The Binance exchange has been faced with a lot of regulatory woes this year with many regulators including the MAS proscribing the activities of the trading platform.Binance Asia Services, the Singapore subsidiary of the Binance exchange has announced it has taken an 18% post-money stake in HG Exchange (HGX), with the deal pending regulatory approval. According to the official announcement, the partnership will help both Binance and HGX advance the integration and use of blockchain technology in Singapore.HG Exchange is one of the pioneering outfits that is the first member-driven private securities exchange. The platform is notably powered by the Zilliqa Blockchain and was founded by leading financial institutions PhillipCapital, PrimePartners, and Fundnel. The exchange was recognized by the Monetary Authority of Singapore (MAS) and was granted a Recognised Market Operator license earlier this year. HG Exchange is known to list the shares of private companies and it plans to expand its suite to include wines, real estate, and art.“Crypto and traditional financial offerings continue to converge. Through this investment, we seek to work with HGX in enhancing offerings of products and services supported by blockchain technology,” said Richard Teng, CEO of Binance Singapore. “We aim to work collaboratively with HGX to enhance the blockchain ecosystem in Singapore.”Beyond the stake it now has in HG Exchange, Binance Singapore is also heavily invested in collaborating with several stakeholders in the blockchain ecosystem in Singapore. The company said it will continue to drive collaboration with local partners, government agencies and talent, to support the sustainable growth of the blockchain ecosystem globally.“In Singapore, we continue to work closely with key government agencies to support the growth of the blockchain ecosystem and development of requisite local talent needed,” Teng added.The model Teng is using to steer the affairs of Binance Singapore stems from his experiences as the Chief Executive Officer of Financial Services Regulatory Authority at Abu Dhabi Global Market. Teng joined Binance in August as the trading platform sought to onboard a number of experienced players to deepen its ties with regulators across the board.Binance Singapore Stake in HGX: Turning the Tides AroundThe Binance exchange has been faced with a lot of regulatory woes this year with many regulators including the MAS proscribing the activities of the trading platform. In response, the exchange suspended the bulk of its services in Singapore and the firm has made a concerted effort to establish a local regulatory compliant trading outfit.“As the market leader, Binance constantly evaluates its product and service offerings,” Binance revealed in one of its latest announcements. “We will be restricting Singapore users in respect of the Regulated Payments Services in-line with our commitment to compliance.”With the emergence of Binance Singapore and the strategic investments in licensed entities, the exchange is turning the tides around in its favor and thus entrenching its bid to become a more recognized player in the Southeastern state. Business News, Cryptocurrency news, Investors News, Market News, News Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Thank you!You have successfully joined our subscriber list.

Category Archives: BSC News

Cryptocurrencies have greatly changed the lives of many people, providing them with new opportunities, uniting people around the world. Thanks to cryptocurrencies, everyone can earn.

Blockchain is an advanced technology that is constantly evolving, offering people new opportunities and prospects. Many people earn money on cryptocurrencies. The areas in which users of digital assets can receive the additional income have increased too.

Cryptocurrencies have not bypassed the gaming sphere. Games already have large user communities, and the ability to earn money makes games not only interesting and exciting but also profitable. More and more people not only play games but also earn money from them.

This game was created by CAKEnergy.finance, providing our users with not only an interesting but also a very profitable product.

POWER is the in-game currency of the platform, which brings profit to all participants. By developing their virtual factory, players receive real income. Your earnings depend only on you and on the strategy you choose. This makes the game really attractive and exciting.

Our game economy allows players to develop their own earning strategy in order to overtake other participants and achieve the best results. But that’s not all. We want our players to earn even more money. So we have provided various incentive measures that will help users to earn even more.

VIP accounts have been created for those who want to increase their income. This gives players premium status, accelerates their achievements in the game, and allows users to increase the capacity of their factories in the shortest possible time. The price of the VIP account depends on the total capacity of the plant.

Every player can try his luck with our lottery. For each of their actions, players receive additional points, which are used in the lottery. Once every 6 hours, 1 winner is selected, who receives 90% of the lottery winnings. The more points you have, the higher the chances of winning.

CAKEnergy.finance uses the Binance Smart Chain blockchain to ensure maximum transparency and honesty of the game and increase user confidence in the economy of the gameplay.

The presence of a blockchain allows us to provide full transparency in the organization of the lottery and the publication of its results. Everything is fair and transparent with us.

For those who want to earn more by promoting the benefits of the CAKEnergy.finance game around the world, a multi-level referral system is provided. This allows you to get 5% – 2.5% – 0.5%.

For us, safety is of paramount importance. The platform of the game is absolutely safe and has passed all checks and audits.

Our main project is CAKEnergy.finance has been audited by hazesecurity and got 5 stars and has been audited by CertiK.

We have created a game not only interesting and exciting but also profitable and honest, where everyone can earn depending on the chosen strategy of the game, being sure that everything on the platform is honest and transparent.

Join CAKEnergy.finance not only just to play, but also to earn on the most promising and rapidly developing cryptocurrency market.

Telegram chat

Binance Asia Service (a.k.a Binance.sg), the Singaporean arm of the world’s leading cryptocurrency trading venue, has invested in the private securities exchange – HG Exchange (HGX) – on December 8th.

Binance’s Strategic Stake

According to the official press release, BAS revealed an 18% post-money stake in HGX. Richard Teng, the CEO of Binance Singapore stated that the platform plans to work collaboratively with HGX to foster the blockchain ecosystem in the region and added:

“Crypto and traditional financial offerings continue to converge. Through this investment, we seek to work with HGX in enhancing offerings of products and services supported by blockchain technology.

In Singapore, we continue to work closely with key government agencies to support the growth of the blockchain ecosystem and development of requisite local talent needed.”

For the uninitiated, HGX was founded by prominent institutions such as brokerage firm PhillipCapital, financial service group PrimePartners, and investment firm Fundnel. Additionally, it is powered by the blockchain platform Zilliqa. Singaporean regulator, the Monetary Authority of Singapore (MAS), recently granted HGX a Recognized Market Operator license.

Regulator Tussle For Binance Not Over

Despite acquiring an 18% stake at the regional private securities exchange and getting access to engage with a regulated market operator, Binance is yet to cement its position in Singapore.

Reports earlier suggested that the cryptocurrency firm planned to withdraw its application from the region. Singapore is a tough nut to crack. Besides, with the mounting regulatory threat across different parts of the world, the CZ-led exchange is now looking elsewhere to build its headquarter.

Binance Asia Services, the Singapore arm of major cryptocurrency exchange Binance, has acquired a stake in a local private securities exchange, Hg Exchange (HGX).On Dec. 7, the company officially announced an acquisition of a post-money 18% stake in HGX, a stock exchange licensed and regulated by the Monetary Authority of Singapore.Binance Singapore CEO Richard Teng said that the new investment will help Binance and HGX further expand the scale of products and services “supported by blockchain technology” in Singapore.“Crypto and traditional financial offerings continue to converge. We aim to work collaboratively with HGX to enhance the blockchain ecosystem in Singapore,” Teng stated.HGX is a community-driven private stock exchange, founded by financial institutions like wealth management firm PhillipCapital, local financial services group PrimePartners, and Fundnel, a Southeast Asian private investment technology platform. The exchange reportedly uses the Zilliqa blockchain.After working as CEO of Financial Services Regulatory Authority at Abu Dhabi Global Market, Teng joined Binance Singapore as CEO in August 2021, a few years after the Singaporean branch was launched. According to the CEO, Binance continues working closely with “key government agencies” to support the growth of the blockchain ecosystem and is actively hiring local talent.Related: Singapore suspends exchange Bitget’s license over K-pop coin promotionThe new investment comes soon after Binance experienced some regulatory issues in Singapore. In late September, Binance restricted Singapore users from using its platform, citing compliance matters. Previously, Binance limited product offerings in Singapore amid regulators alleging that the company may have violated payments laws.Huobi opted to exit Singapore as a global company in order to launch a dedicated local entity in November 2021.

The past four days have marked a decent bullish attempt for a recovery, but several cryptos, including Ethereum Classic, struggled to negate the 38.2% Fibonacci resistance. However, EOS registered double-digit gains over the past few hours to cross the aforestated hurdle.

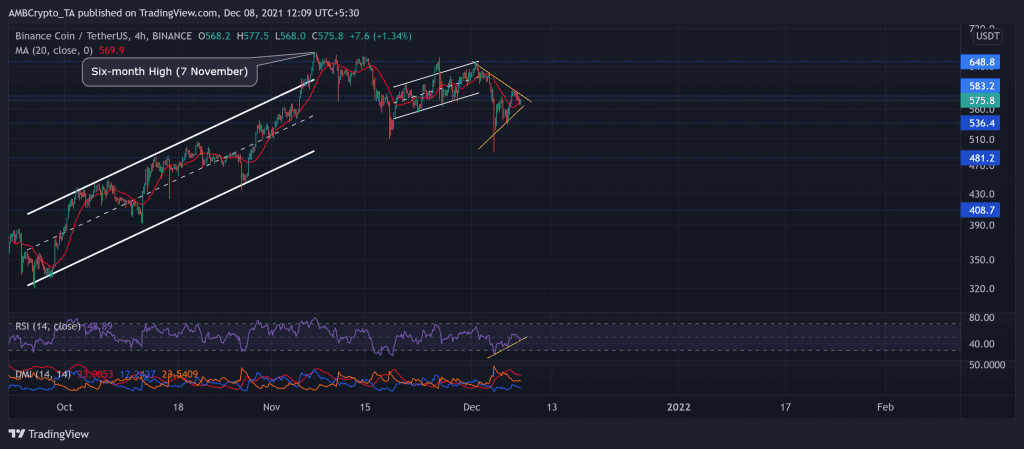

On the other hand, Binance Coin continued its long-term movement but showed mixed near-term signs.

Binance Coin (BNB)

Source: TradingView, BNB/USDT

BNB managed to form a symmetrical triangle after an up-channel breakdown on 4 December. Despite a market-wide breakdown, the alt did not part ways with its long-term bullish tendencies. After poking its six-month high on 7 November, the price action saw a pullback as the bears ensured the long-term resistance at the $648.8-mark.

The bears retested the $583.2 resistance thrice before finally breaching it to hit BNB’s five-week low on 4 December.

At press time, BNB traded at $575.8. The RSI was in an uptrend for the past four days and showed some revival signs as it pointed north. These signs helped the alt to trade above its 20-SMA (red). However, the DMI continued to show a bearish bias.

Ethereum Classic (ETC)

Source: TradingView, ETC/USDT

ETC witnessed a steep plunge while the bulls failed to sustain the 19-week support as it poked its 32-week low on 3 December post a symmetrical triangle breakout. After poking its ten-week high on 9 November, the bulls lost their edge as the price declined between the down channel.

The 61.8% Fibonacci resistance proved vigorous as the bulls failed to breach it after multiple retesting attempts. Now, the 38.2% Fibonacci level stood as a strong hurdle.

At press time, ETC traded at $40.46. The RSI was northbound as it saw a 20 point surge over the past two days and swayed near the midline. The MACD also projected a bullish comeback. However, the recent bullish push was on rather decreasing trading volumes, signaling a weak move on their part.

EOS

TradingView, EOS/USDT

The bearish phase kicked in after an up-channel incline. EOS poked its seven-week high on 10 November. As EOS obliged the 12-week-long resistance (at the $5.4 mark), it witnessed an up-channel breakdown and oscillated in a down-channel (yellow).

As the bulls failed to sustain the four-month resistance at the $3.65-mark, the altcoin plummeted to its 46-week low on 3 December.

However, over the past few hours, EOS saw an over 14% gain and traded at $3.621. This incline saw a push above the 38.2% Fibonacci level, depicting a strong bullish move. If the bulls continue their rally, the price would likely spring above the $3.65-mark (immediate resistance).

The RSI saw a 33 point surge over the past two days as it seemed to head north. Additionally, the MACD and AO displayed an increasing momentum in favor of bulls.

As speculations about the world’s largest exchange, Binance’s exit from its former hub, Singapore took over social media, the latest update cancelled out all rumours, and determined Binance’s expansion plans. Binance CEO, Changpeng Zhao took to Twitter today, declaring that the crypto exchange has acquired 18 per cent of Singapore-regulated private securities exchange, Hg Exchange (HGX).

» Binance acquires 18% stake in Singapore-regulated Hg Exchange https://t.co/ZntbLsZgWk

— CZ 🔶 Binance (@cz_binance) December 8, 2021

Binance Exclusive Investment To Cross Regulatory Hurdles

The acquisition has come just in time when Binance was struggling with getting approval from the Monetary Authority of Singapore (MAS) to legally provide crypto services in the nation. As HGX is a recognised market operator, it could potentially help Binance cross the innumerable regulatory hurdles.

According to Binance Singapore’s Chief Executive, Richard Teng, with its latest investment into HGX, Binance seeks to expand business in Singapore by offering improved and more centralised services, backed by blockchain technology. However, interestingly, Teng had formerly worked as the Chairman at HGX, henceforth, this investment may not been as out of the blue as portrayed.

“Crypto and traditional financial offerings continue to converge. Through this investment, we seek to work with HGX in enhancing offerings of products and services supported by blockchain technology…In Singapore, we continue to work closely with key government agencies to support the growth of the blockchain ecosystem and development of requisite local talent needed” Teng told the Business Times.

Binance CEO on Collaboration of Centralised approach with Decentralised technology

Earlier this month, CoinGape reported on Binance’s alleged, upcoming exit from Singapore in lieu of regulatory inconvenience. Insider reports claimed that Binance hinted at withdrawing its application with the Monetary Authority of Singapore (MAS) because of its overdue approval of an operation’s permit. While Binance CEO declined to comment on the status of his the exchange’s local unit’s licence application in Singapore, he noted that the exchange only seeks to establish in countries with a pro-crypto approach, despite agreeing to become centralised. He asserted that both, risk reduction and Innovation driven economic growth can go hand in hand.

“When (regulators) only go by that metric, they just shut everything down, and yes that’s the best way to reduce risk. But better regulators have 2 metrics – they want to encourage innovation or economic growth and reduce risk. Regulators usually make rules that are much more pro-business when they look at both these metrics.”, The Business Times quoted its impromptu interview with CZ.

advertisement

✓ Share:

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

About Author

The decentralized derivatives exchange dYdX suffered an outage due to its reliance on centralized cloud services from Amazon. Centralized exchanges Coinbase and Binance.US were also impacted by the interruption of service.Sponsored

Sponsored

On Dec 8, the dYdX derivatives DEX reported a service outage which it blamed on Amazon Web Services (AWS).

The team tweeted that the centralized cloud services provider was down resulting in the dYdX front end not loading:Sponsored

Sponsored

We are experiencing greater latency across services and impaired functionality with endpoints not working and the website not loading.

The outage and service disruption lasted around 8-9 hours. At the time of press, the dYdX exchange was back online according to its status page, but the incident has once again raised the issue of true decentralization.

Decentralized or not?

If a decentralized DeFi protocol has to rely on services from a centralized corporation, is it really decentralized?

The team admitted that the platform still has to rely on centralized services and apologized for the outage.

Unfortunately, there are still some parts of the exchange that rely on centralized services (AWS in this case). We are deeply committed to fully decentralizing and this remains one of our top priorities as we continue to iterate on the protocol.

There were a number of responses suggesting that the team runs the exchange on more decentralized cloud services, but they too are not immune from technical issues and outages.

The AWS service status dashboard was still reporting some issues with systems in the US-EAST-1 region at the time of press.

Mainstream media reported that the outage also caused problems in Amazon’s own warehouses. A raft of major websites, streaming providers such as Netflix and Disney+, Alexa, delivery providers, and government services were also affected. Coinbase, which is providing its own cloud services, and Binance.US also suffered an outage according to reports.

Statista estimates that AWS controls around a third of the entire global market for cloud infrastructure services. Too much reliance on one centralized service provider is not a great idea as many have just painfully found out.

DYDX bounces back

The exchange’s native token took a bit of a dive down to $8.80 during the outage but recovered quickly when services resumed.

At the time of writing, DYDX was trading up 2.2% on the day at $9.33 according to CoinGecko. The token has taken a hit in the wider market retreat, however, dropping 26% over the past week. DYDX is currently down 66.5% from its Sept 30 all-time high of $27.86.Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Share Article

Martin has been covering the latest developments on cyber security and infotech for two decades. He has previous trading experience and has been actively covering the blockchain and crypto industry since 2017.

Follow Author

RELATED NEWS

Advertisement     A BNB whale wallet just bought around 100 billion SHIB tokens. The purchase comes amidst a SHIB buying spree among whales. The price of SHIB however continues to struggle. The trend of whales making big splashes in the market continues, especially for Shiba Inu (SHIB). According to mega crypto investors monitoring tool,[Read more…]

DeFi aficionados are always looking for different ways to earn in the decentralized finance market. However, the list of trading, staking, and farming platforms available in the space can be quite overwhelming for new entrants.

Most of the time, traders have to use different platforms for their DeFi activities such as charting, trading, staking, and more. But Sphynx is looking to change that by providing an all-in-one platform for DeFi traders and investors.

What is Sphynx?

Sphynx is an all-in-one decentralized exchange built on the Binance Smart Chain (BSC) for staking, trading, holding, and farming tokens, and more.

Sphynx offers a single platform that has everything a trader or investor might need to successfully navigate the DeFi market, including a consolidated wallet that gives users a view of their digital assets, dynamic charts, farms, staking portals, and more.

It is designed to allow users to trade and conduct other related activities quickly, which is achieved through the automated configurations of the user experience.

The platform automatically configures whatever action users take on the platform. For instance, when users search for a particular token on the platform, the swap is automatically configured so that it is set for traders to buy. Also, if traders wish to sell any of their digital assets, they just simply click on the particular asset, and the swap will be automatically configured to sell.

Sphynx Utilities

The Sphynx platform offers users several utilities that are all geared toward making their trading and investing experience seamless. Some of them include:

Papyrus Charting

The Sphynx Papyrus charts allow users to chart, research and place orders for any token on BSC. Using the charts, traders can check for several important trading information, including market cap, liquidity, and order books, without leaving the platform.

Consolidated Sphynx Wallet

The platform provides users with a consolidated Sphynx Wallet that enables them to store their assets, trade directly from within Sphynx at any time, and reduce transaction costs when tokens are transferred between the different platforms it offers.

Nile Staking Pools

Sphynx Nile Pools allow DeFi projects built on BSC to boost rapid adoption by distributing a portion of their tokens to SPHYNX token holders. Nile Pools also allows existing projects to develop a relationship with the Sphynx community of loyal supporters.

Pyramid Farming

The Sphynx Pyramid farming is for users to earn SPHYNX tokens by creating liquidity for their desired pair and subsequently providing liquidity to the Pyramid. Sphynx offers a mouth-watering APR as an incentive for users to provide liquidity for their favorite DeFi projects.

IDO LaunchPad

The Sphynx launchpad is geared toward providing a platform for new promising DeFi projects to be launched without the developers having to go through the hassle of getting an audience and building a community, as they would have an already developed community on Sphynx.

ETH Bridge

The SphynxSwap platform offers an Ethereum to Binance Smart Chain bridge with their launchpad and DEX features, allowing users to be able to easily switch between the two networks hassle-free.

Introducing SphynxSwap

SphynxSwap is an automated market maker (AMM) that allows any combination of two tokens to be swapped on the platform.

Users can swap their tokens quickly and not worry about high transaction fees. Sphynx also allows investors to earn passively by staking their tokens on the platform. It has a yield farming feature where users can stake liquidity provider (LP) tokens and earn SPHYNX.

The SPHYNX Token

SPHYNX is the native cryptocurrency of the platform. It is a BEP-20 token with a total supply of 1 billion SPHYNX.

The token has a minting function that can only be accessed by MasterChef for farms and staking platform. MasterChef is a smart contract that controls what a farm can do and how. It is the master code that runs all operations.

Future Integrations

Sphynx intends to continue developing its platform and expanding its product offering as the crypto industry continues to grow.

Some future integrations that Sphynx is currently working on include:

NFT MarketPlace

With the NFT space currently making waves, Sphynx aims to embrace it fully. The Sovereign Sphynx Council consists of 8,888 NFT collectibles that will reward holders with a small percentage of fees charged on the platform. The Sphynx NFT Marketplace is still under development and will go live soon.

Cross-chain Trading

Sphynx plans to expand to other smart chains aside from BSC to foster the interoperability of crypto assets, including the launch of an ETH bridge.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to $1750.

With the bidding spanning over a period of 5 days, the aim is to sell twenty iNFTs every day till December 21.Sophia, the world’s first humanoid artificial intelligence (AI) robot, is making news across the world once again. As a part of a promising Metaverse project called the “Noah’s Ark”, tokenized forms of Sophia’s digital anime version will be auctioned off.In 2016, Sophia was built by Hong Kong-based company Hansen Robotics. On 16th February 2016, Sophia made its premiere public appearance at South by Southwest in Austin, Texas, United States. Over the years, the AI robot Sophia has become known for its communication skills and eloquent speaking ability. She has not only spoken in front of the United Nation but also has received Saudi citizenship recently.On December 3, Jeanne Lim, the Chief Executive Officer of Hansen Robotics and co-creator of Sophia, introduced the first digital anime version of Sophia called “Sophia beingAI”. Since the robot left Hansen Robotics, it has started working in the company BeingAI. The version has been claimed under a perpetual license and co-branding partnership.The company has now collaborated with intelligent non-fungible token (iNFT) production firm Alethea AI. The partnership will launch the world’s first intelligent initial game offering on Binance. The launch is all set to include a hundred iNFTs celebrating Sophia BeingAI on Binance‘s NFT marketplace on December 16. With the bidding spanning over a period of 5 days, the aim is to sell twenty iNFTs every day till its conclusion on December 21.An iNFT is an intelligent NFT that is engraved with a GPT-3 prompt as a part of its permanent smart contract. With an iNFT, the customer can enjoy an intelligent NFT that has both communicative and animation functionalities as meticulously curated prompts are saved at the smart contract layer. These smart NFTs can converse in reality with users in gamified ecosystem independently.The digital collectibles, together are called “The Transmedia Universe of Sophia BeingAI”. The collaboration is set to auction 100 iNFTs to establish Alethea AI’s decentralized Metaverse project Noah’s Ark. Former co-founder of Dreamwave productions and comic book artist Pat Lee is all set to illustrate the collection. The famous artist and publisher has previously partnered with Marvel and DC Comics on books like Batman, Superman, Ironman, and Spiderman.Alethea AI revealed the Noah’s Ark project in October this year. According to the company blog post, it is waiting for intelligent NFTs to populate its virtual space. While being a part of the metaverse is a first in Sophia’s history, the AI robot has, however, been involved with the NFT market. Recently in March, Sophia conducted an NFT auction through the Nifty Gateway platform.In one of her most acclaimed speeches at the Future Investment Initiative Conference in 2017, Sophia expressed her emotions by changing faces to express sadness, happiness, and anger. Artificial Intelligence, Blockchain News, Cryptocurrency news, News, Technology News Sanaa is a chemistry major and a Blockchain enthusiast. As a science student, her research skills enable her to understand the intricacies of Financial Markets. She believes that Blockchain technology has the potential to revolutionize every industry in the world. Thank you!You have successfully joined our subscriber list.