Top Galaxy Digital officials recently spoke about the current market trends and adoption volume of Bitcoin in an Earnings Conference Call. The crypto-financial services firm remains bullish on crypto-assets in 2022, especially after a series of positive events for the sector.

Galaxy headed for glory?

CEO Mike Novogratz was particularly pleased with the company’s fourth quarter, one which capped off a brilliant year for Galaxy Digital.

“Our Partner’s Capital at $2.6 billion leaves us one of the most equitized, the strongest balance sheet companies in the crypto space.”

In a previous interview, Novogratz had projected a “rangy” year for Bitcoin between $30,000 and $50,000. To the joy of many, the tide has turned altogether for him, with the exec adding,

“…. the innovation we’re seeing in Web 3 and in the Metaverse space, I’ve gotten more constructive than I was at the beginning of the year. And so it wouldn’t surprise me to see crypto significantly higher by the end of the year.”

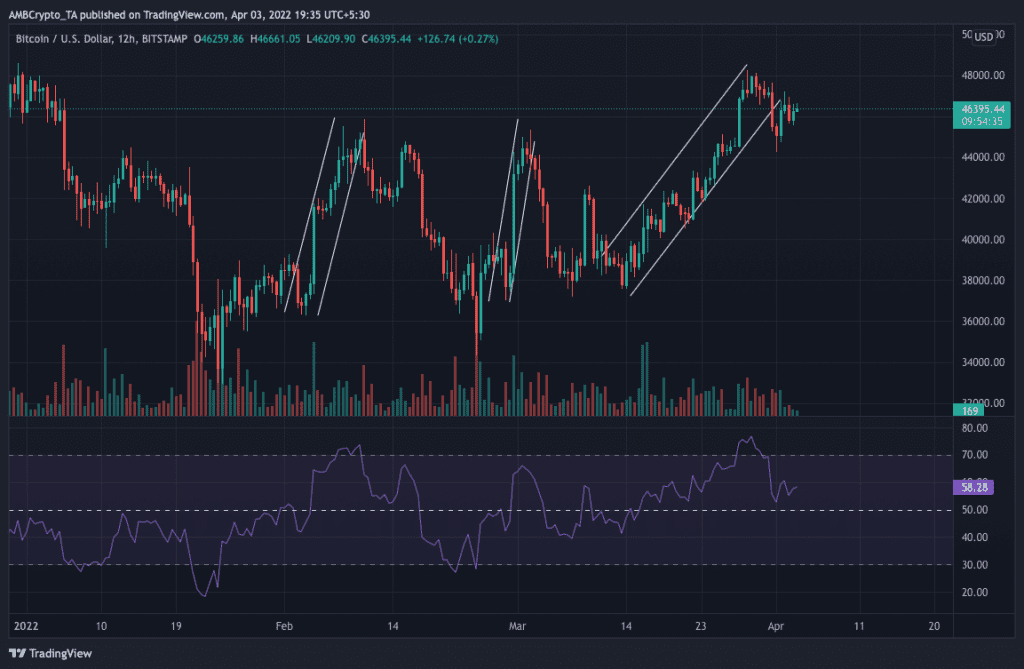

Bitcoin’s bullish performance can be evidenced by its more recent price candlesticks. The RSI indicator, at press time, had a reading of 58.7 – Suggestive of more upside on the charts.

A series of factors have contributed to the same. For instance, some have argued that the Russian invasion on Ukraine has aided Bitcoin bulls during the latest rally. There has also been a sustained increase in adoption rates in many countries despite legal ambiguity of crypto-regulations.

The same was highlighted recently by an analysis of blockchain wallet users, an analysis released by Deutsche Bank.

The forecasted data is beyond promising, with the same pointing to an uncompromising upward trend in the macro landscape for blockchain technology.

Bitcoin, the world’s largest crypto by market cap, is at the heart of it.

Damien Vanderwilt, Co-President of Galaxy Digital, is also bullish on Bitcoin. And, there is more good reason to be so too. $33 billion were invested in crypto and blockchain start-ups in 2021, more than all previous years combined.

What is Bitcoin’s 2022 prediction?

While the year started sluggishly for Bitcoin, it has revelled in recent weeks with the bulls pushing for $50,000.

The importance of Bitcoin in today’s market was further underlined by Glassnode. In its latest weekly newsletter, Glassnode shared some good news for investors worried about crypto-volatility. According to the Newsletter,

“The longer a coin remains dormant, the more likely it is to remain so.”

This suggest that investors who have held a coin for more than a year are likely to experience “wild price swings” and hence, are likely to be “higher-conviction HODLers.” More importantly, the characteristic volatility of Bitcoin is likely to be advantageous for its price movement.