Despite having fallen by nearly 30% since its November all-time high, Bitcoin is in a consolidating bull market and on its way to $100,000, according to a Bloomberg Intelligence report. The paper said it is unlikely that BTC’s bull run has come to a halt and predicts the fixed supply to sustain increasing prices.

“The key question facing Bitcoin nearing the onset of 2022 is whether it’s peaking or simply a consolidating bull market,” the report said. “We believe it’s the latter, and see the benchmark crypto well on its way to becoming global digital collateral in a world going that way.”

The report also highlighted how this year’s corrections have made the asset stronger and its bull market healthier, as Bitcoin endured and got past China’s mining ban to make new highs. In addition to breaching previous tops to reach $69,000 in November, the Bitcoin network hash rate also recently made a new all-time high, showcasing a deep resilience of its consensus protocol.

“Bitcoin appears to be on a trajectory for $100,000. We see it as more of a question of time, notably due to the economic basics of increasing demand vs. decreasing supply,” the report said.

Further mainstream adoption will lead to increased demand for bitcoin, and developments in new exchange-traded funds and futures and legal tender status in El Salvador are examples of this process. According to the report, as BTC issuance declines and its awareness increases, prices are expected to jump and volatility to diminish.

Greater regulatory clarity in the U.S. for Bitcoin might also increase its acceptance among certain types of investors and help fulfill an even higher demand for the asset. The report said next year might be pivotal in that sense, as the country looks set to embrace cryptocurrencies with more detailed legislation and a better understanding of the technologies from government officials.

Monetary policy might also play its part, especially if tightening measures by the Federal Reserve end up leading to a crashing stock market, prompting the central bank to stir the ship the other way.

“A primary force to reverse expectations for Federal Reserve tightening in 2022 is a drop in the stock market, which may be a bit of a win-win for Bitcoin,” the report said, adding that Bitcoin is “well on its way to becoming a digital store of value.”

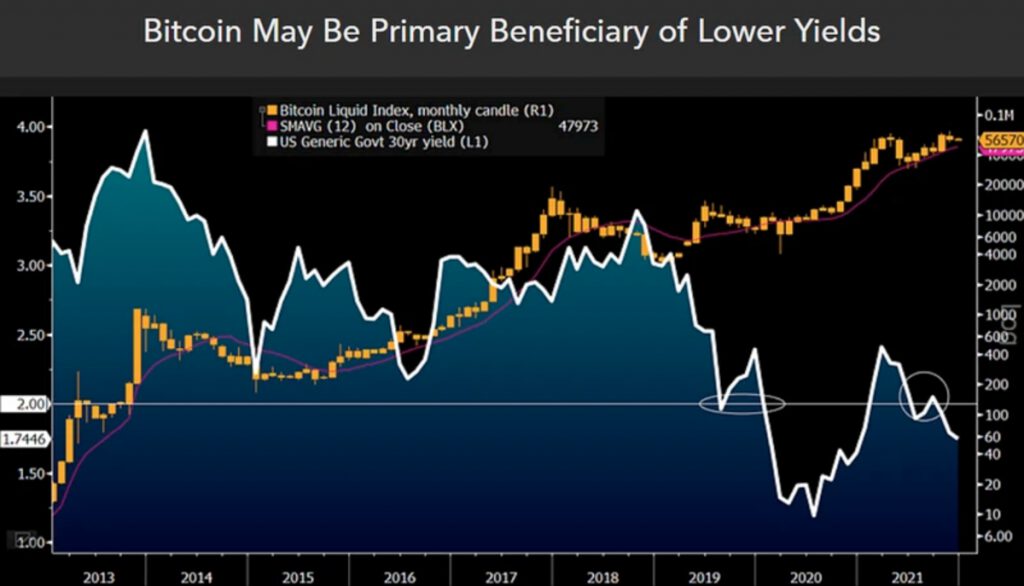

“Bitcoin will face initial headwinds if the stock market drops, but to the extent that declining equity prices pressure bond yields and incentivize more central-bank liquidity, the crypto may come out a primary beneficiary,” per the report.

The report also mentioned the U.S. Treasury long bond’s inability to sustain above 2% despite widespread consensus for higher yields, a phenomenon that could lead to a deflationary environment next year, favoring Bitcoin.

Bloomberg Intelligence explained that funds have been moving away from “old analog gold” and toward Bitcoin.

“The question for 2022 centers on reversal or acceleration of these flows. With bond yields in decline, our bias is toward the latter,” per the report.

Bloomberg added that Bitcoin’s fixed supply, enforced through a diminishing issuance every four years, could help it outperform stocks again next year, putting it at an advantage against an extended stock market that hasn’t had a 10% correction since the 2020 crash.