Cryptocurrencies have cemented their status as one of the most profitable investments of the last decade. Despite the current downturn of most assets, the return on investment on most assets have been stunning. However, it seems that the profitability may have eaten deep into the heads of some “investors” who want to make quick cash, forgetting that these cryptocurrencies are no get-rich-quick schemes. So, this greed has led many to losing their capital to project rug pulls, and sometimes, wallet drains.

That said, we found out that many of these victims do not know what risk to take and what to avoid while investing. Hence, we’ve curated five-pointer risks that crypto investors or traders should never take. Whether beginner or experienced, taking this information into account will prevent you from falling into the hand of lurking crypto thieves.

Risk 1: Trading Without Following Regulation

While cryptocurrencies started with the aim of avoiding government involvement, it seems that it has become necessary to follow rules laid down by the authorities. Therefore, crypto trading apps like BitAlpha AI always encourage their users to check and comply with the crypto trading regulations in their region before investing.

As for regulation, many countries have been involved. The United States Securities and Exchange Commission (SEC) for example, has been at loggerhead with Ripple for years because of regulation issues. This has led Ripple to halt some of its objectives despite the blockchain company claiming to have done no wrong. Not only has the case affected the company, but its users and XRP holders have been left wondering what the next step will be.

Another example of not following regulation is Nigeria. In 2021, the country’s central bank banned the use of bank cards for trading cryptocurrency. Unfortunately, some traders didn’t get the memo early enough. This act led to suspending bank accounts with funds withheld. These, and many other reasons why crypto traders should keep up with the regulations of the industry.

Risk 2: Giving Out Your Seed Phrase

For traders who use centralized exchanges, this might not be an issue. However, many traders followed the “not your keys, not your coins” model. Hence, choosing to store their assets on decentralized exchanges like MetaMask and TrustWallet. While this claims to be safe, saving your seed phrase or private keys on a digital device or telling it to someone else puts your cryptocurrencies at risk.

This is because these days, hackers have found a means of accessing your digital devices and if saved, can be at risk of exploitation. One way to fix this is writing out your password in a safe where only you can access. Another one is to get a hardware wallet and store your assets on it. Examples of these hardware wallets include Ledger or Trezor.

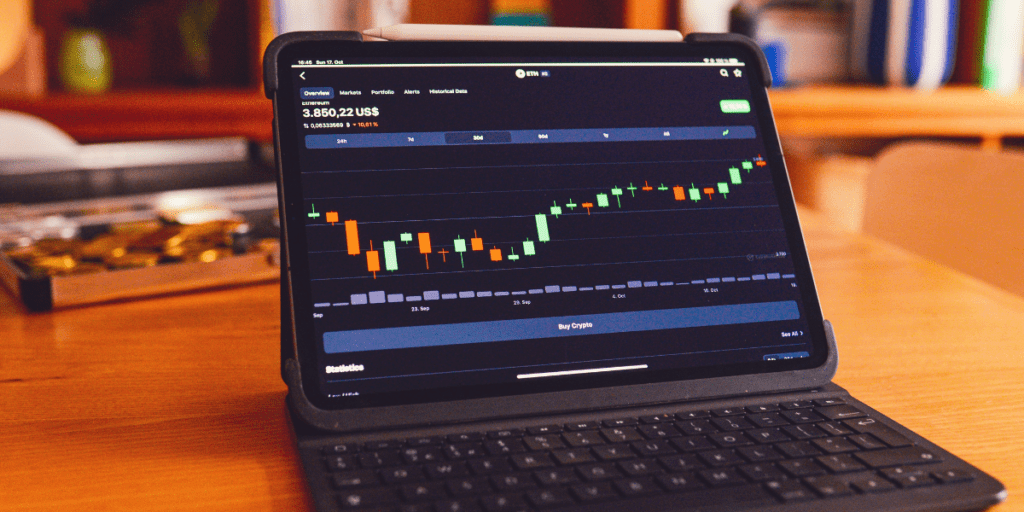

Risk 3: Trading Crypto Futures Without Experience

One misconception about cryptocurrencies is that you can make tons of profits in a short time. While this can be true for a few people, it’s not the case for most. The worst part is how complete beginners go as far as trading derivatives or futures. A simple way to begin trading is the buying low and selling high strategy. Some would prefer spot trading but going to engage in futures trading as a beginner is shooting yourself in the foot.

If you have ever heard of the liquidation that happens daily in the crypto market, you would know how risky trading futures is. As an inexperienced trader, you can lose all your invested capital in one trade without the proper guidance.So, it is recommended to learn the basics and trade cautiously even as the most experienced traders lose as much too. If you feel you have the guts, only try it with money you can afford to lose.

Risk 4: Buying the Top or FOMO

Buying the top is simply buying a cryptocurrency when it’s at a price where it has made lots of prtifts. This is where many newbies make a mistake. Simply because there is hype around an asset does not mean it’s the right time to buy. For most people, it is the Fear of Missing Out speaking. A clear scenario is the Bitcoin pump to $69,000 in 2021. During that time, many inexperienced cryptocurrency investors FOMOed and bought Bitcoin without realizing that that would be its All-Time High (ATH). Since the ATH, BTC has remained far from reaching it again as the market is currently in a bear state. It means one thing— investors who bought at the top are currently in severe loss. So, ensure to do your own research and assess if you’re not buying the top of any coin.

Risk 5: Buying any Meme Cryptocurrency

Meme cryptocurrencies are assets with no known utility but have potential to skyrocket your investments. Examples of these cryptocurrencies or shitcoins are Dogecoin, and Shiba Inu. Of course, these meme coins increased as much as 10,000% in 2021. However, that does not mean that every shitcoin that springs up is a potential Shiba Inu or Dogecoin. In most cases, buying some of them leads to losing your capital. In severe cases, all other assets in your crypto wallet gets drained.

So, as a risk management strategy, try as much as possible to avoid buying any meme coin that comes your way. Once again, the same way shitocins can make you insane ROI is the same way you can lose all. In cases, whether you get to make profits, it is important to ensure that you do not get unnecessarily greedy. Exit the trade and take the profits no matter how small.

The Bottom Line

Finally, we hope that you have been able to pick one or two lessons from the risk mentioned adobe. While this article is not meant to be investment advice, the aim is to ensure that less and less investors understand the risks involved with crypt trading. In addition, knowing the potential consequences of these risks can help more people avoid taking the wrong route.