Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Bitcoin appeared to have found some temporary support in the $40.5k region and bounced to $42.6k, at the time of writing. Binance Coin also found demand in the $413-$417 region and recorded a gain of nearly 10.6% over a period of 40 hours since.

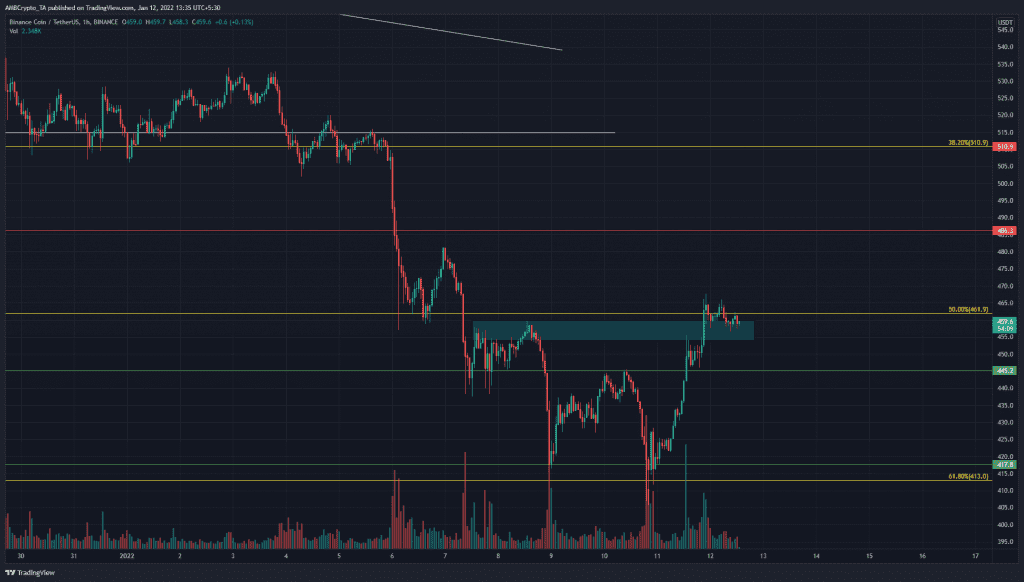

The $480-$486 zone will be the next area of resistance for Binance Coin.

Source: BNB/USDT on TradingView

$417 was a long-term support level for BNB, while the $413 level represented 61.8% retracement for BNB’s move from $254 to $669. On lower timeframes, the $455 area (cyan box) is a place where sellers have been strong and have been able to force a quick move from $455 to $415.

Over the last few hours, Binance Coin has been able to rise above the $455 supply region, shifting the short-term outlook for Binance Coin from bearish to bullish.

In the scenario that BNB does not see a candle close below $450, it remains likely that the price would resume its march upward. The $480 and $486-levels presented short-term targets for the price.

The entire area from $470-$510 did not see much trading activity on BNB’s slide down, meaning sellers were abundantly stronger. Only the $461-level could force a bounce. Hence, it is possible that BNB would quickly climb to $510 if it can rise above $470 on strong volume.

Rationale

Source: BNB/USDT on TradingView

When BNB tested $413 for the second time in the past week, the MACD formed a higher low while the price closed at a lower low. This bullish divergence was followed by the MACD forming a bullish crossover and climbing rapidly above the zero line.

The CMF indicator also showed capital flows into the market.

Conclusion

Trading volume was high when BNB surged north and that would need to be the case once more if BNB breaches the $470-level. Short-term momentum is on the side of the bulls and a former zone of supply at $455 appeared to be flipped to demand.

This offered a buy opportunity and a high risk-to-reward trade considering how thin the $470-$510 area has been in terms of trading volume on the way down.