Binance Coin (BNB) is consolidating above the previous resistance area and has validated it as support. While there are no bullish reversal signs from technical indicators, BNB is trading in a bullish pattern.Sponsored

Sponsored

BNB has been decreasing alongside a descending resistance line, which has been in place since the May 10 all-time high of $691.8.

More recently, the line rejected BNB thrice, on Nov 7, 14 and 26 respectively (red icons). Afterwards, it proceeded to reach a low of $489 on Dec 4. Sponsored

Sponsored

However, the token bounced and created a long lower wick, which is considered a sign of buying pressure. Furthermore, the bounce served to validate the $510 area as support. The area previously acted as resistance during Sept, and has turned to support after the Oct breakout.

However, while the price action could still be seen as bullish. Technical indicators are bearish.

The MACD, which is created by a short- and long-term moving average, is decreasing and is nearly negative. This means that the short-term MA is losing ground relative to the long-term one.

The RSI, which is a momentum indicator, is below 50. Movements above this line are considered bullish, while those below it are bearish.

Therefore, the daily chart provides mixed signs.

Category Archives: BSC News

The LABEL Foundation announced that users can now effortlessly transfer LBL tokens between the Ethereum Mainnet and the Binance Smart Chain.LABEL, a non-fungible token (NFT) infrastructure powered by the base Ethereum protocol, is now bridged to the Binance Smart Chain (BSC). The integration has been made possible by the MultiBaas Middleware platform created by Curvegrid. LABEL now facilitates a connection between the Ethereum Mainnet and the BSC. This means that users can now seamlessly transfer LABEL’s ERC20, ERC721, and ERC1155 tokens between multiple supported blockchains.The LABEL Foundation posits to offer its clientele top-notch content in both education and entertainment. Therefore, by deploying on the BSC ecosystem, LABEL now taps into the several great features of the mainnet. This, in turn, would further expand and enhance the performance of the LABEL decentralized application. On this initiative, LABEL has also tapped notable DeFI Launchpad Solanium as its strategic advisor and investor. This means that the crypto platform will lend its assistance in expanding LABEL’s ecosystem. Based in Amsterdam, Solanium offers a DEX UI, staking, wallet management, governance, decentralized fundraising, and a launchpad.In addition, in order to execute its public sale, LABEL announced that its initial DEX offering (IDO) will take place on RedKite and NFTb.Prior to the BSC Bridge development, LABEL collaborated with leading music education platform OPENTRACK, operated by Clesson. Pursuant to the partnership, a body of extremely skilled instructors will create and provide early content with LABEL’s ecosystem. According to LABEL, some of these slated world-class artists include Mark Lettieri, Scoop DeVille, and Docskim. This roster will also include several other Grammy-nominated artists incubating and monetizing their IP rights on the LABEL platform.LABEL to Achieve Expansion via the Binance Smart Chain DeploymentLABEL is a blockchain-centric, global education platform that grows and promotes several investment processes. The platform focuses on paring down any challenges or pitfalls that pertain to investment procedures and existing content production. The platform’s main objective is to provide users with top-notch educational and entertaining resources. LABEL undertakes this through the decentralized autonomous organization (DAO) voting system.LABEL is also looking to create a fair profit-sharing environment for intellectual property rights matters. Furthermore, it sees migrating to the BSC as the first step at eventually becoming a multifaceted, multichain NFT infrastructure. This would subsequently lead to the enablement of the LABEL content incubation on disparate blockchain protocols. In order to achieve this faster, LABEL is also entering partnerships with several organizations across the media and entertainment space.The globe is becoming more digitized – more so now in light of the Covid pandemic. There is now a bigger apparent need for people to utilize different technologies in communicating with one another. This is also now reflected in the booming NFT sector as people also want to make viable investments in addition to interfacing digitally. LABEL’s efforts, including bridging to the Binance Smart Chain, working with Solanium, and collaborating with OPENTRACK, are a few efforts – with more expected to come – geared towards general NFT adoption. Blockchain News, Cryptocurrency news, News Tolu is a cryptocurrency and blockchain enthusiast based in Lagos. He likes to demystify crypto stories to the bare basics so that anyone anywhere can understand without too much background knowledge.

When he’s not neck-deep in crypto stories, Tolu enjoys music, loves to sing and is an avid movie lover. Thank you!You have successfully joined our subscriber list.

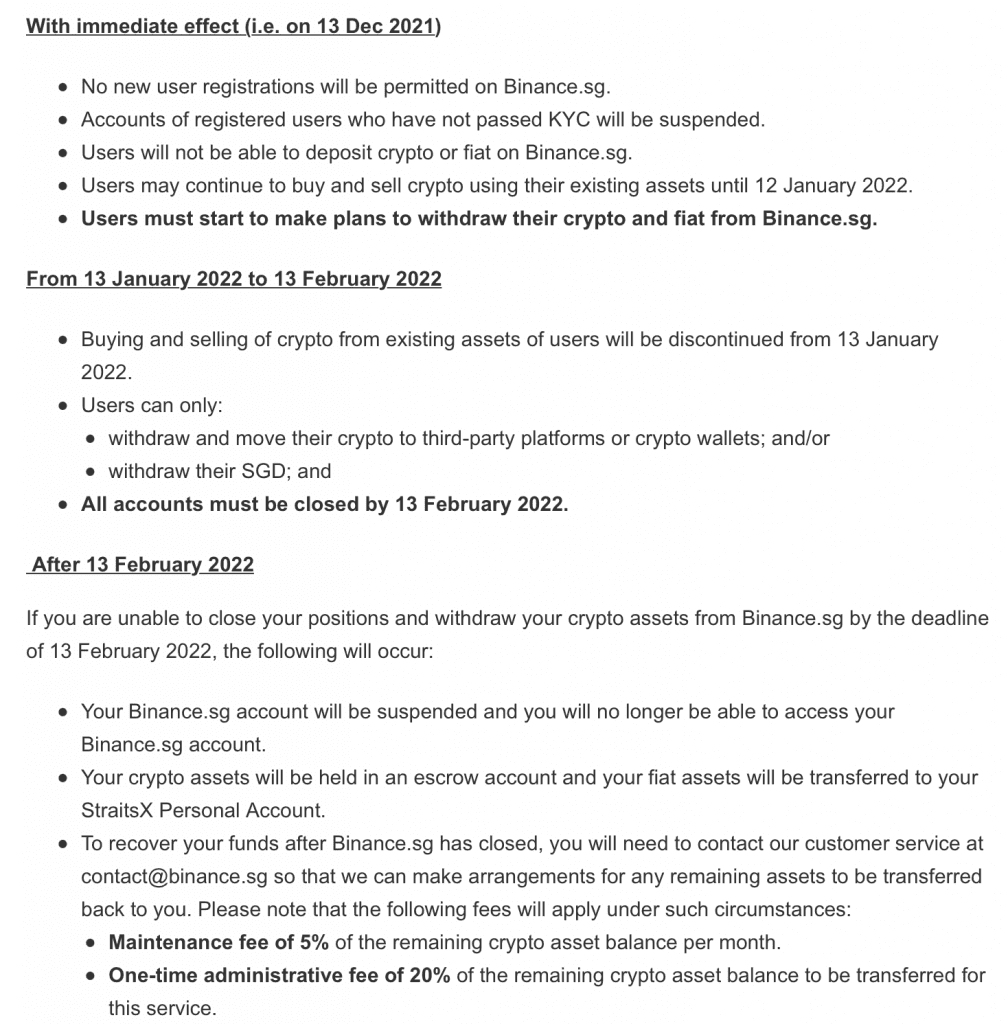

Binance has apologized and warned that BAS would not be in charge of any losses that result from users’ failure to withdraw their assets and close their accounts by February 13, 2022.On Monday, crypto exchange platform Binance announced its decision to withdraw its license application in Singapore and wind down its digital payment token (“DPT”) services there. According to Binance, the management made the decision “taking into account strategic, commercial and developmental considerations globally.”The announcement has an immediate effect. Starting on December 13, Binance.sg does not allow registration of new users and depositing crypto or fiat. Besides, it will suspend accounts of already existing users who have not passed KYC. However, they will be able to trade crypto until 12 January 2022. Starting from January 13, users will only be able to withdraw and move their crypto to third-party platforms or crypto wallets as well as withdraw their SGD. By February 13, Binance.sg will have closed all the accounts. Binance has also apologized and warned that BAS would not be in charge of any losses that result from users’ failure to withdraw their assets and close their accounts by this deadline.Richard Teng, chief executive officer of Binance Singapore, commented:“We always put our users first, so our decision to close Binance.sg was not taken lightly. I am grateful to the Monetary Authority of Singapore for its ongoing assistance to Binance Asia Services and we look forward to future opportunities to work together.”According to the Monetary Authority of Singapore, approximately 170 crypto firms applied for a Digital Payment Token License in Singapore. Notably, only four applicants got approval for the license. Around 100 of the applicants have either withdrawn their filings or got rejection.Binance’s Future PlansAccording to Binance Asia Services (BAS), instead of making efforts to get a license in Singapore, it will refocus its operations toward blockchain technology.Chia Hock Lai, co-chairman of the Blockchain Association Singapore, said:“Not all crypto activities are regulated, and increasingly big crypto players might want to consider having distinct regulated and unregulated entities, to optimize their revenue and partnership models across different jurisdictions.”Notably, back in November, Binance named Singapore as a crypto-friendly jurisdiction. At that time, Binance was also considering several locations as potential headquarters. Being the largest cryptocurrency exchange in the world by volume, Binance was remaining one of the biggest companies without headquarters. Currently, the company is communicating with regulators around the world.Recently, we reported about Binance’s intention to expand in the UK in the upcoming 6-18 months. Besides, Binance will deepen its foothold in Indonesia. It is likely to be easy as the Indonesian government maintains a favorable stance when it comes to digital currencies. Altcoin News, Binance News, Business News, Cryptocurrency news, Editor’s Choice Daria is an economic student interested in the development of modern technologies. She is eager to know as much as possible about cryptos as she believes they can change our view on finance and the world in general. Thank you!You have successfully joined our subscriber list.

The world’s largest digital asset trading venue – Binance – considers doubling its presence in Asia by setting up a blockchain innovation hub in Singapore.

On the other hand, the company intends to withdraw its application for a crypto-exchange license in the city-state. Binance.sg will shut down its operations on February 13, 2022, as all accounts will be closed by that date.

Binance Blockchain Hub in Singapore

According to a statement seen by CryptoPotato, the cryptocurrency firm aims to create a blockchain center in Singapore through its Binance Asia Services (BAS). The move is expected to boost the global crypto ecosystem. In line with its mission, Binance will explore a variety of Singapore-based initiatives, such as blockchain education, incubation programs, and further investment opportunities.

Philbert Gomez – Vice President of Digital Industry Singapore (DISG) – commented:

“We look forward to working with Binance to develop a vibrant blockchain ecosystem that will benefit Singaporeans and Singapore-based companies to create world-class innovation for the region and globally.”

Not long ago, Binance launched a similar initiative in Europe. In November, it joined forces with France Fintech and created a $116 million blockchain project on the Old Continent.

Arguably the world’s most-popular crypto-exchange, Binance has found itself in hot water with global watchdogs over a lack of regulatory clarity. It has faced objections on a consistent basis from different authorities around the world.

Consider this – The Monetary Authority of Singapore (MAS) has, in the past, raised concerns about Binance’s operations in the city-state. Well, fast forward to mid-December, and the MAS may have won the session-ender against the crypto-platform.

Huge blow for Binance

BREAKING: Binance Singapore withdraws its application for a crypto-exchange license, and says its platform https://t.co/ZnfCcRCuIM will close by Feb. 13 https://t.co/QdfZOEc7xR pic.twitter.com/JPQjIKYlWy

— Bloomberg Crypto (@crypto) December 13, 2021

Binance Singapore has withdrawn its application for a license to operate a cryptocurrency exchange. It will shut down its trading platform in Singapore. The official announcement, first reported by Bloomberg, revealed,

“Ending an effort that started last year to win approval from Singapore’s authorities.”

Binance plans to “wind down” all services that relate to dealing with cryptocurrency tokens by 13 February 2022. The exchange takes no responsibility for the users’ assets after the said deadline.

“With immediate effect, users must start to make plans to withdraw their crypto and fiat from Binance.sg. Accounts of registered users who have not passed KYC will be suspended.”

However, users may continue to buy and sell crypto using their existing assets until 12 January 2022. From 13 January, Binance.sg users will be barred from buying and selling crypto. During this phase, users can only withdraw and move their crypto to third-party platforms or crypto-wallets; and/or withdraw their SGD. All accounts must be closed by the aforementioned date.

A streamlined summary of the aforementioned timelines is as follows,

Source: Binance

Moreover, Binance Singapore was among roughly 170 companies that applied to the Monetary Authority of Singapore (MAS) for a license to provide crypto-services. The company had been operating under a temporary exemption during the licensing process. But, no more.

According to Richard Teng, Chief Executive Officer of Binance Singapore,

“We always put our users first, so our decision to close Binance.sg was not taken lightly. Our immediate priority is to help our users in Singapore transition their holdings to other wallets or other third-party services.”

Despite the ongoing regulatory scrutiny, however, Binance continues to explore new jurisdictions and developments.

Interestingly, just a week ago, Binance acquired 18 percent of Singapore-regulated private securities exchange, Hg Exchange (HGX). Now the question remains – Will this change anything in the future? Only time will tell.

Crypto exchange Binance has withdrawn its license application for pursuing digital payment token (DPT) services in Singapore. Starting today, Binance.sg has stopped onboarding new users and will not allow Singaporeans to deposit cryptocurrencies or fiat on the exchange.By Feb 13, 2022, Binance plans to “wind down” all services that relate to dealing with cryptocurrency tokens. However, the exchange announced to take no responsibility for the users’ assets after the self-determined deadline:“With immediate effect, users must start to make plans to withdraw their crypto and fiat from Binance.sg. Accounts of registered users who have not passed KYC will be suspended.”Binance Singapore users are currently allowed to buy and sell crypto using their existing assets until Jan. 12, 2022. Starting Jan. 13, Binance.sg users will be barred from buying and selling crypto. During this phase:“Users can only withdraw and move their crypto to third-party platforms or crypto wallets; and/or withdraw their SGD. All accounts must be closed by 13 February 2022.”Binance plans to make further arrangements to release users’ assets upon an official request to the company’s customer service.Following the final date, Binance will not allow any Singapore users to close positions or withdraw crypto assets. “The locked crypto assets will be held in an escrow account and your fiat assets will be transferred to your StraitsX Personal Account,” the announcement read.“We recommend that you take action as soon as possible before the deadline for account closure (13 February 2022). Please note that BAS will not be held responsible for any losses that result from your failure to withdraw your assets and close your account by 13 February 2022.”Binance has not yet responded to Cointelegraph’s request for comment.Related: Binance reportedly in talks to launch crypto exchange in IndonesiaDespite the ongoing regulatory scrutiny, Binance continues to explore new jurisdictions for setting up localized crypto exchanges. Binance is reportedly in talks with Indonesia’s richest family, the Hartonos, for launching an exchange service. According to a Bloomberg report, Binance may soon finalize a crypto venture with Hartonos-controlled PT Bank Central Asia (BCA).If approved, the new BCA partnership will allow for the launch of a second crypto venture for Binance in Indonesia. The crypto exchange is also planning to expand to the United Kingdom in the next six to 18 months amid regulatory resistance.

sponsored

Nested exchanges are becoming a popular tool for money launderers. Learn all about nested exchanges/services and what we’re doing to combat them as well as how to avoid them and why accounts get blocked or frozen because of them.

Main Takeaways:

A nested exchange provides crypto trading services through an account or wallet on an existing host exchange.

Nested exchanges are attractive crypto platforms for money launderers looking to bypass KYC and AML requirements.

In this article, you’ll learn how to avoid nested exchanges, the common security issues and how we combat this problem at Binance.

A new trend is emerging in the world of cryptocurrencies, and it’s not pretty. They’re called nested exchanges, and it’s the latest vehicle of choice for money launderers worldwide. In short, a nested exchange provides crypto trading services through an account or wallet on an existing host exchange. The nested exchange typically operates in secret and is rarely associated with the host exchange. So why do people use them?

Some users prefer nested exchanges because they enforce minimal know-your-customer (KYC) and anti-money laundering (AML) requirements. Perhaps they live an anonymous life off the grid, or even worse, they’re up to something nefarious. More often than not, it’s the latter situation. Here’s how nested exchanges work:

Person A visits a nested exchange and decides to trade ETH for BTC

Person A deposits the ETH on the nested exchange.

The nested exchange sends the ETH to their account/wallet on the host exchange to complete the conversion.

The nested exchange returns the newly-converted funds to person A and the trade is complete.

However, the lax requirements make this process a very appealing gateway for bad actors looking to cover the tracks of their illegally-acquired funds and bypass requirements on centralized exchanges, like Binance. In this article, you’ll learn how to avoid nested exchanges, the common security issues and how we combat this problem at Binance.

How to Avoid Nested Exchanges

Nested exchanges can look just like your traditional crypto exchange. Some may have a false user interface, but this is less common. Users will typically know what nested service they’re using, but most won’t see or know the host exchange it’s operating on. If you want to avoid nested exchanges and all the associated risks, we recommend using a regulated, centralized exchange or a nested service that is legally compliant with proper KYC and AML procedures.

It’s a telltale warning sign if your crypto exchange requires little to no verification checks or trading limits. If you suspect your provider is a nested exchange, you can always use a blockchain explorer to track if your funds came from a wallet on another exchange.

Security Issues

The significant risks with these services are the lack of supervision from the host exchange. Remember, by putting the complete trust of your funds in an exchange with minimal security, you are also taking on more considerable risk. Bad actors deliberately use these services to avoid the AML/KYC procedures at the host services. Even if you’re using a nested exchange for your day-to-day crypto trading, you may unintentionally be funding criminal and terrorist activities. In that case, the nested exchange could be subject to law enforcement takedowns. Your funds could be confiscated or blocked indefinitely, depending on the jurisdiction and duration. In the event that law enforcement has reason to believe that a nested exchange is conducting an unlawful operation, and is able to take legal action against it, the service, and it’s assets, may be frozen and/or seized. There are several reasons why law enforcement may take this action, but the user-side concern should be that their funds can end up being irrecoverable due to the legal action against a service. Even when they are recoverable, the effort could be burdensome in regards to time and financial resources.

How Binance Combats Nested Exchanges

In most cases, the host exchange compliance staff will contact customers regarding exposure to a nested exchange. Of course, this applies to many other situations besides just nested exchanges. If this happens to you, work with compliance to provide any requested documentation and answer all the questions truthfully. At Binance, we regularly audit our business and personal accounts that appear to be operating a business. These audits include risk scoring and analyzing the flow of funds. We’ve also recently implemented TRM Labs Chain Analyzer, an industry-leading security tool that identifies nested services living inside a macro exchange.

If a nested service seems to be acting in bad faith, appropriate action will be taken, including offboarding and law enforcement and regulatory notification. Currently, nested exchanges are very popular in Ukraine and Russia, which have the largest concentration of money laundering per geographic region of all customers. Just recently, we de-platformed multiple accounts associated with Suex.io, an illegally-operating Russian cryptocurrency exchange, and shared all relevant information with the appropriate authorities.

As an industry leader, we have a responsibility to combat bad actors and safeguard the crypto ecosystem. While we do our best to spot and flag nested exchanges on our platform, these accounts don’t always declare their status as a nested exchange. We recommend that our users follow best security practices, trade on KYC and AML-compliant exchanges, and look for nested exchange-red flags.

Tags in this story

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

More Popular NewsIn Case You Missed It

Advertisement     Changpeng Zhao has warned investors not to sell their BTC to Michael Saylor in a state of panic. Binance’s CEO appeared to have taken note of Saylor’s aggressive Bitcoin purchases during price dips. Michael Saylor’s MicroStrategy has purchased well over 100,000 BTC since it began its buying spree in 2020. Michael Saylor’s[Read more…]

Binance is one of the most recognizable names in the cryptocurrency industry. After all, it’s the leading exchange and forefront for the entire field – a place where many newcomers begin their cryptocurrency journey.

However, what a lot of people don’t know, is that apart from its popular exchange, Binance also runs a whole lot of other initiatives, each one of which aimed at furthering the cause of crypto.

One of these different avenues is Binance Labs. Those of you who are well-versed in the world of crypto VCs and angel investors have surely heard of it, but if you haven’t dived into the field of early-stage investing, it might have slipped under the radar.

In short, Binance Labs is the venture capital arm of Binance and CryptoPotato had the chance to talk to Chase Guo – its Investment Director. With a background in investment at companies such as Blackstone Group and Morgan Stanely, he also holds a Bachelor’s degree in Economics from the University of Pennsylvania.

In this interview, we discuss the intricacies of Binance Labs, their investment goals, how they choose which projects to invest in (and special tips for entrepreneurs looking to get incubated), Changpeng Zhao (CZ)’s attitude in building Binance a flat organization, and much more.

The Middleman Between 3rd Party and Binance

“As the venture capital arm and innovation incubator of Binance, Binance Labs identifies, invests, and empowers viable blockchain entrepreneurs, startups, and communities, providing financing to industry projects that help grow the larger blockchain ecosystem,” Guo explains.

“Binance Labs is committed to supporting fast-executing teams who positively impact the crypto space. Since Binance Labs is a venture capital arm of Binance, we potentially consider our portfolio companies to be listed on Binance exchange, and that some can go through Launchpad or Launchpool.

Also, many of them can work with Binance Smart Chain (BSC) to build their products. Binance Labs is kind of a ‘middleman’ who connects the 3rd party (portfolio companies) to the entire Binance ecosystem.”

Chase Guo, Source: LinkedIn

What is the current focus or crypto trend Binance Labs is looking at for projects to invest in?

“Within the crypto and blockchain industry, the market changes and evolves very rapidly. This makes it hard to predict which sector will be the next focus or trend. That is why Binance Labs does not specify one sector for investments, but instead, we look extensively for blockchain projects that have the potential to facilitate mass adoption of crypto globally.

We consider putting capital into projects that match our values. We want to invest in the early stages of the projects and HODL tokens or equities for the long term and to be a supporter of the projects we invest in. Also, we would like to contribute to these projects, adding value to them, so that they can grow into industry players, just like we did with our previous portfolio companies.”

Over 100 Projects in More Than 25 Countries

Please share some statistics and numbers regarding the recent investments Binance Labs has made.

“Binance Labs has incubated over 100 projects in more than 25 countries across the world since its inception in April 2018. We are closing a number of deals regularly and this is to discover projects that can lead the market in their early stages.”

How does Binance Labs choose if to invest? What are the ‘game changers’ of whether a project will successfully receive investment?

“Binance Labs looks for top-tier teams with disruptive ideas. For earlier stage projects, the fundamentals of the team decide how the project will turn out in the future. We look for teams with good vision, strong execution capabilities, and grit. For later-stage projects, we look for strong execution in the form of operational stats and historical growth and then how they stack up against competitors in the space.

On top of that, I would like to share some questions that the Binance Labs team asks before making investments. I think individual investors should ask similar questions when they consider making investments in projects.

How do these projects tackle adoption by users?

Will this project change the world?

Will people like this product when it is launched?

What does the business model look like, and will this business be sustainable for the next 10 years?”

Besides the funding, is there any kind of support or guidance done by Binance to the projects?

“We provide full support to all projects, from day-to-day operational advice to integrations with the Binance ecosystem. We guide our portfolio companies through different products including NFT IGO, Binance Launchpad, Launchpool, listing, and more.

We have a regular incubation program that we run, and we are in the middle of Season 3 of the Incubation Program now. Season 4 of the Incubation Program will officially launch in March 2022 and projects can apply to be part of it through an application form.”

Anyone Wants to Reach CZ Can Send Him a Message

If I am a founder of a project, what tip can you give to make it and get funded by Binance Labs?

“I think fundamentals such as product-market fit, adoption of its products, and previous entrepreneurship track record are important. You also need founders who have a clear vision and mission, which will keep you and the team keeps building the product through the ups and downs.”

The Binance organization: Speaking to Gin Chao (Binance former CSO), he mentioned in his 2019 interview that Binance is a flat organization, is it still like that as of 2021? How is Changpeng Zhao (CZ) reachable in such a huge organization?

“Yes, Binance is still a flat organization. If anybody in the organization wants to reach out or talk to CZ, they can send him a message. Not only for CZ, but we also have easy access to having conversations with the senior members of the organization.”

CZ, CEO of Binance

SPECIAL OFFER (Sponsored)

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to $1750.

The world’s largest digital asset exchange – Binance – reportedly plans to work with Indonesia’s richest family – the Hartono brothers – to establish a cryptocurrency venture on the island. The endeavor would enable the company to enter into a developing country with a population of around 273 million, many of whom lack access to financial services.

Binance Eyeing Indonesia

The leading digital asset trading venue has faced regulatory backlash from many watchdogs in recent months. As a result, Changpeng Zhao – CEO of Binance – asserted that his company will change its structure and will no longer act as a decentralized platform with “no headquarters and no borders.”

In the following days after his announcement, the company was linked to several nations where it could set up a global base, including Ireland and France. Interestingly, CZ revealed that his firm would even apply for a Financial Conduct Authority (FCA) license in the United Kingdom.

According to a December 10 Bloomberg report, the exchange is now looking to expand its global reach by establishing a presence in Indonesia. People familiar with the matter have revealed that Binance is in talks with PT Bank Central Asia, controlled by the siblings Budi and Michael Hartono (Indonesia’s richest family) and PT Telkom Indonesia (the nation’s largest telecommunication provider).

The company aims to create a cryptocurrency venture in Indonesia as such a partnership will encourage broader digital asset adoption in the country.