- Solana witnessed a spike in the number of network participants in the bear market, unlike Ethereum and BNB, where activity declined.

- Active wallets on the Solana network increased by 58%, outpacing other blockchains.

- Solana’s price trend looks ready for reversal, SOL could decline to $25.

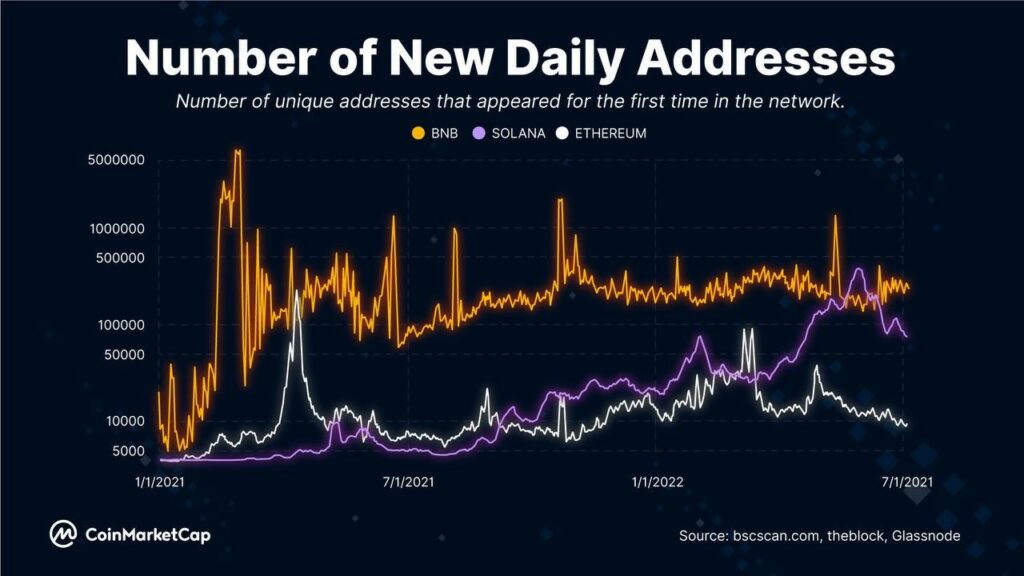

While address activity on leading altcoin networks Ethereum and Binance Chain declined, Solana witnessed a spike. The Solana network bucked the trend as the network’s users increased their activity.

Data revealed that active addresses on the Solana network have grown by 58% since the beginning of 2022. Solana has therefore outperformed competitors Ethereum and Binance Chain in terms of active address growth.

Active addresses on a network is a metric considered an indicator of user growth in a cryptocurrency. Solana’s active address count increased during the bear market, a sign of increasing interest in SOL and participation from the wider crypto community.

It is interesting to note that while Solana witnessed a 58% growth in active addresses, the BNB chain registered a fall of 17.9% and Ethereum suffered a worse decline, at 51.8%.

Solana has emerged as the only major layer-1 cryptocurrency with high participation and activity in terms of addresses on the network. Solana suffered a series of outages and downtime throughout the past year, due to technical glitches and high NFT trade volume on its blockchain.

Despite the struggle, the Solana network has witnessed tremendous growth, leaving peers like BNB Chain and Ethereum behind.

The Total Value Locked (TVL) on the Solana network failed to reflect the momentum of its address activity, and dropped close to $2.9 billion, against May 2022’s $6 billion. This insight reveals that the address activity has failed to increase the inflows to the Solana network, and there is room for further growth in the altcoin’s TVL with the spike in the number of participants.

Solana’s price remains at risk of collapse with the divergence between the address activity and TVL of the altcoin’s network. On observation, Solana’s price chart looks ready for a trend reversal.

Solana price could follow suit if Bitcoin price drops below the 200-week SMA at $22,559. This remains a key level for the asset. A decline below this level could trigger Solana’s price drop to $38, $31, and $25 weekly support floor. The 40% downswing is likely in Solana’s price in the event of a BTC price drop to the $22,559 level.