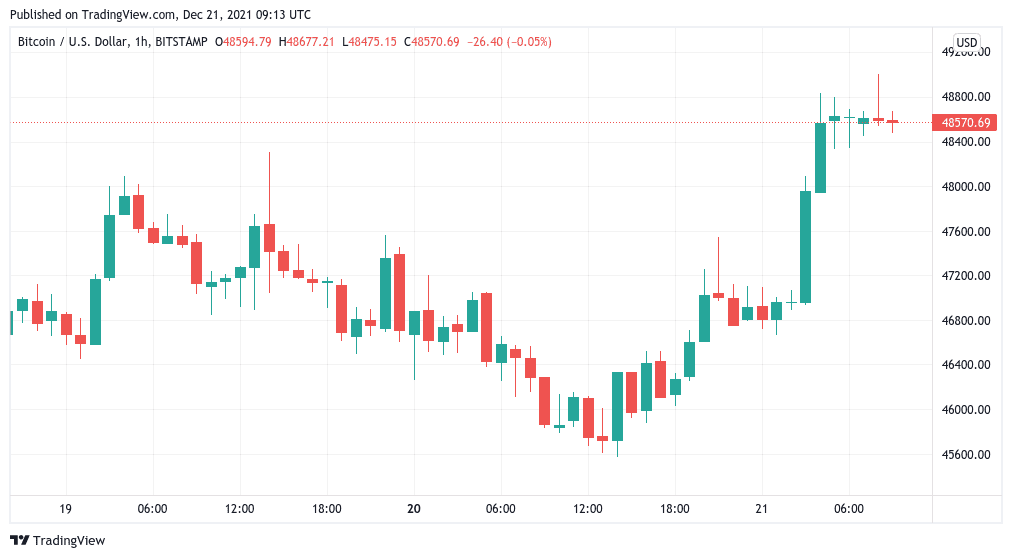

Bitcoin (BTC) rebounded over 5% on Dec. 21 as a dramatic turnaround in the fortunes of the Turkish lira boosted investors’ confidence.

Wishing on a sentiment flip

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing overnight as the lira shot up as much as 40% against the United States dollar.

The move came as Turkey’s president, Recep Tayyip Erdoğan, announced sweeping measures to protect consumers and attract lira investors. USD/TRY had previously hit all-time highs of near 19, half of which had occurred in the last two months.

In an ironic twist, Erdoğan himself had come out against cryptocurrency in September, declaring Turkey to be “at war” with the industry.

The switch-up fuelled Bitcoin and altcoins alike, with 5% gains mirrored across the major cryptocurrency charts Tuesday.

Cointelegraph contributor Michaël van de Poppe was among analysts noting the correlation.

#Bitcoin bounces nicely today.#Ethereum bounces even better today.

The actual reason?

Turkish Lira makes a strong bounce.

— Michaël van de Poppe (@CryptoMichNL) December 20, 2021

“Good chances we’re done with the correction,” he added in one of various Twitter posts about spot price action on the day.

“The longer we stay here, the faster the sentiment flips.”

A look at popular sentiment gauge the Crypto Fear & Greed Index reflected modest relief entering thanks to the uptick, the mood rising two points to 27/100 or from “extreme fear” to “fear.”

Analysts eye evaporating unrealized gains

Data covering hodler behavior, meanwhile, pointed to an impending watershed moment repeating itself when it comes to Bitcoin profitability.

Related: Don’t expect retail sell-off to crash Bitcoin price — Analyst

Released by monitoring resource Whalemap, it showed that BTC at a loss should soon pass BTC being hodled with unrealized gains. Historically, upside resumes when such crossovers occur.

There are around 4 million #Bitcoin hodled at prices above $50,000. This equates to around 20% of the entire 870B market cap. All of these coins are currently at a loss. pic.twitter.com/n4dx7NHG8R

— whalemap (@whale_map) December 20, 2021

“Not quite there yet but looking promising,” the Whalemap team told Telegram subscribers, adding in comments to Cointelegraph that in principle, “the more unrealized losses, the better.”