Enjin Coin price shows the formation of a bottom reversal pattern on the four-hour chart, indicating that it is due for a quick run-up. Supporting this view are two on-chain metrics that solidify the short-term bullish future of ENJ.

Investor activity reveals bullish intent

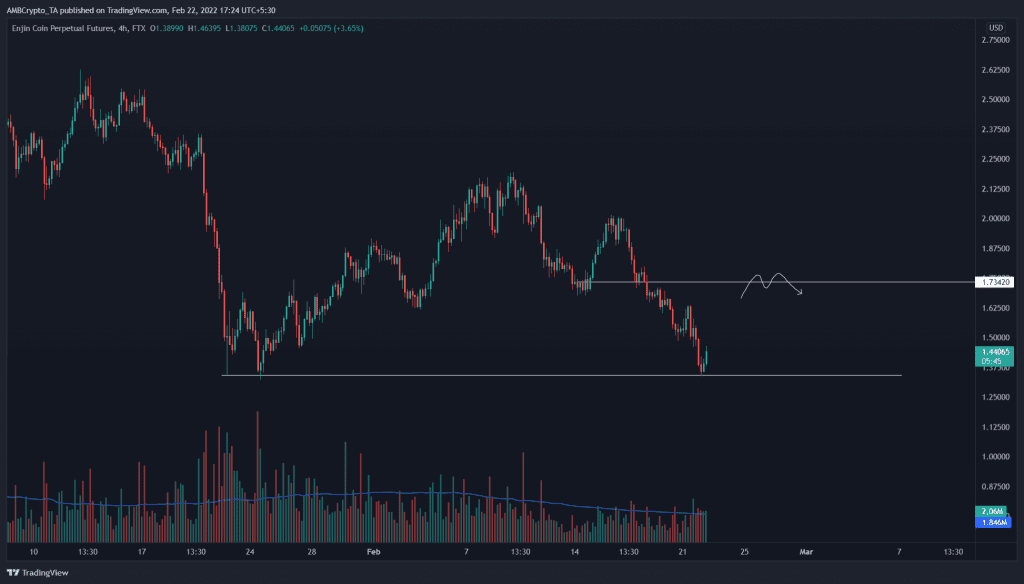

Enjin Coin price set up two equal lows at $1.34 on 22 January and 22 February, revealing a bottom reversal pattern known as a double bottom. This setup indicates that the downtrend is coming to an end and that trend reversal is likely.

However, due to the formation of a double bottom, many investors tend to long the altcoin after the second tag, leaving their stop-losses below it. The collection of these stop-losses is termed as “liquidity.”

Market makers often look to push the asset into these liquidity pools to engineer liquidity for themselves. Effectively, these players temporarily move the market in the opposite direction to collect liquidity. After their objective is complete, the asset heads in the opposite direction.

Therefore, Enjin Coin could see another dip below $1.34 before an uptrend kick-starts. The resulting rally will push ENJ by 30% to tag the $1.73 resistance barrier.

While the technical outlook might seem highly bullish, the recent uptick in 1-hour active addresses adds credence to it. A sudden spike in these numbers serves as a proxy of investors’ intent or in simple terms, reveals that many buyers are flocking toward the asset and are expecting a reversal.

Moreover, this increase in 1-hour active addresses is occurring when the price is declining, suggesting a bullish divergence. All in all, Enjin Coin seems likely for a quick run-up.

Further solidifying the bullish outlook and the investor sentiment is the Market Value to Realized Value (MVRV) model. This index is used to determine the average profit and loss of investors that purchased ENH over the past month.

Since the MVRV is hovering around -22%, it suggests that short-term holders are selling at a loss. However, as mentioned in previous articles, this is termed as an opportunity zone since long-term investors tend to accumulate in these regions as the risk of a sell-off is little to none.

The only way Enjin Coin price’s bullish outlook could turn sour is if the Bitcoin price crashes again. This development could knock ENJ below $1.341, invalidating the bullish thesis. Such a move could trigger further descent from panic selling investors.