Crypto exchange FTX joined many other fallen projects — including Terra (LUNA), 3AC, Celsius and Voyager — in filing for bankruptcy in 2022. Owing to the devastation caused by multi-billion dollar losses suffered by businesses and investors, the man running the biggest crypto exchange, Binance CEO Changpeng “CZ” Zhao, envisions an era of greater regulatory scrutiny in the near future.With one of the biggest crypto businesses falling overnight, CZ believed the episode was devastating for the industry, which took away a lot of consumer confidence. Speaking at Indonesia Fintech Summit 2022, he said:“I think basically we’ve been set back a few years now. Regulators rightfully will scrutinize this industry much, much harder, which is probably a good thing, to be honest.”Regulations in crypto historically circled around Know Your Customer (KYC) and Anti-Money Laundering (AML). However, CZ reiterated his long-standing belief that regulations must focus on exchange operations, such as business models and proof of reserves. As a result, he believed that tighter regulatory scrutiny around crypto business operations is around the corner.CZ sharing his thoughts on FTX and the future of crypto during Indonesia Fintech Summit 2022. Source: YouTubeWhile FTX’s collapse is bound to have a short-term impact on retail investors, in the longer term, this is a wake-up call for discussions about how to handle risks across crypto ecosystems. Speaking specifically about FTX, he said:“The last three days is just a revelation of problems. The problems were there way longer. This problem wasn’t created in the last three days.”CZ pointed out that the biggest red flag about FTX was Alameda Research’s financials, which were full of FTX Tokens (FTT) that made him finalize the decision to sell off Binance’s FTT holdings worth over $2 billion at the time. The following day, FTX CEO Sam Bankman-Fried reached out to CZ with a deal that “did not make sense from a number of fronts”. At the same time, CZ hoped to get an over-the-counter (OTC) deal for protecting users:“Original intention was let’s save the users, but then the news of misappropriating user funds, especially U.S Regulatory Agencies investigations (made us realize) we can’t touch that anymore.”CZ believes that increasing transparency and educating regulatory agencies about crypto audits and cold wallet information will make the industry much healthier. Finding the right balance of rules is not ask, he said.The entrepreneur highlighted the need for easy tools for saving private keys and other security functionalities but argued that the crypto ecosystem will grow in incremental steps and not giant leaps.Related: Binance Proof-of-Reserve pledge gains support following FTX crisisTaking a proactive approach in regaining investor confidence, Binance published a new page titled “Proof of Assets,” which displays details about the exchange’s on-chain activity for its hot and cold wallet addresses.“Our objective is to allow users of our platform to be aware and make informed decisions that are aligned with their financial goals,” said Binance in an official statement.

Author Archives: admin

Elon Musk recently said that he had a conversation with Sam Bankman-Fried before the Twitter deal. He also shared some predictions going forward.

The world’s richest man recently joined a discussion on Twitter with over 60,000 listeners to talk about the FTX hack and bankruptcy.

Musk revealed that he had a conversation with the exchange’s former CEO – Sam Bankman-Fried and that his opinion of him wasn’t the best.

… I got a ton of people telling he’s got huge amounts of money that he wants to invest in the Twitter deal and I talked to him for about half an hour and I know my bullshit meter was redlining. It was like, this dude is bullshit – that was my impression.

Musk said he hadn’t heard of him before that, while adding:

[…] Everyone including major investment banks – everyone was talking about him like he’s walking on water and has a zillion dollars. And that was not my impression – that dude is just, there’s something wrong, and he does not have capital and he will not come through. That was my prediction.

Later on, Musk also reiterated the importance of keeping funds on cold storage. He also said:

I think there probably is a future for Bitcoin, Ethereum, and DOGE. I can’t really speak to the others. But if you’ve got one of those three in a cold wallet and off an exchange, I think my guess is it works out well.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

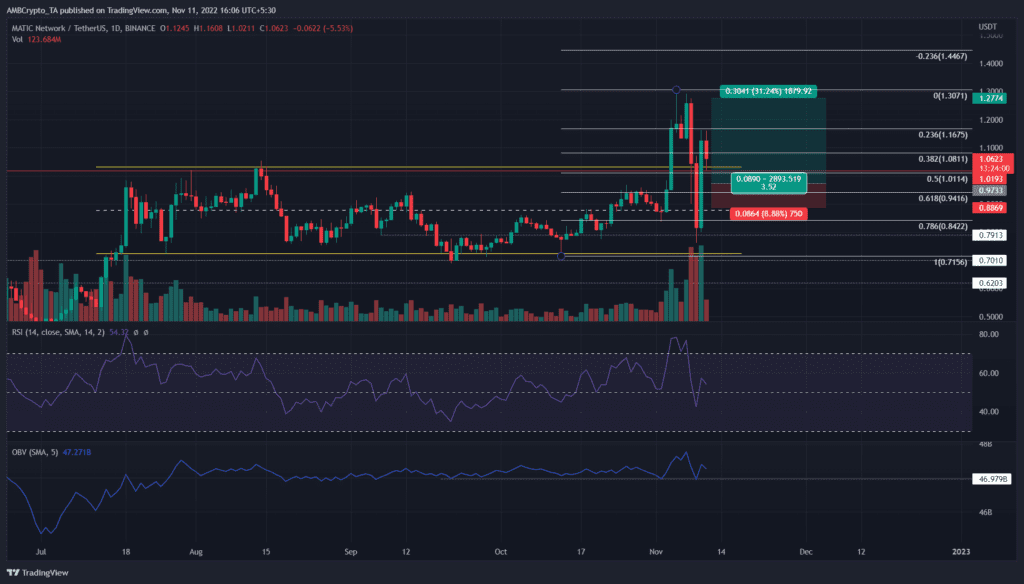

The higher timeframe structure was bearish, but there was a possibility of a bounce

The $1 mark could be crucial for bulls and bears in the coming days

MATIC saw growth in the DeFi space as its Total Value Locked (TVL) outdid that of Avalanche’s. It also received praise from Vitalik Buterin regarding its newly launched zk-EVM.

Read Polygon’s [MATIC] Price Prediction 2023-2024

But this slew of positive news did nothing to stop the nasty price action on the charts. On 8 and 9 November, MATIC shed nearly 40%, only to bounce by 45% on 10 November. For higher timeframe traders, an opportunity to buy the asset can arise soon, but caution would be key.

A bounce from a gap on the charts can occur, but the sentiment can quickly sway bearish

Source: MATIC/USDT on TradingViewThe past week saw a significant volume breakout past the range (yellow) MATIC has traded within since July. In this process, the $1 psychological mark was convincingly broken. Near the $1.3 level, substantial resistance was seen. With Bitcoin’s shift to a lower timeframe bearish bias on 7 November, MATIC began to retrace.

It dropped as low as $0.77 before recovering spectacularly to reach $1.14 on 10 November. For higher timeframe traders, this kind of volatility can be daunting. On the other hand, lower timeframe traders might have a field day trading the volatility.

The positives for MATIC were that Relative Strength Index (RSI) could climb above neutral 50 while the On-Balance Volume (OBV) defended a support level from mid-September. Yet, in the face of the price action in recent days, these factors might not count for much.

A glance at a lower timeframe chart (four-hour) showed that the rally on 10 November left a fair value gap (inefficiency) in the $0.96-$1.02 region. Hence, it was likely MATIC would drop to this area in the coming days. Traders with a larger risk appetite can assess buying opportunities in this zone on the lower timeframes.

A bounce from this zone can seek out the local highs near $1.3. Invalidation of this bullish idea would be a session close below $0.9, as $0.92-$0.96 has been a support zone in recent days.

Supply on exchanges drops while sentiment is weakly positive

Source: SantimentThe supply on exchanges metric began to trend upward on 21 October and continued to do so till 6 November. During this time, MATIC saw a steep rally and an even quicker sell-off. Since then, this metric witnessed a dip. The inference was that selling pressure could have waned, based on the evidence this metric provided.

In a similar fashion, the weighted sentiment behind MATIC was hugely positive during the rally to $1.3 but petered out after that. It was certainly fair to say that investor confidence has taken a hit in the past few days. Active deposits of MATIC have also been high in the past week, which resulted in huge surges in short-term selling pressure.

FTX and FTX US wallets have been impacted in a potential hack recording over $600 million in tokens transferred by the exploiter. FTX US General Counsel Ryne Miller earlier tweeted the wallet movements as “abnormal” and the facts and reasons were unclear to him or the FTX team.

In the following tweet, Ryne Miller claimed the FTX team hurried precautionary measures to move all digital assets to cold storage after recording some unauthorized transactions. Some believe former FTX developer Samuel Hyde is behind the hack.

Former FTX Employees Behind the Hack

On-chain experts observed millions in outflow from FTX and FTX US wallets, suspected to be the start of the bankruptcy process. However, FTX employees confirmed to ZachXBT that they don’t recognize these withdrawals. Moreover, FTX Community Chat admin dropped a message in the Telegram group saying that FTX has been hacked and FTX apps are malware. The admin also urged users to delete the app and warned of possible Trojans on the FTX website.

FTX US general counsel Ryne Miller in a tweet claimed that unauthorized transactions observed by FTX led the team to expedite transfers from wallets. He pointed out that FTX US and FTX.com are required to move all digital assets to cold storage as a precautionary measure as part of the Chapter 11 bankruptcy filings.

“Following the Chapter 11 bankruptcy filings – FTX US and FTX [dot] com initiated precautionary steps to move all digital assets to cold storage. Process was expedited this evening – to mitigate damage upon observing unauthorized transactions.”

Trending Stories

Defi and NFT project founder Foobar claimed FTX counsel noticed the black hat exploiters withdrawing tokens and swapping to ETH and DAI. Thereafter, he took white hat actions to save some funds from unauthorized transactions. Moreover, ZachXBT estimates the black hat transfers at nearly 450 million and white hat rescue from multisig at nearly 200 million so far.

Meanwhile, some claims FTX employees are behind the exploit, especially former FTX developer Samuel Hyde. While the motive is unclear, but the action may have been due to a conflict with the top leadership earlier this year.

advertisement

Tether Blacklists USDT Related to Hacker

Several on-chain data revealed that the exploiter was converting stablecoins to DAI and other crypto assets to Ethereum. As a result, stablecoin issuer Tether blacklisted $3.9 million USDT on Avalanche (AVAX) and $27.5 million USDT on Solana (SOL) of the FTX attacker, reported on-chain sleuth ZachXBT.

FTX Token (FTT) price fell to a low of $2.05 today. In the last 24 hours, the price has plunged over 35% and 90% in a week. The crypto market further slides over 3% amid the pressure due to the FTX crisis.

Read more: Over $1 Billion In Customer Funds Missing At FTX

✓ Share:

Varinder is a Technical Writer and Editor, Technology Enthusiast, and Analytical Thinker. Fascinated by Disruptive Technologies, he has shared his knowledge about Blockchain, Cryptocurrencies, Artificial Intelligence, and the Internet of Things. He has been associated with the blockchain and cryptocurrency industry for a substantial period and is currently covering all the latest updates and developments in the crypto industry.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

In a Twitter Space hosted by Mario Nawfal, Twitter CEO Elon Musk shared his impression of Sam Bankman Fried when latter approached him regarding a potential investment in Twitter.

Bankman-Fried contacted Musk in March, expressing his desire to participate in Musk’s bid for Twitter. When asked about SBF’s involvement in the deal in the ‘Emergency Space‘ on Twitter, Elon said “I had never heard of him. People told me that he’s got money that he wants to invest. And I talked to him for about half an hour.”

Also Read: Reports Suggest More Than $1 B In Customer Funds Missing At FTX

“My bullshit metre was like redlighting. This dude is full of shit. That was my impression,” he said. Elon told the audience, “That dude is just so wrong. He does not have capital. And he will not come through. That was my prediction. And that’s definitely what happened.”

Trending Stories

Elon Musk’s reaction to meeting SBF. Taken from an earlier Twitter spaces. h/t @rugmedry

pic.twitter.com/xtlXiGdZzb

advertisement

— Autism Capital 🧩 (@AutismCapital) November 12, 2022

Later, the host asked Elon Musk what recommendation he would give to the crypto community as it scrambles to save itself post FTX’s meltdown. To this, Elon agreed with the host’s stance on not storing crypto assets on exchanges, saying “Not your keys, not your wallet.”

Also Read: US Midterm Elections and FTX Collapse: Here’s How Crypto Twitter is Reacting

✓ Share:

Dhirendra is a writer, producer, and journalist who has worked in the media industry for more than 3 years. A technology enthusiast, a curious person who loves to research and know about things. When he is not working, you can find him reading and understanding the world through the lens of the Internet. Contact him at [email protected]

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

FTX News: Sam Bankman-Fried (SBF), Former CEO of FTX has been alleged of funding and lobbying in Washington, D.C over the last year. Now, the XRP holder’s lawyer has claimed that SBF and U.S. SEC are working on a negotiation deal.

Is SEC bailing out SBF?

John Deaton, Amicus Curiae in the XRP lawsuit called US representative candidates to get ready to file Subpoenas over SBF’s mother, Barbara Fried. He asked to add private emails, texts and messaging apps.

He claimed that SBF’s mother has likely reached out to Gary Gensler, SEC chair in an attempt to bag negotiations deal for her son. This will be an attempt to avoid a life sentence for the Ex FTX CEO.

Earlier, Coingape reported that expert believes that the US Watchdogs including SEC might be helping SBF to get away from the FTX crisis. However, the commission has already launched a probe on the FTX US. The agency will also investigate the probable connection between FTX and several other firms regarding SBF.

XRP Lawyer drops some of his perspectives on the FTX crisis handling. He highlighted that a software developer sits in jail without any clear evidence of what he did. There is just a piece of evidence that he provided the code.

Trending Stories

advertisement

✓ Share:

Ashish believes in Decentralisation and has a keen interest in evolving Blockchain technology, Cryptocurrency ecosystem, and NFTs. He aims to create awareness around the growing Crypto industry through his writings and analysis. When he is not writing, he is playing video games, watching some thriller movie, or is out for some outdoor sports. Reach me at [email protected]

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Place/Date: – November 12th, 2022 at 11:17 am UTC · 3 min read Source: Orbeon Protocol ApeCoin (APE) has seen losses in both value and trading volume over the last few months as the hype around the coin, designed to emulate the success of the famous NFT project Bored Ape Yacht Club (BAYC), loses support.As things stand, ApeCoin (APE) has only been able to rise with sufficient hype to drive demand behind the coin, and without this, investors are selling their ApeCoin (APE) daily. As a result, Orbeon Protocol (ORBN) is seeing a massive influx as analysts predict a 6000% increase in value by the end of presale. Orbeon Protocol (ORBN) is Made for InvestorsOrbeon Protocol is radically shaking-up the crowdfunding and venture capital sectors, giving everyday investors the chance to invest in exciting new start-up opportunities worldwide. Orbeon Protocol does this by minting fractionalized, equity-backed NFTs, which can be purchased for as little as $1. Each fractionalized NFT represents a stake in a real-world business.Companies seeking investment can skip the regulatory hurdles and cynical middlemen of old, instead forming a community with their investors directly on the Orbeon Protocol platform.A significant attraction is the sheer capability of the whole ecosystem. As well as creating a groundbreaking route to investment, they also provide a platform to swap cryptocurrencies between users, an exchange for trading business fractions, as well as a dedicated secure wallet to track portfolios.As well as this, the native ORBN token provides holders with benefits such as bonuses on staking their tokens, governance rights to decide the direction Orbeon protocol takes, and access to exclusive investor groups.The price of ORBN is currently $0.004 in the presale phase which opened at the end of October and will run until early 2023. Experts predict a price rise of up to 6000% in that time.ApeCoin (APE) Lacks Identity and PurposeAPE has always been a peculiar cryptocurrency. ApeCoin, a combination of other currencies, has long struggled with its identity, perhaps on purpose. Since ApeCoin is a decentralized autonomous organization, APE holders can take part in governance decisions, cast votes on money allocations, regulations, partnerships, and project selection. However, it is dogged by a lack of real-world value and doesn’t appear to have any identifiable purpose. Hence, it is held in contempt by more serious crypto players, who often criticize it for lacking utility and being based purely on hype.Following its launch, ApeCoin did generate a great deal of buzz and publicity but, as time passed, this proved unsustainable. ApeCoin lost a disheartening 80% of its value during 2022 and many industry analysts are, understandably, negative about its long-term prospects. Furthermore, there doesn’t appear to be much that the ApeCoin founders can or are willing to do to breathe new life into the coin.SummaryAs ApeCoin begins to stagnate, the market consensus becomes clear; Holders are selling their APE for projects with more utility, viability and potential to solve real-world problems. Orbeon Protocol (ORBN) fits the bill for all of these, and investors are swarming the project – price predictions see the ORBN token surging from $0.004 to $0.24.Find Out More About The Orbeon Protocol: Presale, Website, Telegram. Disclaimer: Coinspeaker is not responsible for the trustworthiness, quality, accuracy of any materials on this page. We recommend you conduct research on your own before taking any decisions related to the products/companies presented in this article. Coinspeaker is not liable for any loss that can be caused due to your use of any services or goods presented in the press release. Created with Sketch. Subscribe to our telegram channel. Join