Ethereum (ETH) has recovered steadily after slumping below $1,000 earlier this month, as traders rushed in to accumulate the token at lower levels.

ETH is trading at $1,225- up nearly 27% from a low of $897 touched earlier this month. A series of liquidations in big holders had caused a large amount of tokens to be dumped onto the market, causing a major price drop.

But the fall below $1,000 also appears to have attracted bargain hunters, who expect the token to rise substantially after the blockchain moves to proof of stake.

Traders also see lesser sell-side pressure on the token, given that a number of overleveraged positions have now been liquidated.

Data from Coinglass also shows that the pace of ETH liquidations has fallen drastically over the past week, after skyrocketing earlier in the month.

Trending Stories

ETH balance on exchanges on a continued downtrend

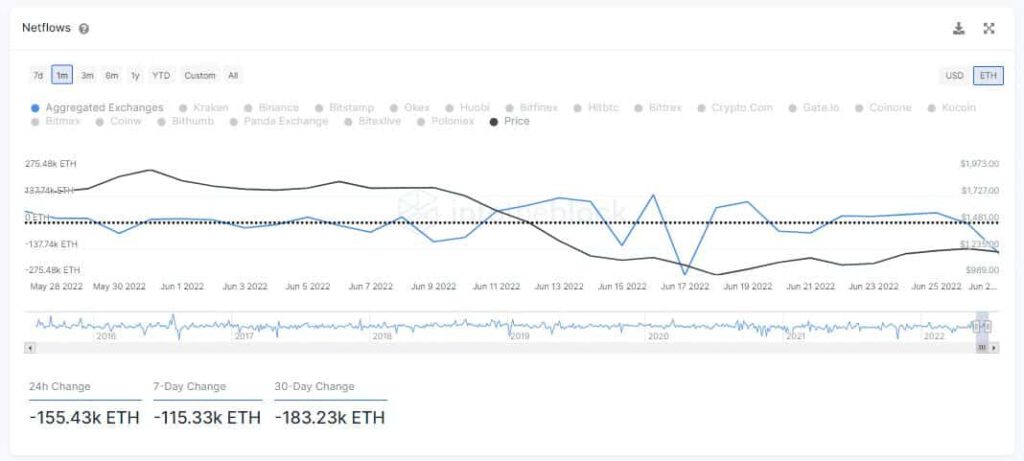

Data from blockchain analytics firm Into The Block shows that ETH balance on centralized exchanges has fallen to new lows. This trend reflects that traders are likely accumulating the token by moving it off-exchange, reducing its active supply.

According to Into The Block, a total of 183.2K ETH- roughly $223 million- has been withdrawn from centralized exchanges in the past 30 days.

Sentiment still shaky despite recovery

But traders remain cautious of any further price headwinds, given that macroeconomic factors are largely detrimental towards crypto markets.

ETH remains sensitive to any more liquidations, especially after hedge fund Three Arrows Capital, a major holder, defaulted on a $660 million loan. The fund may be forced to liquidate more of its holdings to repay its creditors.

ETH prices are also sensitive to any news on the merge. A recent hiccup in deploying the merge on a testnet rattled traders. Focus now turns to an upcoming deployment on the Sepolia testnet in early July.

If successful, the move could help ETH prices recover further. The world’s second largest crypto is trading over 60% down so far in 2022.