi) on the Ethereum network, the mainstream blockchain has become overcrowded, causing problems like high transaction fees. However, he suggested blockchains and NFTs to transfer to L2 to counter scalability and high gas fees issues.

Both, Dogecoin and AMC Stock in Top 10

While Ethereum may be the ultimate alt-coin, Dogecoin is the original meme token. Apart from being Tesla CEO, Elon Musk’s favourite, DOGE has established itself in the decentralised industry and found a spot above several Alt-coins will complex technology.

Along with “Ethereum Price” and “Dogecoin”, “AMC Stock” has also reserved its place in the top 10 most searched news list. AMC, being the largest movie theatre chain in the United States, does not shy away from incorporating meme tokens to its business. Recently, AMC announced to accept payments in both, Dogecoin and Shiba Inu, making history for commercial giants in crypto.

The post Google Trends Data: ‘Dogecoin’ and ‘Ethereum Price‘ Amongst Top 10 Most Searched News appeared first on Coingape.

]]>

The post Tezos Price Prediction: XTZ Is Up 35% To 5.5% As Bulls Aim For $7.0 appeared first on Coingape.

]]>

Tezos price is up 35% over the last 24 hours to the current price around $5.5412. This follows news on a deal with Ubisoft which went viral on social media on Tuesday. These news bolstered XTZ as it rebounded off the $3.87 support level leaping 51% to intraday high of $5.83 on Tuesday.

This has bolstered bulls who are now determined to take the DeFi coin to areas above $7.0.

The Ubisoft Deal Bolsters the Tezos Price Rally

As earlier, the current XTZ price rally is reinforced by the announcement of a significant partnership with video game maker Ubisoft. The gaming company is launching Ubisoft Quartz, a platform where users can acquire unique NFTs called Digits, which can be used in-game and the platform will use the Tezos blockchain. The Tezos team said in a tweet that the Ubisoft Quartz will be build on Tezos.

.@Ubisoft Quartz is built on @Tezos, an energy-efficient and self-upgradable Proof of Stake blockchain.

Learn more at https://t.co/MzfgmL4IrX#Tezos #CleanNFT #BlockchainEvolved https://t.co/XlSEZeVlmM

— Tezos (@tezos) December 7, 2021

Games based on blockchain platforms have gained traction in 2021 and for Tezos to partner with one of the largest video game makers in the world could lead to a long-term rally for the XTZ coin.

As such, the Tezos price turn away from its downtrend that followed the weekend crypto market bloodbath with an impressive 50% to $5.8.

XTZ/USD Daily Chart

As such, if Tezos price rises above the immediate resistance at $5.816, it is likely to move upwards to tag the $7.00 psychological level.

Note that the parabolic SAR has just flipped from negative to positive and moved below the price suggesting that XTZ market momentum is now bullish.

Moreover, the MACD has just sent a buy Tezos signal on the daily chart. This happened today when the 26-day Exponential Movign Average (EMA) (blue line) crossed above the 26-day EMA (orange) accentuating the bullish narrative .

Looking Over The Fence

On the flipside, failure to rise above the $5.813 resistance could see the Tezos price drop towards the 200-day SMA at $4.6706 where it could take a breather before continuing the rally.

Therefore, XTZ investors are advised to wait for a closure above the $5.8 for a bullish breakout or a closure below the $4.6706 for a confirmation of a bearish breakout.

The post Tezos Price Prediction: XTZ Is Up 35% To 5.5% As Bulls Aim For $7.0 appeared first on Coingape.

]]>

The post Breaking: Binance Expands Business in Singapore Amid Exit Speculations appeared first on Coingape.

]]>

As speculations about the world’s largest exchange, Binance’s exit from its former hub, Singapore took over social media, the latest update cancelled out all rumours, and determined Binance’s expansion plans. Binance CEO, Changpeng Zhao took to Twitter today, declaring that the crypto exchange has acquired 18 per cent of Singapore-regulated private securities exchange, Hg Exchange (HGX).

» Binance acquires 18% stake in Singapore-regulated Hg Exchange https://t.co/ZntbLsZgWk

— CZ

Binance (@cz_binance) December 8, 2021

Binance Exclusive Investment To Cross Regulatory Hurdles

The acquisition has come just in time when Binance was struggling with getting approval from the Monetary Authority of Singapore (MAS) to legally provide crypto services in the nation. As HGX is a recognised market operator, it could potentially help Binance cross the innumerable regulatory hurdles.

According to Binance Singapore’s Chief Executive, Richard Teng, with its latest investment into HGX, Binance seeks to expand business in Singapore by offering improved and more centralised services, backed by blockchain technology. However, interestingly, Teng had formerly worked as the Chairman at HGX, henceforth, this investment may not been as out of the blue as portrayed.

“Crypto and traditional financial offerings continue to converge. Through this investment, we seek to work with HGX in enhancing offerings of products and services supported by blockchain technology…In Singapore, we continue to work closely with key government agencies to support the growth of the blockchain ecosystem and development of requisite local talent needed” Teng told the Business Times.

Binance CEO on Collaboration of Centralised approach with Decentralised technology

Earlier this month, CoinGape reported on Binance’s alleged, upcoming exit from Singapore in lieu of regulatory inconvenience. Insider reports claimed that Binance hinted at withdrawing its application with the Monetary Authority of Singapore (MAS) because of its overdue approval of an operation’s permit. While Binance CEO declined to comment on the status of his the exchange’s local unit’s licence application in Singapore, he noted that the exchange only seeks to establish in countries with a pro-crypto approach, despite agreeing to become centralised. He asserted that both, risk reduction and Innovation driven economic growth can go hand in hand.

“When (regulators) only go by that metric, they just shut everything down, and yes that’s the best way to reduce risk. But better regulators have 2 metrics – they want to encourage innovation or economic growth and reduce risk. Regulators usually make rules that are much more pro-business when they look at both these metrics.”, The Business Times quoted its impromptu interview with CZ.

The post Breaking: Binance Expands Business in Singapore Amid Exit Speculations appeared first on Coingape.

]]>

The post Bitcoin Price Analysis: BTC Back Above $50K As Market Recovery Begins appeared first on Coingape.

]]>

Bitcoin (BTC) continues its Monday recovery that has seen BTC/USD regain the crucial support above $50,000. Bitcoin price was continuously rejected by the $52,000 resistance level of December 07 as the big crypto gained carrying the crypto market with it.

Bitcoin Price Is Still Bullish

A look at the BTC/USD 1-hour candle chart below shows that Bitcoin was fiercely rejected by the $52,000 psychological level on Tuesday.

BTC/USD One-Hour Chart

At the time of writing, Bitcoin price seems to have retreated under this pressure towards the $50,000 level. BTC price teeters around $50,600 as the support from the wider market aims at pushing the price of the largest cryptocurrency by market capitalisation to retest the $53,600 resistance.

“Bitcoin rejecting at $51.6K. That’s an important level, just like $53.5K–55.5K is,” Tweeted Cointelegraph contributor Michaël van de Poppe.

“The trend still up since the recent crash, through which $49.6K is an area that I’d like to see hold if we want to retest the $53.5–55.5K zone.”

Hence, a daily closure above the $51,600 level could bolster the bulls wo might push the BTC price to tag cross above the $52,000 psychological to tag December 03 close around $53,600. This would represent an approximately 6% upswing from the current price.

The upsloping Relative Strength Index (RSI) validates BTC’s bullish narrative

BTC/USD Daily Chart

However, nerves are still intense among crypto traders coupled with claims that current gains could be temporary and that the dip is yet to come.

No wonder the over 1% dip in Bitcoin price of the last 24 hours suggests that the bears are not done with pulling the price lower.

Therefore, if BTC/USD slips below the $50,000 level, it could trigger massive sell orders that are likely to take the price deeper. However, the big crypto might find support at the 200-day Simple Moving Average (SMA) around $46,708.

The movement of the MACD below the zero line in the negative region accentuates this pessimistic outlook.

The post Bitcoin Price Analysis: BTC Back Above $50K As Market Recovery Begins appeared first on Coingape.

]]>

The post Just-In: VISA Launches Cryptocurrency Financial Advisory Arm For Institutions appeared first on Coingape.

]]>

VISA, the payment processing giant has launched its cryptocurrency financial advisory arm for institutions, in a bid to expand its crypto-focused services. The crypto advisory services would be housed within the consulting and analytics division and it would help Visa clients to navigate their way through the vast crypto space.

Visa said the crypto advisory group would help financial institutions, retail giants, and other businesses in their crypto venture, be it rolling out crypto features or exploring the popular Non-Fungible Tokens (NFT). The payment processor also revealed that American bank UMB has become its first client and they are already using its crypto advisory services.

Nikola Plecas, Visa’s European crypto lead said:

“Crypto for us is a huge new vertical and growth opportunity. And we will be continuing to focus on growing this business moving forward,”

VISA Processed $3.5 Billion in Crypto Payments

Visa has come a long way from blocking crypto transactions on its platform up to 2019 and now trying to become a leading payment processor in the crypto market. The payment gateway giant processed $3.5 billion in crypto-linked transactions on its network from Oct. 1, 2020, to Sept. 30, 2021.

Earlier in the first quarter of 2021, Visa has said that it would focus on becoming the largest gateway for crypto in the coming future. Apart from offering customers and merchants to accept crypto payments, the payment processor is now looking to venture into the NFT world as well. Visa paid $150,000 for the popular NFT collectible crypto punks.

Cuy Sheffield, head of the crypto at Visa had said:

“We think that NFTs are going to play a really important role in the future of retail and social media, entertainment and commerce. So we wanted to understand firsthand what it takes to acquire, custody, and interact with an NFT. We’ve worked with Anchorage to do this so that we can build the expertise and be better positioned to help clients navigate this space.”

The new crypto advisory group would also offer its services for NFT lunches and use them for brand promotions.

The post Just-In: VISA Launches Cryptocurrency Financial Advisory Arm For Institutions appeared first on Coingape.

]]>

The post Senate Banking Committee to Host Hearing on Stablecoins Regulation appeared first on Coingape.

]]>

Amid growing scrutiny on stablecoins, regulators have become determined to carve out guidelines distinguishing stablecoins legislation from that of other cryptos. In the latest update, the US Senate Banking Committee has declared the timeline for upcoming hearing on Stablecoins regulation, dated December 14, 2021, i.e., coming Tuesday. The hearing is titled – “Stablecoins: How do they work, how are they used, and what are their risks?”, and will be held at the Dirksen Senate Office Building 538, along with streaming live on the senate’s website.

The lot of witnesses include, Alexis Goldstein, Director of Financial Policy at the Open Markets Institute, together with Professor Hilary J. Allen, American University Washington College of Law. However, according to the announcement published on the senate’s website, additional witnesses could potentially be added ahead of the hearing.

Stricter Regulation on Stablecoins Issuance

This hearing could nail down the ongoing debate around stablecoins. Although, it may not be the best news for the crypto community, given the US authorities long-standing argument on the risky nature of stablecoins. Last month, the U.S. Treasury Department published a report on the risks related to stablecoins, claiming that they threaten consumer protection and economic stability.

Especially, post the Tether fiasco, the Treasury Department’s report confirmed stricter regulations around stablecoins, enabling transparency in stablecoin reserve holdings. In according with the new laws, stablecoin issuance in the US will only be limited to insured depository institutions, which are subject to appropriate supervision and regulation.

“Stablecoins and stablecoin arrangements raise significant concerns from an investor protection and market integrity perspective…To address risks to stablecoin users and guard against stablecoin runs, legislation should require stablecoin issuers to be insured depository institutions, which are subject to appropriate supervision and regulation, at the depository institution and the holding company level…The legislation would prohibit other entities from issuing payment stablecoins.”

Japan’s Financial Services Agency (FSA) also followed in the US Treasury’s footsteps, in laying out new rules for stablecoins. Along with duplicating the issuance limitation law, the FSA also determined a rather stern AML regulatory approach, referring to illegal activities that utilise stablecoins.

The post Senate Banking Committee to Host Hearing on Stablecoins Regulation appeared first on Coingape.

]]>

The post This Money Manager Aims to Open Biggest Crypto Trading Floor in New York appeared first on Coingape.

]]>

New York City has become the latest contender for the crypto hub in the US, especially after the newly elected Mayor promised to work towards making the city a growing hot spot for crypto businesses. A number of VC firms and money managers are looking to make the city their business home and proposals for the world’s largest crypto trading floor are already in.

Jason Ader, a former casino analyst aims to bag the casino license from the city with a $3 billion bet. He said the casino would be one of its kind as it would host the world’s largest crypto trading floor along with space for parking flying cars in the future. Ader said the casino would also feature an esports arena and a separate sector for live events. He explained,

“The goal is to have a differentiated but comprehensive approach to entertainment that goes beyond casino gaming with some pretty cool elements,”

The venue for the casino is yet to be decided but Ader said, given a choice he would prefer Manhattan.

New York Looks to Dethrone Miami

Miami is currently considered as the true Bitcoin city in the United States with a pro-Bitcoin Mayor in the form of Francis Suarez. Suarez has made way for the first even city coin that works on top of the Bitcoin network and the funds generated by the coin will be used for the development of the city.

New York City Mayor Eric Adams has made his crypto goals clear with the announcement of taking his full salary in Bitcoin. During his Mayor run, crypto was a key part of his campaign and he has doubled down on his promises after winning the race. There were possible talks about New York also working towards developing a city coin quite similar to the Miami coin as well.

The post This Money Manager Aims to Open Biggest Crypto Trading Floor in New York appeared first on Coingape.

]]>

The post Australia to Introduce New Regulatory Laws and Licensing Frameworks for Crypto Firms appeared first on Coingape.

]]>

As some top economies across the world are working to bring clarity on crypto regulations, Australia joins the bandwagon. As per the latest report, Australian lawmakers will soon create a licensing framework for cryptocurrency exchanges.

Australian Treasurer Josh Frydenberg has recently welcomed this move saying that Bitcoin and other digital assets would emerge under a financial licensing scheme for crypto trading platforms. Speaking of this development, Mr. Frydenberg said:

“Australia has an opportunity to be among the leading countries in the world in leveraging this new technology. Recent surveys have found that up to 17 percent of Australians currently own cryptocurrency, with that figure likely even higher among young Australians.”

The Australian Treasurer said that he will begin talks on the licensing framework of crypto from early 2022. Besides, they will also be regulating crypto custodians i.e. businesses who hold digital assets on behalf of their consumers.

Crypto businesses in Australia are also supporting this move. BTC Markets chief executive Caroline Bowler said: “It would be a crushing shame to not have our regulation keep pace with international peers such as Singapore, Canada and Britain”.

Australia’s Own Central Bank Digital Currency (CBDC)

Australian Treasurer Josh Frydenberg also spoke about the possibility of having a central bank digital currency (CBDC) and doing pilot testing before the end of 2022. However, he advocates for the cash industry saying that the Australian CBDC should be replacing physical banknotes.

Besides, the country is looking to broaden the scope of laws for online transactions providers. Tech giants like Google and Apple are making rapid penetration in the payments market. Furthermore, there’s a fast emergence of buy-now-pay-later (BNPL) providers ike Afterpay Ltd. operating without any direct supervision. Speaking of this, Treasurer Frydenberg said:

“If we do not reform the current framework, it will be Silicon Valley that determines the future of our payment system. Australia must retain its sovereignty over our payment system.”

The post Australia to Introduce New Regulatory Laws and Licensing Frameworks for Crypto Firms appeared first on Coingape.

]]>

The post OpenSea CFO Clarifies That They Are “Not Planning an IPO” After Community Backlash appeared first on Coingape.

]]>

The world’s largest NFT marketplace OpenSea has been facing a sort of community backlash after news broke out that the company is planning for an IPO. The news was that Ethereum-based OpenSea shall be raising funds through an Initial Public Offering (IPO) after the company appointed its new CFO Brian Roberts.

However, a day later after facing massive community backlash, OpenSea CFO has issued a clarification. In his recent tweet, Roberts wrote:

There was inaccurate reporting about @OpenSea‘s plans. Let me set the record straight: there is a big gap between thinking about what an IPO might eventually look like & actively planning one. We are not planning an IPO, and if we ever did, we would look to involve the community.

Brian Roberts recently joined OpenSea after his successful tenure at the ride-sharing company Lyft. Mr. Roberts has been instrumental in the successful public listing of Lyft back in 2019.

Roberts Sees Huge Growth In Web 3 Companies

The new OpenSea CFO is quite optimistic about the developments taking place in Web 3.0. Speaking about his decision to resign at Lyft and join OpenSea as the CFO, Roberts said: “I voted with my feet”.

Speaking to Bloomberg, Roberts said that the growth in Web 3.0 companies and in particular the OpenSea’s NFT marketplace made it easier for him to decide. “I haven’t been this excited about something in a very long time,” he said. “It reminds me of 1995 eBay” speaking of OpenSea’s rampant growth and profits, Roberts added:

“I’ve seen a lot of P&Ls (profit and loss statements) but I’ve never seen a P&L like this. When you have a company growing as fast as this one, you’d be foolish not to think about it going public”. It “would be well-received in the public market given its growth.”

OpenSea Founder and CEO Devin Finzer also confirmed that the company is looking for fresh funds. However, they are yet to figure out what kind of investors they are willing to bring. OpenSea currently has backing from some of the top investors like A16Z, Founders Fund, Coinbase and Blockchain Capital.

The post OpenSea CFO Clarifies That They Are “Not Planning an IPO” After Community Backlash appeared first on Coingape.

]]>

The post New York Lawmaker Gives Reason For Holding No Crypto, Urges Colleagues To Do Same appeared first on Coingape.

]]>

Popular New York lawmaker Alexandria Ocasio-Cortez, also known as AOC, has revealed that she doesn’t own or hold Bitcoin. Well known for her somewhat unique political beliefs and stances, the Democrat has shared her opinion about members of the U.S Congress owning cryptocurrencies. According to her, it is “absolutely wild” and unethical for U.S. representatives to be able to buy and trade popular stocks, while also being at the helms of affairs of policy-making.

New York Lawmaker Hopes To Stay Impartial By Not Holding Any Crypto

While speaking on her Instagram story on Monday, Alexandria Ocasio-Cortez (AOC) explained why she has taken it upon herself to not own stocks or digital currencies. She mentions that her reasons border around her belief that members of Congress who want to remain professional and unbiased in their law making, have no business owning or holding BTC and the likes.

She added in her Instagram story, that their job as lawmakers, makes them — herself and colleagues, privy to very sensitive information and upcoming policy. She also says that because she sits as a member on the Financial Services Committee FSC, digital assets are also a no-go area for her if she is to remain as ethical as possible in her job.

AOC Still Wary of Crypto

AOC has always been outspoken about virtually anything, and recently, she caused an uproar/debate with her “Tax the Rich” Met Gala dress. She and her colleagues Rashida Tlaib and Ayanna Pressley made efforts to get the attention of president Joe Biden in their quest to get the president to choose someone other than Jerome Powell, to chair the Federal Reserve. As it turns out, Biden eventually chose Powell, against AOC’s wish that the U.S. president choose someone that would really tackle social change and prioritize the so-called climate crisis.

The post New York Lawmaker Gives Reason For Holding No Crypto, Urges Colleagues To Do Same appeared first on Coingape.

]]>

The post BSV Price Analysis: The BSV Coin Prepares For Its Next Big Move Resonating Inside A Definite Range appeared first on Coingape.

]]>

On December 6th, the long-awaited result of the identity of Satoshi Nakamoto has dropped in favor of Craig Wright. The BSV coin, following the primary vision of Satoshi Nakamoto(Craig Wright), showed a sudden price surge of 42% in its intraday session due to this news. Furthermore, the technical chart shows the coin is still in a range-bound movement, maybe preparing for even a bigger move than this.

Key technical points:

- The BSV price reclaims the 50-day EMA

- The intraday trading volume in the BSV coin is $1.03 Billion, indicating an 87%. again

Source- BSV/USD chart by Tradingview

Since the bloodbath of may, the BSV coin had never seen what’s beyond the $200 mark. For almost six months, that price has been wobbling between two definite levels of $290 and $110, creating a definite range for the coin. This range represents a resting period for the coin, which will eventually provide a strong directional move when the price breaks out from the border levels of this range.

The crucial EMA levels(20, 50, 100, and 200) indicate a bearish for this coin since its price is trading below the trend defining 100 AND 200 EMA. However, the Relative Strength Index(52) moving above the neutral zone maintains a bullish sentiment within the BSV coin.

BSV/USD 4-hour Time Frame Chart

Source- BSV/USD chart by Tradingview

The BSV coin shows some minor resistance/support levels in this lower time frame chart. After bouncing from the bottom support on December 6th, the coin price knocked out the nearest resistance level of $110, trying to move to the other side of the range.

The coin price is currently struggling to sustain above the next resistance level of $162. in case of a fallout, the $110 should act as a good support level and help the price sustain the bullish sentiment.

The post BSV Price Analysis: The BSV Coin Prepares For Its Next Big Move Resonating Inside A Definite Range appeared first on Coingape.

]]>

The post Ethereum, Harmony and Spell Token Price Analysis: 07 December appeared first on Coingape.

]]>

Following the crash on December 4, Ethereum has risen to trade above the $4000 level again. At press time, the coin was trading for $4357.43. The alt-king propelled above the $4272.77 mark and could attempt to trade near the resistance mark of $4540.97 Ethereum’s additional resistance stood at its multi-week high of $4865.31. Over the last 24 hours, the coin registered a 6.2% increase in value. The trading volume of Ethereum also crept up over the last day.

Ethereum Price Analysis

Ethereum’s technicals portrayed a bullish outlook, the coin’s price was seen above the 20-SMA line which indicated that price momentum was still controlled by the buyers in the market.

MACD signalled a bullish crossover and displayed green histograms. The Relative Strength Index was above the half-line in correspondence to the 20-SMA line, although the indicator flashed a downtick, this could mean a dip in prices over the upcoming trading sessions.

In case of a price reversal, the support region for Ethereum awaits at $4010.80 and then at $3854.10.

Harmony Price Analysis

Harmony was priced at $0.195 after it surged 16% over the last 24 hours. Harmony was among the top gainers that showed double-digit appreciation. Over the past 72 hours, the token displayed a steady recovery, however, in the last 24 hours the prices have seen a considerable increase. The outlook was also positive at the time of writing.

Buying pressure as indicated on the Relative Strength Index also showed a surge, the token also recorded a hike in the trading volume over the past day.

MACD’s bullish crossover agreed with the bullish price action. A continuous upward push will cause Harmony to encounter resistance at $0.208 and then at $0.269, a level that bulls have not gotten past in the last few days. Additional price ceilings awaited the coin at $0.334 and at $0.368, a level the coin last touched in October.

Bollinger Bands displayed constriction, however, it also flashed a little relaxation which is usually indicative of volatile price action.

On the flip side, the major support level was at $0.162.

Spell Token Price Analysis

Spell Token surged by a massive 60.9% over the last 24 hours, it is the native token of Abracadabra.money DeFi protocol. The token depicted an enormous growth in its trading volume by 97.83% over the last 24 hours. Major technicals have pointed towards a massive bull price action.

Relative Strength Index in the last 24 hours revised its monthly high which is indicative of a growth in the number of buyers in the market. MACD also underwent a bullish crossover.

Capital inflows were in surplus as seen on the Chaikin Money Flow, which also was the monthly high for the token.

The tremendous surge in prices could be a consequence of the increase in the growth of decentralized stablecoins. Abracadabra.money is powered by the SPELL Token which is a stable coin, the total value locked of which has been increasing along with its circulating supply.

The post Ethereum, Harmony and Spell Token Price Analysis: 07 December appeared first on Coingape.

]]>

The post AVAX Price Analysis: The Coin Price Has Discounted 35% In This Correction Phase; Is This a Fair Value For AVAX? appeared first on Coingape.

]]>

The AVAX token is trying to stabilize its price from the remarkable rally it initiated in august with a correction phase. Currently, the price is plunged to the crucial support of the $0.5 Fibonacci retracement level, which has the potential to continue the bulls rally.

Key technical points:

- The dynamic support 20-day EMA is flipped to the possible resistance level

- The intraday trading volume in the AVAX token is $1.37 Billion, indicating a 14.15%.

Source- AVAX/USD chart by Tradingview

The last time when we covered an article on AVAX/USD, The token price rally gave $146 as its New All-Time High on the technical chart. After a robust rejection from this new resistance, the token initiated a retracement phase, where he has lost 25% over the last two weeks. The token is currently sunk to 0.5 Fibonacci retracement level and indicates a high demand pressure through numerous lower price candles.

The crucial EMA levels(20, 50, 100, and 200) sustain a bullish mood for this token since its price is trading higher than the trend defining 100 AND 200 Ema. However, the dynamic support of the November rally 20 EMA is flipped to resistance.

The Relative Strength Index(44) shows a constant downward trend in the chart that is approaching the oversold zone.

AVAX/USD 4-hour Time Frame Chart

Source- AVAX/USD chart by Tradingview

The AVAX coin price showed an impressive V-shaped recovery after bouncing from the $80 support. However, the crypto traders should wait for the price to break out from this nearest resistance of $100 to get a better confirmation for the price to continue this rally.

According to the Fibonacci pivot levels, the crypto traders can expect the nearest resistance at $97, followed by $116. As for the opposite end, the support levels are $77 and $65.

The post AVAX Price Analysis: The Coin Price Has Discounted 35% In This Correction Phase; Is This a Fair Value For AVAX? appeared first on Coingape.

]]>

The post GALA Price Analysis: The Flag Pattern Can Resume Bull Rally In GALA Token appeared first on Coingape.

]]>

The GALA token price is going through a usual correction phase after its remarkable rally in November. Furthermore, the price is plunged to the 0.5 FIB level and is trying to sustain above. The crypto traders would get a better confirmation resuming this rally when the token breaks out from the bullish pattern.

Key technical points:

- The 20-day EMA providing strong support to GALA price

- The intraday trading volume in the GALA token is $1.1 Billion, indicating a 3.68% gain.

Source- GALA/USD chart by Tradingview

The last time when we covered an article on GALA/USD, the token price marked $8.4 as the New All-Time High on its technical chart. After obtaining strong rejection from this new resistance, the price entered a correction phase and lost 40% in almost two weeks. The token is currently plunged to the 0.5 Fibonacci retracement level and indicates strong demand pressure with several lower price rejection candles.

The crucial EMA levels(20, 50, 100, and 200) sustain a bullish sentiment for this token as its price is trading above all of them. The Relative Strength Index(53) displays a steady downtrend in the chart approaching the oversold zone.

GALA/USD 4-hour Time Frame Chart

Source- GALA/USD chart by Tradingview

For the correction phase mentioned above, the GALA price has revealed a Flag pattern in the 4-hour time frame chart. The price is currently resonating between the two descending trendlines leading to this short-term downtrend. Thus, the crypto traders should wait for the price to breach the overhead resistance trendline, which would provide them an excellent long entry opportunity.

The MACD indicator’s lines have started approaching the neutral zone from below. If they manage to jump above this middle line, the crypto traders will get an extra confirmation for a bull rally.

The post GALA Price Analysis: The Flag Pattern Can Resume Bull Rally In GALA Token appeared first on Coingape.

]]>

The post Loopring Price Analysis: Can LRC Bulls Leverage From This Bear Trap? appeared first on Coingape.

]]>

After its second rejection from this level All-Time High $3.82, the LRC price action formed a double bottom pattern in the daily time frame chart. However, on December 4th, the token warned about intense demand pressure below the $2.17 neckline the lower rejection in the daily candle, which eventually led to a fakeout.

Key technical points:

- The 20 EMA dynamic support is flipped to a potential resistance

- The daily RSI line shows a steady downtrend, approaching the oversold territory

- The intraday trading volume in the LRC token is $1.05 Billion, indicating a 184% gain.

Source- LRC/USD chart by Tradingview

The LRC token displayed a remarkable rally in November, which made a New All-Time High of $3.82. Later the token price entered a minor retracement phase, indicating this level as a possible resistance level.

The LRC price managed to bounce back from this 0.5 Fibonacci retracement in order to continue the bull rally. However, the price could never exceed $3.82, triggering another bearish reversal. Furthermore, this whole price structure revealed a double bottom pattern in the technical chart indicating an excellent opportunity for crypto traders.

The crucial EMAs(20, 50, 100, and 200) maintain a bullish alignment for this token. Furthermore, the 20 EMA line, which provided dynamic support to the price, has turned to possible resistance with the recent pullback.

The Relative Strength Index(52) indicates a strong selling within this token, displaying steady approaching the oversold zone.

LRC/USD 4-hour Time Frame Chart

Source- LRC/USD chart by Tradingview

On December 5th, the LRC price breached the $2.1 neckline of this bearish pattern with a daily candle closing below it. However, the price couldn’t sustain this lower level, and giving a bullish engulfing candle of 20% gain on the next day, the price jumped above this neckline, indicating a fakeout.

As for now, the price is trying to retest its nearest resistance level of $2.66. If the coin managed to reclaim this overhead, the long trader would have an extra edge for their long position.

The post Loopring Price Analysis: Can LRC Bulls Leverage From This Bear Trap? appeared first on Coingape.

]]>

The post MATIC, Chainlink and Algorand Price Analysis: 07 December appeared first on Coingape.

]]>

At the time of writing, the altcoin market was trading in the green owing to the king coin’s upward climb over the last 24 hours. Matic happened to be one of the top gainers, it had secured a staggering 30.1% increase over the past day. The altcoin has galloped and hit a multi-month high after the crash that occurred on December 4 while the bulls could attempt to revisit the all-time high. At the time of writing, MATIC was priced at $2.34 with an overhead resistance at $2.44.

MATIC Price Analysis

Technicals for MATIC remained positive in correspondence to the surge in prices, the altcoin had lost almost 34% of its value post the crash and now it has propelled to make up for most of it. The buying strength has also shown recovery since December 4.

Awesome Oscillator also flashed green signals, which indicated bullishness in the market and another upswing could cause the token to break past its $2.44 resistance at touch its all-time high. MACD underwent a bullish crossover and pointed towards positive price action.

Relative Strength Index was above the half-line as buying pressure recovered, however, the indicator displayed a downtick which might signal towards a price reversal. Incase of which, the coin might find support on $2.06 and then at $1.85. Other support lines rest at $1.76, $1.55 and $1.49.

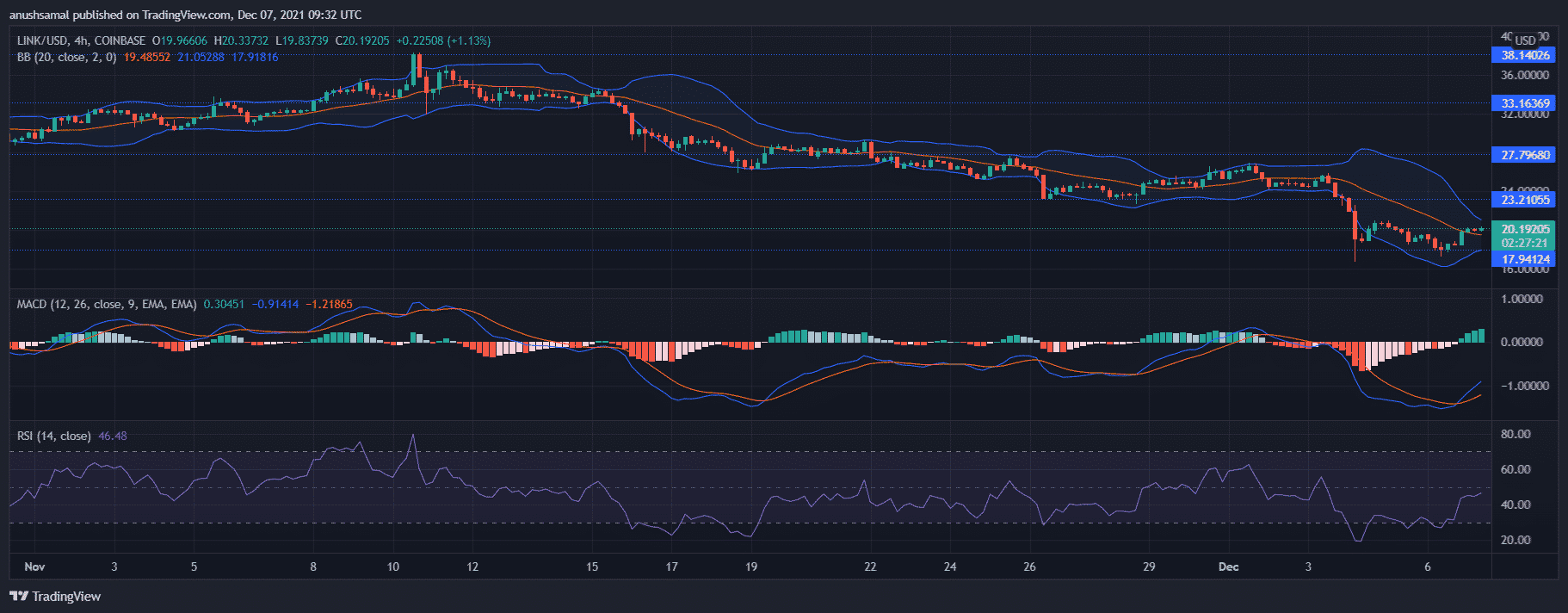

Chainlink Price Analysis

It has been a bearish run for Chainlink over the past week, much to its relief, the coin surged 13% over the last 24 hours. The outlook for the altcoin also displayed recovery on its 4-hour chart by registering positive buying strength. AT the time of writing, the coin was trading at $20.19 with its overhead resistance at $23.21. Other price ceilings rested at $33.16 and then at its multi week high of $38.14.

MACD displayed a bullish crossover, indicating that the coin has recovered over the last 24 hours. Bollinger Bands converged heavily, indicating that prices might not show volatility over the immediate trading sessions, however, it could also indicate chances of a price reversal.

Relative Strength Index displayed increased buying strength, although the indicator was parked within the bearish zone. In case of a fall from the current price levels, the immediate support level was at $17.94.

Algorand Price Analysis

Algorand was trading for $1.76 and has finally exhibited considerable gain of 6% over the last 24 hours . For over a month the coin has been consolidated and the price action remained sandwiched between $2.23 and $1.60. Major resistance marks for ALGO was at $1.97 and $2.23. The technicals have indicated a recovery over the past 24 hours.

MACD underwent bullish crossover and pointed towards positive price action. Capital inflows have also recovered as indicated by the Chaikin Money Flow. In accordance with the same, Relative Strength Index also displayed positive buying pressure.

Incase the bulls drag down the prices down again, ALGO might meet with its $1.60 and $1.45 support levels. In recent news, Algorand’s TVL surpassed the $100 million mark.

The post MATIC, Chainlink and Algorand Price Analysis: 07 December appeared first on Coingape.

]]>

The post Three Arrow Capital CEO Shuts Down the $400 million Hack Speculations, Here’s What Happened appeared first on Coingape.

]]>

The crypto community was flooded with speculations of yet another hack, this time around the hedge fund manager, Three Arrow Capital’s wallets were at risk. However, the firm’s CEO has clarified that it is just a move from L1 to L2.

Earlier today, the Chinese journalist, Colin Wu tweeted that 91,477 ETH, which amounts to approximately $400 million were transferred from FTX, Binance and Coinbase to the wallet marked by nansen as Three Arrow Capital. The fearmongering spread like wild fire and the market was full of hack speculations, given the ongoing hack frenzy in the decentralized industry. Nevertheless, Three Arrow Capital’s CEO, Su Zhu took to Twitter and noted that there are multiple other incoming transfers to shift to L2.

Look I couldn't let you guys jerk off watching the burn without me

Eth L1 still unusable for newcomers, show it to your grandma if you don't believe me

I'll still bid it hard on any panic dump like this weekend obv

100k eth is dust fwiw, more coming

— Zhu Su

(@zhusu) December 7, 2021

Zhu continued claiming that L1 is highly unusable, especially for newcomers. However, this was not the first time Zhu commented against Ethereum despite being an avid user himself. Three Arrow Capital CEO has even said that he has “abandoned Ethereum despite supporting it in the past”, because the network is not affordable enough for new users. While saying that, he has contradicted himself emphasising on the importance of L2.

Want to soften this and say abandon is the wrong word. Was heat of the moment. I'm sorry.

There are great teams working on scaling Eth on L2.

Would've preferred to see eth1x roadmap. Also would've preferred focusing on users rather than holders welfare in upgrades. https://t.co/N3YTAbfVBi

— Zhu Su

(@zhusu) November 21, 2021

L2 to Resolve Scalability Issues

The need for Layer 2 scaling solutions on the Ethereum network has been proven inevitable by the Ethereum founder, Vitalik Buterin, to facilitate the safest and most sustainable way to scale Ethereum while preserving decentralization. Earlier this October, Buterin spoke at the 2021 Shanghai International Blockchain Week, highlighting the need for scalability and implementation of rollups.

Vitalik Buterin talked about L2 scalability in reference to the non-fungible tokens (NFTs) frenzy, together with the explosive growth of decentralized finance (Defi) on the Ethereum network. Vitalik suggested that moving all NFTs to layer-two solutions can beat the high gas fees issue, further advising blockchains and NFTs to transfer to L2 to counter scalability issues. According to Buterin, the mainstream blockchain has become overcrowded, causing problems like high transaction fees.However, he noted that upcoming scaling solutions may take longer than expected to become fully operational. Henceforth, he suggested Rollups as the second-best option for users. Rollups are a Layer 2 solution that handles transactions outside the Ethereum mainnet, i.e., Layer 1.

The post Three Arrow Capital CEO Shuts Down the $400 million Hack Speculations, Here’s What Happened appeared first on Coingape.

]]>

The post Crypto FUD: Debunking Myths Surrounding Upcoming New Indian Crypto Bill appeared first on Coingape.

]]>

The Indian cryptocurrency bill has brought a ton of hype and speculations around the government’s probable regulatory path. Many mainstream and reputable media houses have been found peddling false narratives and fear-mongering, despite the Indian Finance Minister’s assurance regarding a positive approach.

The latest FUD surrounding the Indian crypto bill is regarding possible jail terms and fines for breaching the ban. The tweet made by Bloomberg correspondent Walter Bloomberg talks about a proposal in the first copy of the crypto bill which subjected crypto traders to arrest without warrants for infringing on the law.

INDIA BILL SEEKING TO BAN CRYPTO PAYMENTS PROPOSES MAKING THOSE WHO INFRINGE THE LAW SUBJECT TO ARREST WITHOUT WARRANT AND BEING HELD WITHOUT BAIL -DOCUMENT

— *Walter Bloomberg (@DeItaone) December 7, 2021

There was some early confusion regarding the recently tabled cryptocurrency bill due to similar wordings from February this year. The government sources cleared that it was a bureaucratic procedure and assured that the government has been working on reformulating the flaws with the first draft. Another thing to note here is that no regulations have been passed yet, and no information has come officially. Most of the reputed media houses are using anonymous sources to report on the matter, but on most occasions, these insider Infos have turned false.

Crypto Traders Must Wait For Government Clarification

Speculations-led news articles were the main reason behind the downturn in the Indian market a couple of weeks ago, as many of the media publications speculated possible ban. Thus, crypto traders in India must be wary of the source of the information rather than the media publication releasing it.

The cryptocurrency bill has been tabled for discussion during the ongoing winter parliamentary session. Once approved by both the upper and lower house, the bill would finally become a law. Until then crypto traders in India must not panic and fall for false narratives. The government has assured that the crypto market will be regulated as an asset class and while prohibiting its use in the payment sector.

The post Crypto FUD: Debunking Myths Surrounding Upcoming New Indian Crypto Bill appeared first on Coingape.

]]>

The post Just-In: Japan to Impose Stricter Regulations on Stablecoins appeared first on Coingape.

]]>

The Financial Services Agency (FSA) of Japan has announced that they will follow the US regulator’s footsteps in the matter of strengthening regulatory oversight for Stablecoins. According to reports from a local publication, the FSA has declared the updated restrictions on Stablecoins issuance in the nation, in lieu of which, only banks and wire transfer services will now be able to issue stablecoins.

The Japanese authorities referred to the Tether fiasco in the US, noting that by imposing restrictions on the issuance of Stablecoins, the government aims to ascertain the economy’s stability by preventing mass liquidation amid fear that the issuer of the currency going bankrupt. The FSA has clarified that it shall introduce the legislation of Stablecoins by next year, further confirming that they took regulatory framework inspiration from the US. Additionally, Japan is aiming to launch a yen-based cryptocurrency by 2022 as well.

Japan to Impose Additional AML Restrictions

Along with restrictions on the issuance of Stablecoins, the FSA also plans on imposing additional security protocols to make the decentralized industry less risky, ensuring consumer protection. According to reports, the authorities will publish the updated and stern anti-money laundering guidelines. Regulatory oversight will substantially increase on intermediaries like wallet providers involved in stablecoin transactions. These wallet providers will be required to follow the Japan’s law on preventing transfers of criminal proceeds by verifying user identities and reporting suspicious transactions.

The Japanese regulators are following up on their initiation of fastening crypto laws in the nation. Earlier this year, the FSA formed a new division to oversee a broader market of “decentralized finance”. Thus, regulating all blockchain-based financial operations that don’t have central intermediaries. Furthermore, Japan’s Finance Ministry joined the regulation project in lieu of the fast-moving development of the crypto industry.

“Japan can no longer leave things unattended with global developments over digital currencies moving so rapidly”, Reuters quoted the Ministry’s note.

The post Just-In: Japan to Impose Stricter Regulations on Stablecoins appeared first on Coingape.

]]>

The post Ethereum Price Analysis: ETH Sits On Strong Support Above $4,000 appeared first on Coingape.

]]>

Ethereum price is up approximately 7% to the current price $4,366 as it trades in a third straight bullish session in the daily timeframe. Bulls are determined to recover the weekend losses that followed the crypt market flash crash that saw the ETH lose as much as 22% in just a few hours. If the largest altcoin continues to hold above the $4,000 crucial level, it would be possible to recover even last week’s losses.

Ethereum Price Sits On Robust Support Downwards

Ethereum (ETH) is trading close to the 50-period Simple Movign Average (SMA) around $4,351. Closing above the 50 SMA will bolster the bulls who will push the price of the smart contracts giant’s token rise above the $45,82 support embraced by the lower boundary of the ascending parallel channel.

Such a move will place ETH back into the confined of the rising channel and a complete recovery of last week’s losses would be possible with Ethereum tagging $4,873 embraced by the middle boundary of the governing chart pattern.

ETH/USD Four-Hour Chart

The upward movement of the Relative Strength Index (RSI) indicator and its position above the midline validates this bullish outlook.

Also, ETH sits on strong support provided, not only by the $4,000 psychological level but also the 100 and 200 SMAs at $3,888 and $3197 respectively.

In addition, data from on-chain metrics provider, IntoTheBlock validate the strong support that Ethereum price has downwards. Its In/Out of the Money Around Price (IOMAP) model shows that ETH immediate support at $4,300 is relatively strong. It is within the $4,235 and $4,364 price range where roughly 1.53 million addresses previously bought approximately 4.43 million ETH.

Ethereum IOMAP Chart

The same IOMAP chart above shows that the path with least resistance for Ethereum price is upwards. Therefore, investors should remain hopeful that as long as ETH remains above $4K, it remains significantly bullish for the long-term holders.

However, a breakdown of the $4,300 immediate resistance could trigger massive sell orders that are likely to pull Ethereum down towards the $4,107 support floor or below the $4,000 level to tag the 100 SMA at $3,889.

The post Ethereum Price Analysis: ETH Sits On Strong Support Above $4,000 appeared first on Coingape.

]]>

Binance (@cz_binance)

Binance (@cz_binance)  (@zhusu)

(@zhusu)